Region:Middle East

Author(s):Rebecca

Product Code:KRAA9457

Pages:82

Published On:November 2025

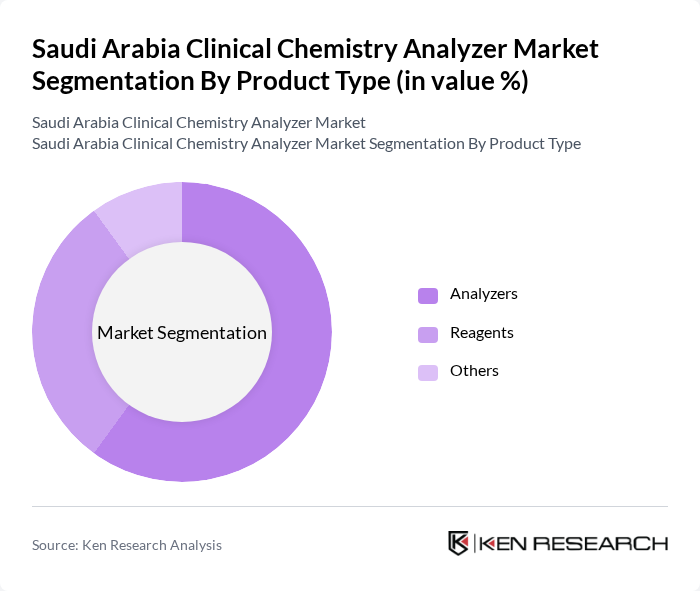

By Product Type:The product type segmentation includes analyzers, reagents, and others. Analyzers remain the most significant segment due to their essential role in performing a broad range of tests efficiently and accurately. The demand for high-throughput and automated analyzers has surged, driven by the need for rapid diagnostic results and workflow automation in clinical settings. Reagents, while crucial, follow as their utilization is directly linked to analyzer usage. The "Others" category includes ancillary products such as calibrators, controls, and consumables that support the main offerings .

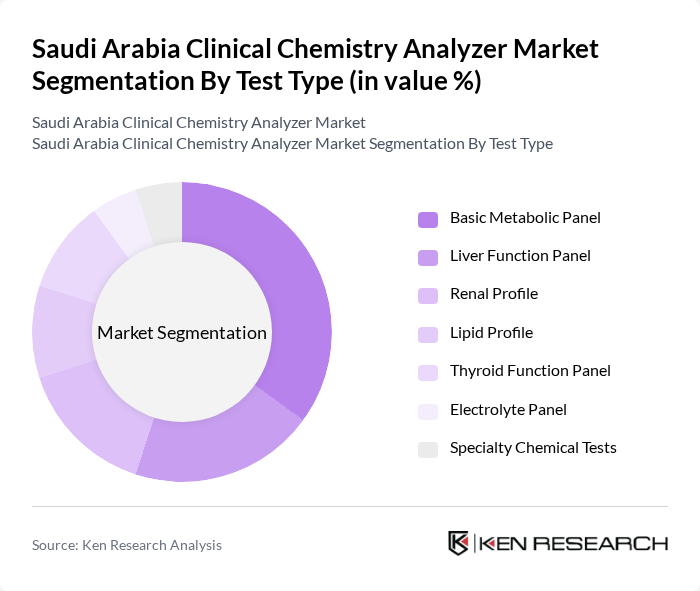

By Test Type:The test type segmentation encompasses various panels such as Basic Metabolic Panel, Liver Function Panel, Renal Profile, Lipid Profile, Thyroid Function Panel, Electrolyte Panel, and Specialty Chemical Tests. The Basic Metabolic Panel leads the market due to its widespread use in routine health assessments and its ability to provide critical information about a patient's metabolic state. Other panels, while important, cater to more specific diagnostic needs, thus having a smaller market share .

The Saudi Arabia Clinical Chemistry Analyzer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Diagnostics, Siemens Healthineers, Roche Diagnostics, Beckman Coulter (Danaher Corporation), Thermo Fisher Scientific, Mindray Medical International Limited, Sysmex Corporation, Ortho Clinical Diagnostics, Bio-Rad Laboratories, Agilent Technologies, Horiba Medical, Fujifilm Holdings Corporation, PerkinElmer, DiaSorin S.p.A., QIAGEN N.V. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the clinical chemistry analyzer market in Saudi Arabia appears promising, driven by ongoing technological advancements and increased healthcare investments. The integration of artificial intelligence in diagnostic processes is expected to enhance accuracy and efficiency, while the shift towards automation will streamline laboratory operations. Additionally, the growing emphasis on preventive healthcare will likely lead to increased demand for routine testing, further propelling market growth and innovation in diagnostic solutions.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Analyzers Reagents Others |

| By Test Type | Basic Metabolic Panel Liver Function Panel Renal Profile Lipid Profile Thyroid Function Panel Electrolyte Panel Specialty Chemical Tests |

| By End-User | Hospitals Diagnostic Laboratories Research Laboratories & Institutes Others |

| By Technology | Fully Automated Analyzers Semi-Automated Analyzers Point-of-Care Testing (POCT) Devices Others |

| By Distribution Channel | Direct Sales Local Distributors Online Sales Others |

| By Region | Central Region (Riyadh) Eastern Region (Dhahran, Khobar) Western Region (Jeddah, Mecca) Southern Region |

| By Application | Routine Diagnostic Testing Emergency Testing Preventive Screening Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Laboratories | 100 | Laboratory Managers, Clinical Chemists |

| Diagnostic Centers | 80 | Pathologists, Operations Managers |

| Research Institutions | 50 | Research Scientists, Lab Technicians |

| Private Clinics | 40 | General Practitioners, Clinic Managers |

| Healthcare Policy Makers | 40 | Health Administrators, Policy Analysts |

The Saudi Arabia Clinical Chemistry Analyzer Market is valued at approximately USD 105 million, reflecting a significant growth driven by the increasing prevalence of chronic diseases, advancements in diagnostic technologies, and a focus on preventive healthcare.