Region:Middle East

Author(s):Rebecca

Product Code:KRAC0211

Pages:81

Published On:August 2025

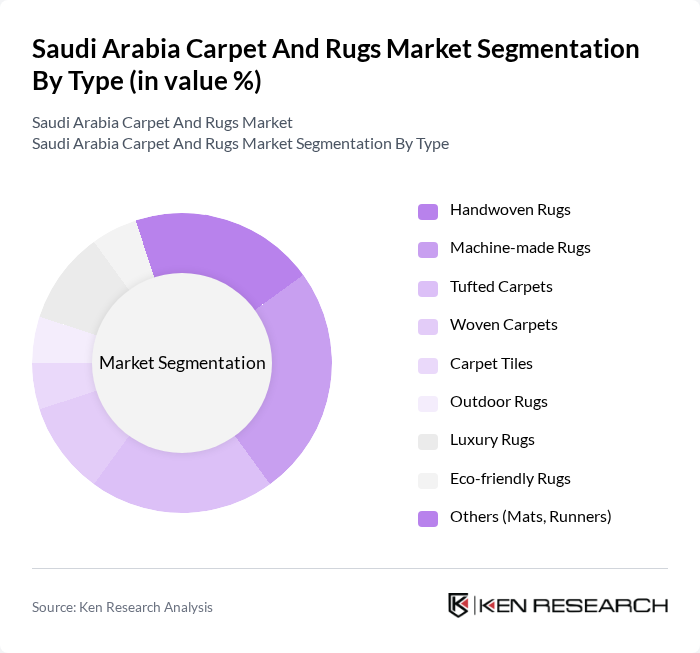

By Type:The market is segmented into handwoven rugs, machine-made rugs, tufted carpets, woven carpets, carpet tiles, outdoor rugs, luxury rugs, eco-friendly rugs, and others such as mats and runners. Each type serves distinct consumer preferences and applications, with machine-made and tufted carpets favored for affordability and variety, while luxury and handwoven rugs cater to premium and traditional tastes .

The machine-made rugs segment is currently dominating the market due to their affordability, variety, and ease of production. This segment appeals to a broad consumer base, including residential and commercial users, who prioritize cost-effectiveness without compromising on style. The increasing trend of online shopping has also facilitated the growth of this segment, as consumers can easily access a wide range of options. Additionally, machine-made rugs are often available in contemporary designs, aligning with modern interior decor trends .

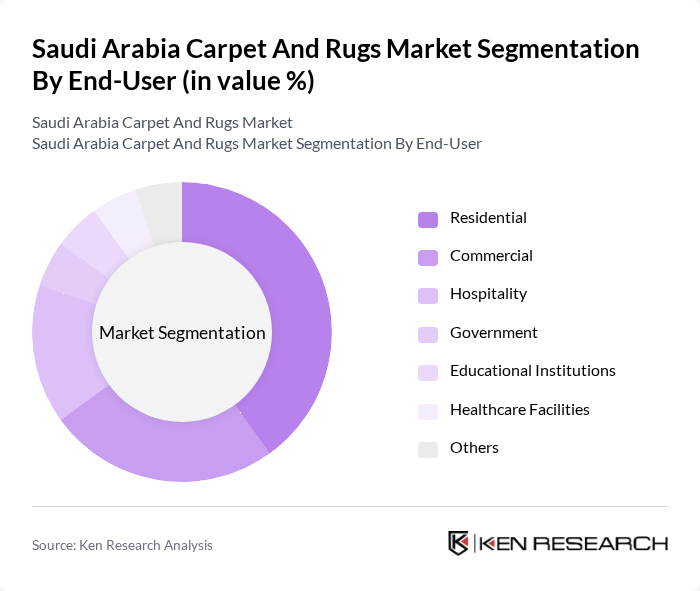

By End-User:The market is segmented based on end-users, including residential, commercial, hospitality, government, educational institutions, healthcare facilities, and others. Each segment has unique requirements and preferences, influencing the types of carpets and rugs purchased. The residential segment is the largest, driven by home renovation and interior design trends, while commercial and hospitality sectors are expanding due to growth in real estate and tourism .

The residential segment is the largest end-user category, driven by the growing trend of home decoration and renovation. Consumers are increasingly investing in carpets and rugs to enhance the aesthetic appeal of their living spaces. The rise in disposable income and the influence of social media on home decor trends have further fueled this demand. Additionally, the availability of a wide range of styles and materials caters to diverse consumer preferences, making residential carpets a popular choice .

The Saudi Arabia Carpet And Rugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Carpets, Al-Muhaidib Group, Al-Ameen Carpets, Al-Faisal Carpets, Al-Mansour Carpets, Al-Sarh Carpets, Al-Jazira Carpets, Al-Mahmal Carpets, Al-Qassim Carpets, Al-Riyadh Carpets, Al-Saudia Carpets, Al-Tamimi Carpets, Al-Watania Carpets, Al-Zahrani Carpets, Al-Muhtadi Carpets, Al Harithy Company, Al Abdullatif Industrial Investment Company, Oriental Weavers, Al Sorayai Group, and Al Sadhan Group contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia carpet and rugs market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As manufacturers increasingly adopt automation and digital tools in production, efficiency and product quality are expected to improve. Additionally, the shift towards online shopping will reshape retail strategies, allowing brands to reach a broader audience. With a growing emphasis on sustainability, eco-friendly products will likely gain traction, aligning with global trends and consumer demand for responsible sourcing and production practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Handwoven Rugs Machine-made Rugs Tufted Carpets Woven Carpets Carpet Tiles Outdoor Rugs Luxury Rugs Eco-friendly Rugs Others (Mats, Runners) |

| By End-User | Residential Commercial Hospitality Government Educational Institutions Healthcare Facilities Others |

| By Material | Wool Nylon Polyester Polypropylene Cotton Silk Jute Sisal Others |

| By Design | Traditional Modern Geometric Floral Customized Others |

| By Distribution Channel | Online Retail Offline Retail Wholesale Direct Sales Others |

| By Price Range | Budget Mid-range Premium Luxury Others |

| By Region | Riyadh (Central Region) Jeddah (Western Region) Mecca & Medina (Western Region) Eastern Province (Dammam, Khobar) Southern Region Northern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Carpet Sales | 150 | Store Managers, Sales Executives |

| Manufacturing Insights | 100 | Production Managers, Quality Control Officers |

| Consumer Preferences | 150 | Homeowners, Interior Designers |

| Import/Export Dynamics | 80 | Logistics Coordinators, Trade Compliance Officers |

| Market Trends Analysis | 120 | Market Analysts, Business Development Managers |

The Saudi Arabia Carpet and Rugs Market is valued at approximately USD 1.8 billion, reflecting a robust growth driven by increasing consumer demand for home decor, rising disposable incomes, and significant urbanization efforts in the country.