Region:Middle East

Author(s):Rebecca

Product Code:KRAD6192

Pages:80

Published On:December 2025

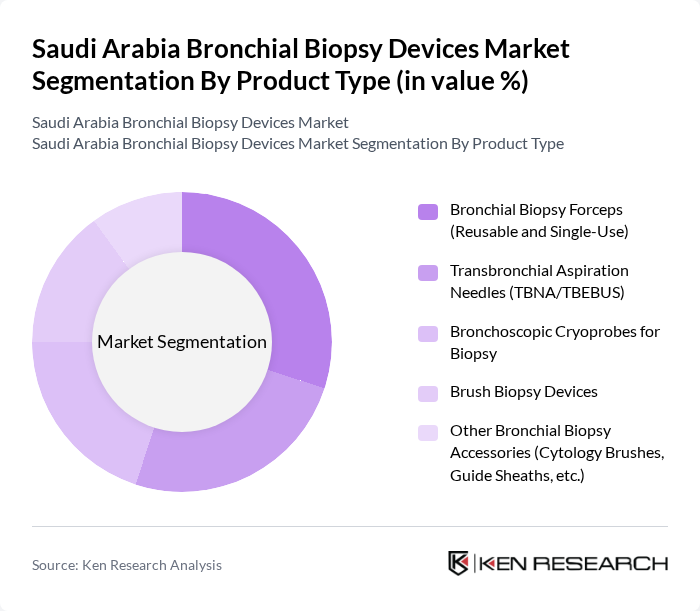

By Product Type:The product type segmentation includes various devices used for bronchial biopsies, which are essential for diagnosing respiratory diseases. The subsegments are as follows:

The Bronchial Biopsy Forceps segment, which includes both reusable and single-use options, is currently dominating the market due to their versatility and effectiveness in obtaining tissue samples. The increasing preference for minimally invasive procedures among healthcare providers and patients has led to a higher adoption rate of these devices. Additionally, advancements in design and materials have improved the performance and safety of bronchial biopsy forceps, further solidifying their market leadership.

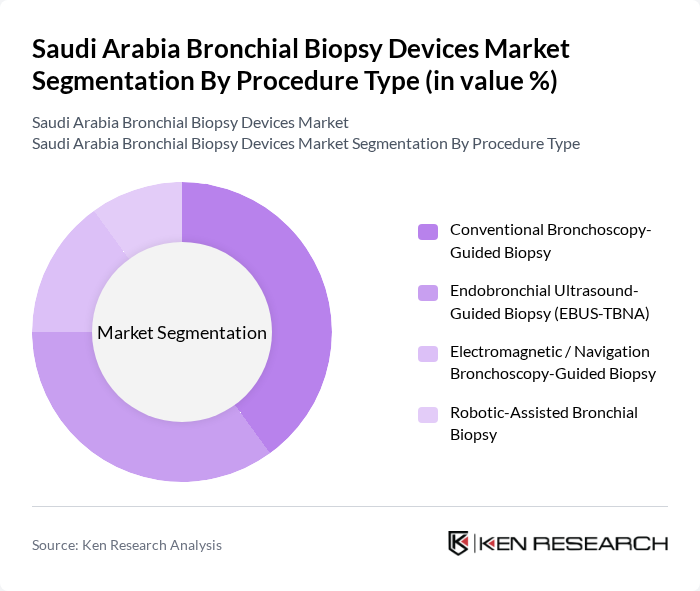

By Procedure Type:The procedure type segmentation categorizes the methods used for conducting bronchial biopsies. The subsegments are as follows:

The Conventional Bronchoscopy-Guided Biopsy segment leads the market due to its established efficacy and widespread use in clinical practice. This method is favored for its reliability and the ability to visualize the bronchial tree directly, allowing for accurate tissue sampling. The growing number of trained professionals and the availability of advanced bronchoscopy equipment further enhance the adoption of this procedure type.

The Saudi Arabia Bronchial Biopsy Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Olympus Corporation, Boston Scientific Corporation, Medtronic plc, Cook Medical LLC, CONMED Corporation, Karl Storz SE & Co. KG, Ambu A/S, Teleflex Incorporated, HOBBS Medical, Inc., Medline Industries, LP, Becton, Dickinson and Company, Veran Medical Technologies (a Siemens Healthineers company), Intuitive Surgical, Inc., Broncus Medical Inc., Local & Regional Distributors (e.g., Al Faisaliah Medical Systems, Tamer Healthcare) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bronchial biopsy devices market in Saudi Arabia appears promising, driven by ongoing advancements in medical technology and increasing healthcare investments. As the government continues to prioritize healthcare infrastructure, the integration of innovative diagnostic tools is expected to enhance patient care. Additionally, the growing trend towards personalized medicine and minimally invasive procedures will likely further stimulate demand for bronchial biopsy devices, ensuring improved diagnostic accuracy and patient outcomes in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Bronchial Biopsy Forceps (Reusable and Single-Use) Transbronchial Aspiration Needles (TBNA/TBEBUS) Bronchoscopic Cryoprobes for Biopsy Brush Biopsy Devices Other Bronchial Biopsy Accessories (Cytology Brushes, Guide Sheaths, etc.) |

| By Procedure Type | Conventional Bronchoscopy-Guided Biopsy Endobronchial Ultrasound-Guided Biopsy (EBUS-TBNA) Electromagnetic / Navigation Bronchoscopy-Guided Biopsy Robotic-Assisted Bronchial Biopsy |

| By Application | Lung Cancer and Pulmonary Nodule Diagnosis Infectious and Granulomatous Lung Disease Diagnosis Interstitial and Inflammatory Lung Disease Diagnosis Other Respiratory Tract Pathology |

| By End-User | Tertiary Care & Specialty Hospitals Public & University Teaching Hospitals Private Hospitals and Day-Care Surgical Centers Specialized Pulmonology & Diagnostic Centers |

| By Distribution Channel | Direct Sales to Hospitals & Health Systems Authorized Local Medical Device Distributors Group Purchasing Organizations (GPOs) & Tender-Based Procurement Online and E-Procurement Platforms |

| By Region | Central (Including Riyadh Region) Western (Including Makkah & Madinah Regions) Eastern (Including Dammam & Al Khobar) Northern Southern |

| By Patient Demographics | Adult Patients (18–64 Years) Pediatric Patients (<18 Years) Geriatric Patients (?65 Years) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 120 | Procurement Managers, Medical Equipment Buyers |

| Pulmonology Clinics | 90 | Clinic Directors, Lead Pulmonologists |

| Medical Device Distributors | 70 | Sales Managers, Product Specialists |

| Healthcare Regulatory Bodies | 60 | Regulatory Affairs Officers, Compliance Managers |

| Research Institutions | 50 | Research Scientists, Clinical Researchers |

The Saudi Arabia Bronchial Biopsy Devices Market is valued at approximately USD 140 million, reflecting a significant growth driven by the rising prevalence of respiratory diseases and advancements in minimally invasive biopsy techniques.