Region:Middle East

Author(s):Geetanshi

Product Code:KRAB6665

Pages:89

Published On:October 2025

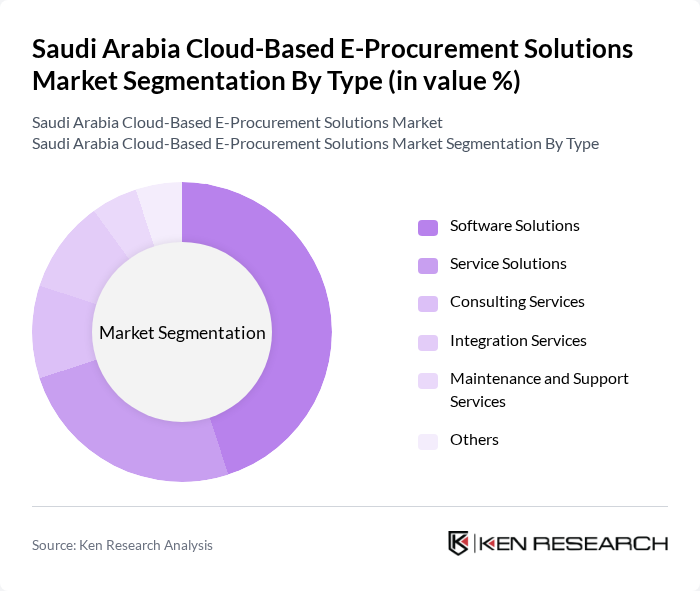

By Type:The market is segmented into various types, including Software Solutions, Service Solutions, Consulting Services, Integration Services, Maintenance and Support Services, and Others. Among these, Software Solutions are leading the market due to their ability to automate procurement processes and enhance efficiency.

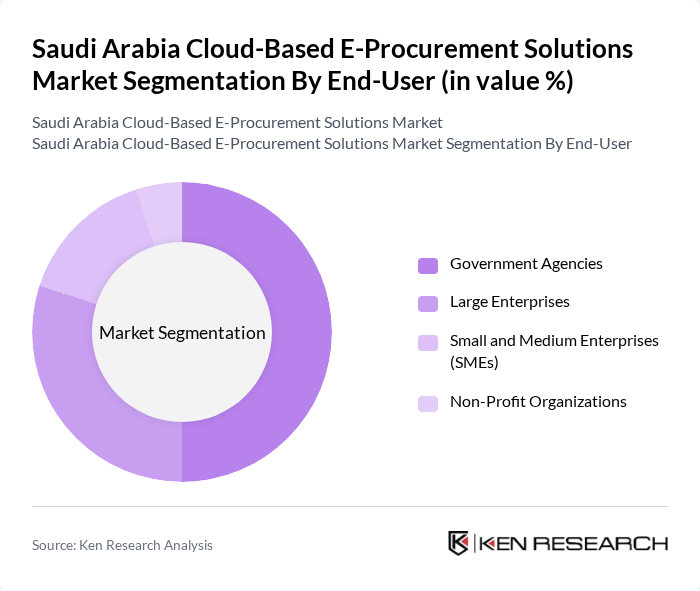

By End-User:The end-user segmentation includes Government Agencies, Large Enterprises, Small and Medium Enterprises (SMEs), and Non-Profit Organizations. Government Agencies are the dominant segment, driven by the need for compliance with new regulations and the push for digital transformation in public procurement.

The Saudi Arabia Cloud-Based E-Procurement Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Coupa Software Incorporated, Jaggaer, Ivalua, GEP Worldwide, Ariba, an SAP Company, Proactis, SynerTrade, Zycus, Basware, Tradeshift, SpendHQ, Determine, a Corcentric Company, Xeeva contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia cloud-based e-procurement solutions market appears promising, driven by ongoing digital transformation initiatives and government support. As organizations increasingly recognize the benefits of e-procurement, the market is expected to witness significant growth. The integration of advanced technologies, such as artificial intelligence and blockchain, will further enhance procurement processes, ensuring transparency and efficiency. Additionally, the focus on sustainability will shape procurement strategies, aligning with global trends and local regulations.

| Segment | Sub-Segments |

|---|---|

| By Type | Software Solutions Service Solutions Consulting Services Integration Services Maintenance and Support Services Others |

| By End-User | Government Agencies Large Enterprises Small and Medium Enterprises (SMEs) Non-Profit Organizations |

| By Industry Vertical | Construction Healthcare Retail Manufacturing Education Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Sales Channel | Direct Sales Online Sales Reseller Partnerships |

| By Geographic Region | Central Region Eastern Region Western Region Southern Region |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Procurement Departments | 100 | Procurement Managers, IT Directors |

| Healthcare Sector E-Procurement | 80 | Supply Chain Managers, Procurement Officers |

| Construction Industry Procurement | 70 | Project Managers, Procurement Specialists |

| Retail Sector E-Procurement Solutions | 90 | Operations Managers, E-commerce Directors |

| Manufacturing Sector Procurement | 75 | Supply Chain Directors, IT Managers |

The Saudi Arabia Cloud-Based E-Procurement Solutions Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by digital transformation initiatives and the demand for transparency in public procurement processes.