Region:Middle East

Author(s):Geetanshi

Product Code:KRAB6797

Pages:99

Published On:October 2025

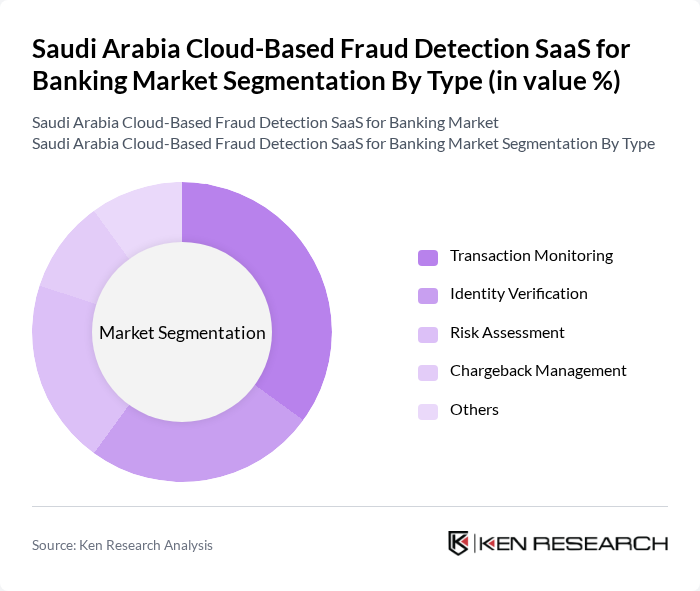

By Type:The market can be segmented into various types, including Transaction Monitoring, Identity Verification, Risk Assessment, Chargeback Management, and Others. Each of these sub-segments plays a crucial role in addressing specific fraud-related challenges faced by banking institutions.

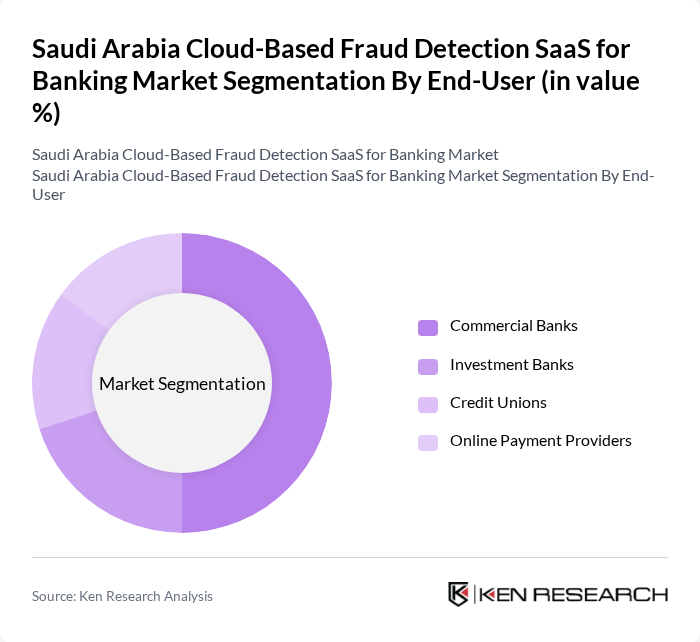

By End-User:The end-user segmentation includes Commercial Banks, Investment Banks, Credit Unions, and Online Payment Providers. Each of these segments has unique requirements and challenges that cloud-based fraud detection solutions can address effectively.

The Saudi Arabia Cloud-Based Fraud Detection SaaS for Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as FICO, SAS Institute Inc., ACI Worldwide, NICE Actimize, Oracle Corporation, IBM Corporation, Palantir Technologies, Experian, RSA Security LLC, ThreatMetrix, Verafin, Kount, Forter, Zoot Enterprises, Sift Science contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cloud-based fraud detection SaaS market in Saudi Arabia appears promising, driven by technological advancements and increasing digitalization in banking. As banks continue to embrace AI and machine learning, the integration of these technologies into fraud detection systems will enhance their effectiveness. Furthermore, the ongoing government initiatives aimed at promoting digital transformation will likely accelerate the adoption of innovative solutions, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Transaction Monitoring Identity Verification Risk Assessment Chargeback Management Others |

| By End-User | Commercial Banks Investment Banks Credit Unions Online Payment Providers |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Application | Fraud Detection Compliance Management Risk Management |

| By Sales Channel | Direct Sales Online Sales Reseller Partnerships |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Region | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Large Commercial Banks | 100 | Chief Information Officers, Fraud Prevention Managers |

| Regional Banks | 75 | IT Security Analysts, Compliance Officers |

| Fintech Companies | 50 | Product Managers, Risk Assessment Specialists |

| Insurance Firms | 40 | Fraud Analysts, Data Scientists |

| Regulatory Bodies | 30 | Policy Makers, Regulatory Compliance Experts |

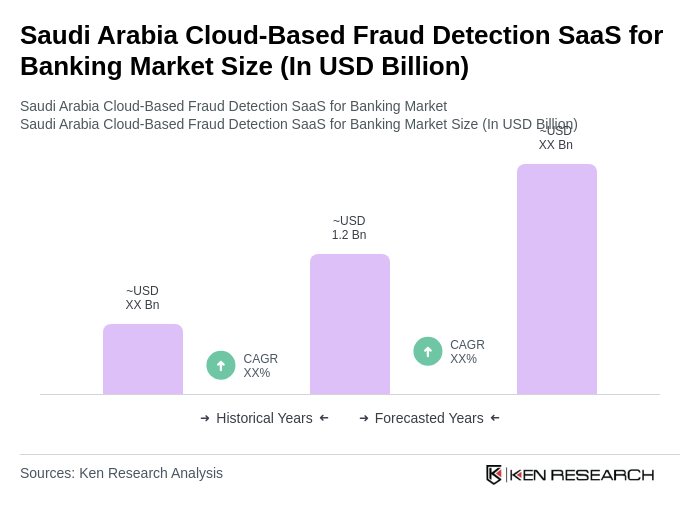

The Saudi Arabia Cloud-Based Fraud Detection SaaS for Banking Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased digitization, rising fraud incidents, and the adoption of advanced technologies like AI and machine learning.