Region:Middle East

Author(s):Shubham

Product Code:KRAC3538

Pages:96

Published On:October 2025

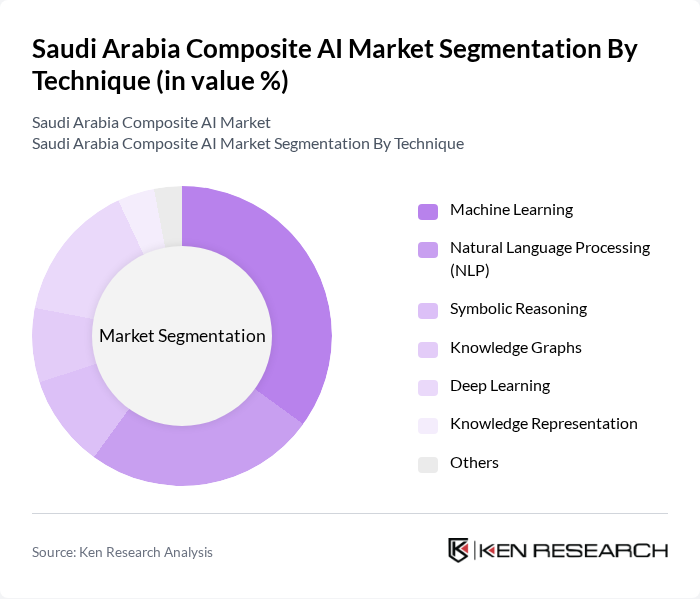

By Technique:The market is segmented based on various techniques used in composite AI, including Machine Learning, Natural Language Processing (NLP), Symbolic Reasoning, Knowledge Graphs, Deep Learning, Knowledge Representation, and Others. Each technique plays a crucial role in enhancing AI capabilities, with Machine Learning and Deep Learning being the most prominent due to their wide applications in data analysis and predictive modeling.

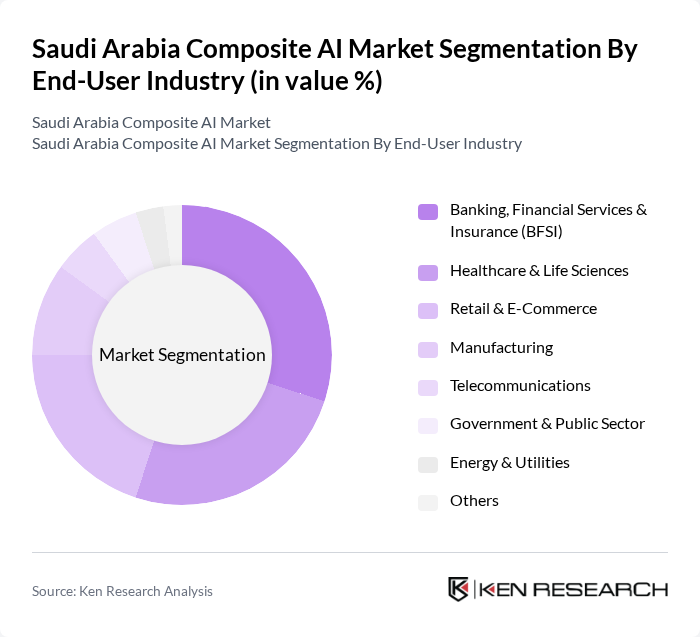

By End-User Industry:The composite AI market is also segmented by end-user industries, including Banking, Financial Services & Insurance (BFSI), Healthcare & Life Sciences, Retail & E-Commerce, Manufacturing, Telecommunications, Government & Public Sector, Energy & Utilities, and Others. The BFSI sector leads the market due to the increasing need for fraud detection and risk management solutions, while healthcare is rapidly adopting AI for clinical decision support and patient management.

The Saudi Arabia Composite AI Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Microsoft Corporation, Google LLC, Amazon Web Services, Inc., Oracle Corporation, SAP SE, Accenture PLC, Infosys Limited, Wipro Limited, Tata Consultancy Services (TCS), Palantir Technologies Inc., NVIDIA Corporation, SAS Institute Inc., UiPath Inc., Automation Anywhere, ServiceTitan (Composite AI for Enterprise Services), Pegasystems Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia Composite AI market appears promising, driven by ongoing government support and increasing private sector investments. As the nation continues to embrace digital transformation, the integration of AI into various sectors, including healthcare and finance, is expected to accelerate. Moreover, the focus on ethical AI practices and data protection will likely shape the regulatory landscape, fostering a more secure environment for AI deployment. This evolving ecosystem will create numerous opportunities for innovation and collaboration in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Technique | Machine Learning Natural Language Processing (NLP) Symbolic Reasoning Knowledge Graphs Deep Learning Knowledge Representation Others |

| By End-User Industry | Banking, Financial Services & Insurance (BFSI) Healthcare & Life Sciences Retail & E-Commerce Manufacturing Telecommunications Government & Public Sector Energy & Utilities Others |

| By Application | Fraud Detection & Risk Management Clinical Decision Support Customer Service Automation Supply Chain Optimization Predictive Maintenance Drug Discovery & Development Personalization & Recommendation Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Service Offering | Consulting Services Platform & Software Solutions Implementation & Integration Services Support & Maintenance Training & Education |

| By Region | Riyadh Metropolitan Eastern Region (Dammam, Khobar) Western Region (Jeddah) Central Regions Other Regions |

| By Pricing Model | Subscription-Based (SaaS) Pay-Per-Use (Usage-Based) Licensing (Perpetual) Managed Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare AI Solutions | 120 | Healthcare Administrators, IT Managers |

| Financial Services AI Applications | 100 | Chief Technology Officers, Risk Analysts |

| Retail AI Integration | 90 | Retail Managers, E-commerce Directors |

| Manufacturing AI Innovations | 80 | Operations Managers, Production Supervisors |

| AI in Education Sector | 70 | Educational Administrators, Curriculum Developers |

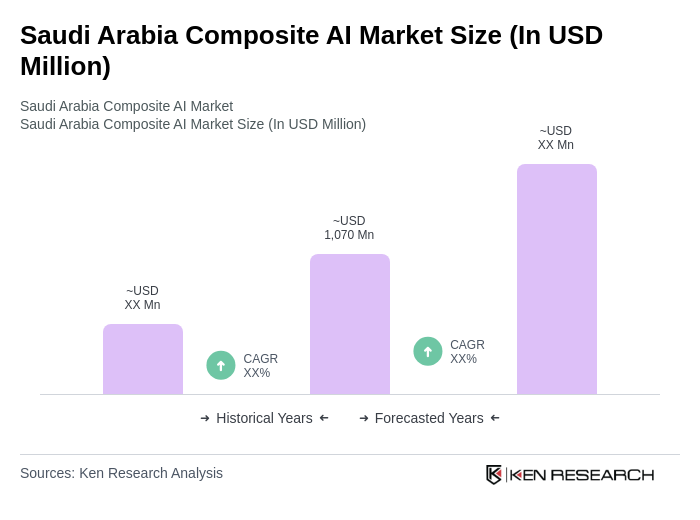

The Saudi Arabia Composite AI Market is valued at approximately USD 1,070 million, reflecting significant growth driven by the adoption of AI technologies across various sectors, including healthcare, finance, and retail.