Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7995

Pages:81

Published On:December 2025

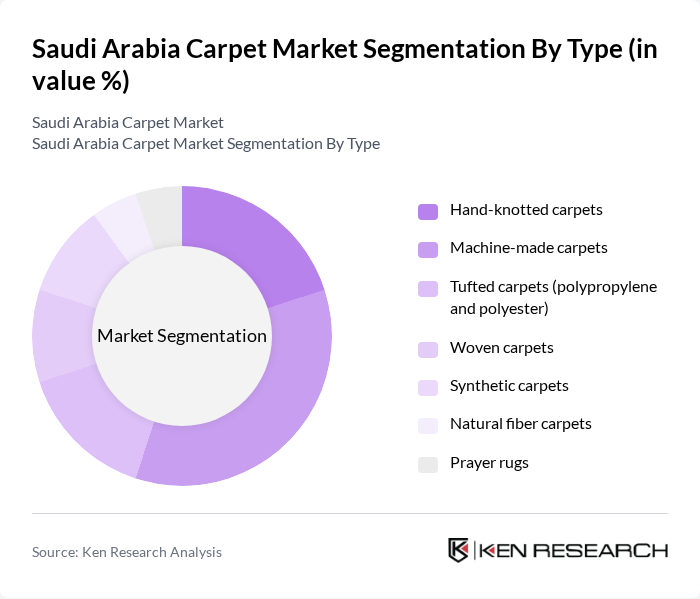

By Type:The carpet market in Saudi Arabia is segmented into various types, including hand-knotted carpets, machine-made carpets, tufted carpets (polypropylene and polyester), woven carpets, synthetic carpets, natural fiber carpets, and prayer rugs. Among these, machine-made carpets are gaining popularity due to their affordability and variety, while hand-knotted carpets are favored for their craftsmanship and cultural significance, with tufted carpets leading due to cost-effective production and versatility in residential and commercial applications.

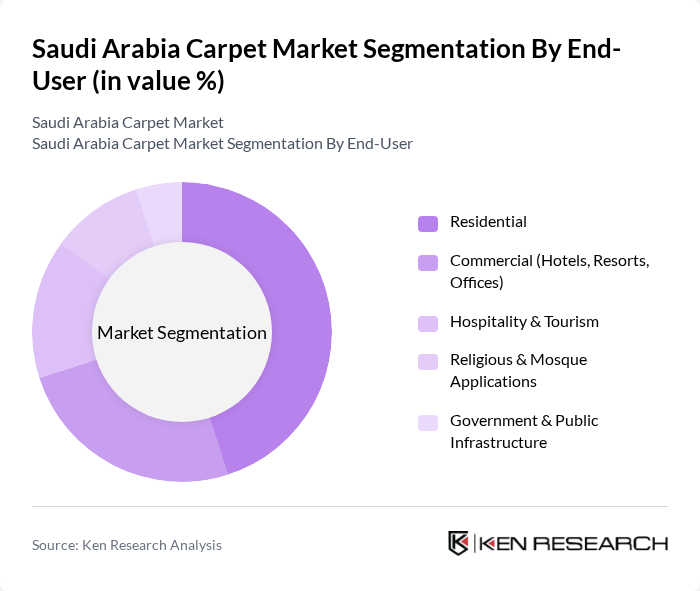

By End-User:The end-user segmentation of the carpet market includes residential, commercial (hotels, resorts, offices), hospitality & tourism, religious & mosque applications, and government & public infrastructure. The residential segment is the largest, driven by increasing home ownership and renovation activities, while the commercial segment is growing due to the expansion of the hospitality sector and rising investments in tourism infrastructure.

The Saudi Arabia Carpet Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Carpets, Riyadh Velvet Factory, Ege Carpets (Saudi Operations), Al-Sorayai Group, Al-Muhaidib Group, Al-Farooq Carpets, Al-Jazira Carpets, Al-Mansour Carpets, Al-Sarh Carpets, Al-Mahmal Carpets, Al-Qassim Carpets, and Al-Nasr Carpets contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia carpet market is poised for dynamic growth, driven by increasing consumer interest in luxury and customized products. As the real estate sector continues to expand, the demand for high-quality carpets is expected to rise, particularly in urban developments. Additionally, the integration of technology in carpets and a shift towards sustainable materials will likely shape future trends, creating opportunities for innovation and differentiation in the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Hand-knotted carpets Machine-made carpets Tufted carpets (polypropylene and polyester) Woven carpets Synthetic carpets Natural fiber carpets Prayer rugs |

| By End-User | Residential Commercial (Hotels, Resorts, Offices) Hospitality & Tourism Religious & Mosque Applications Government & Public Infrastructure |

| By Material | Wool Silk Cotton Polypropylene Polyester Blends |

| By Design | Traditional Arabian designs Modern Geometric Floral Contemporary custom designs |

| By Distribution Channel | Online retail Offline retail Direct sales to developers Wholesale & B2B Interior design partnerships |

| By Price Range | Budget (Mid-range tufted options) Mid-range Premium Luxury (High-end custom carpets) |

| By Region | Central Region (Riyadh) Eastern Region Western Region (Jeddah, Mecca, Medina) Southern Region Northern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Carpet Sales | 150 | Store Managers, Sales Representatives |

| Manufacturing Insights | 100 | Production Managers, Quality Control Supervisors |

| Consumer Preferences | 120 | Homeowners, Interior Designers |

| Export Market Dynamics | 80 | Export Managers, Trade Analysts |

| Market Trends and Innovations | 70 | Product Development Managers, Marketing Executives |

The Saudi Arabia Carpet Market is valued at approximately USD 1.8 billion, driven by increasing consumer demand for home decor, rising disposable incomes, and urbanization trends, alongside expanding real estate developments.