Region:Middle East

Author(s):Shubham

Product Code:KRAD0643

Pages:88

Published On:August 2025

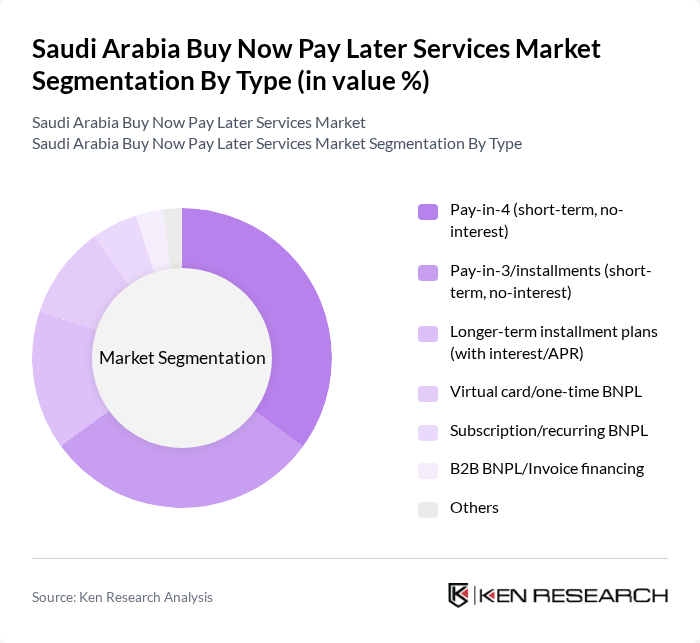

By Type:The segmentation by type includes various subsegments such as Pay-in-4 (short-term, no-interest), Pay-in-3/installments (short-term, no-interest), Longer-term installment plans (with interest/APR), Virtual card/one-time BNPL, Subscription/recurring BNPL, B2B BNPL/Invoice financing, and Others. Among these, the Pay-in-4 and Pay-in-3/installments options are gaining significant traction due to their appeal to consumers seeking short-term, interest-free payment solutions, which aligns with BNPL’s strong usage at online checkout and growing presence at POS in Saudi Arabia’s rapidly digitizing payments landscape. The convenience and flexibility offered by these options cater to the growing demand for manageable payment plans, particularly among younger consumers, supported by near-universal smartphone and internet access in the Kingdom.

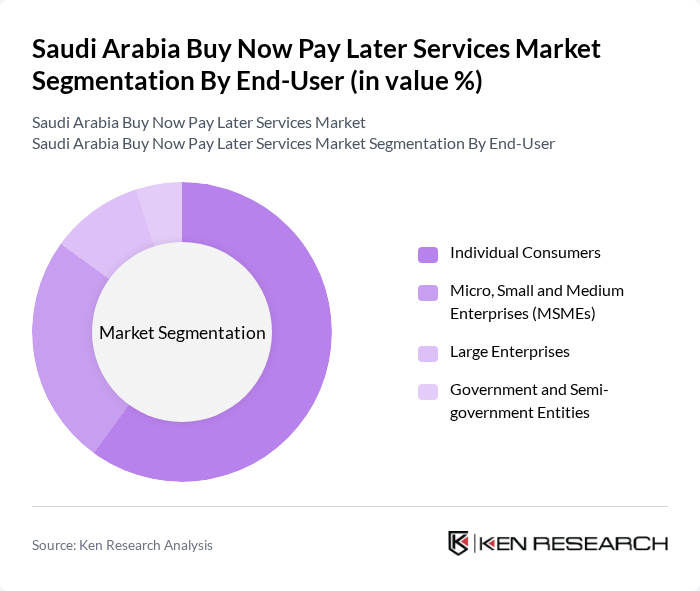

By End-User:The end-user segmentation includes Individual Consumers, Micro, Small and Medium Enterprises (MSMEs), Large Enterprises, and Government and Semi-government Entities. Individual consumers represent the largest segment, driven by the increasing trend of online shopping and the desire for flexible payment options, with digital wallets and card-based online payments already entrenched in the market and supportive of BNPL usage. MSMEs are also leveraging Buy Now Pay Later services to enhance their cash flow and attract more customers, while larger enterprises and government entities are gradually adopting these solutions to streamline their procurement processes as BNPL integrates across online and POS ecosystems.

The Saudi Arabia Buy Now Pay Later Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tamara, Tabby, Spotti (formerly Spotii), Postpay, valU (EFG Hermes), Cashew, Jeel Pay, Payfort (Amazon Payment Services), PayTabs, stc pay, mada (Saudi Payments), HyperPay, Noon Payments, Jazeera Paints PayLater (merchant BNPL), MIS Forward (Forward Fintech) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the BNPL market in Saudi Arabia appears promising, driven by technological advancements and evolving consumer preferences. As mobile payment solutions gain traction, the integration of AI and machine learning for risk assessment will enhance service efficiency. Additionally, the shift towards sustainable financing practices is likely to shape the market, encouraging providers to adopt ethical lending standards. Overall, the BNPL landscape is set for dynamic growth, with innovative solutions catering to diverse consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Pay-in-4 (short-term, no-interest) Pay-in-3/installments (short-term, no-interest) Longer-term installment plans (with interest/APR) Virtual card/one-time BNPL Subscription/recurring BNPL B2B BNPL/Invoice financing Others |

| By End-User | Individual Consumers Micro, Small and Medium Enterprises (MSMEs) Large Enterprises Government and Semi-government Entities |

| By Sales Channel | Online (e-commerce and in-app) POS/In-store (integrated at checkout) Merchant plug-ins/marketplaces |

| By Payment Frequency | Bi-weekly Payments Monthly Payments Custom Schedules (merchant/program specific) |

| By Customer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Income Level (Low, Middle, High) Urban vs Rural |

| By Product Category | Consumer Electronics and Appliances Fashion and Personal Care Grocery and Everyday Essentials Travel, Tickets, and Experiences Healthcare and Pharmacy Furniture and Home Improvement Auto aftermarket and Mobility |

| By Customer Loyalty Programs | Reward Points Cash Back Offers Referral Bonuses |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Usage of BNPL Services | 150 | End-users aged 18-45 who have used BNPL |

| Merchant Adoption of BNPL Solutions | 100 | Retail Managers and Business Owners |

| Financial Institutions' Perspectives | 80 | Banking Executives and Financial Analysts |

| Regulatory Insights on BNPL | 50 | Policy Makers and Regulatory Officials |

| Consumer Attitudes Towards Credit Options | 120 | General Consumers with varying income levels |

The Saudi Arabia Buy Now Pay Later services market is valued at approximately USD 90100 million, reflecting a significant growth trajectory driven by increased digital payment adoption and e-commerce activities.