Region:Middle East

Author(s):Rebecca

Product Code:KRAD4911

Pages:99

Published On:December 2025

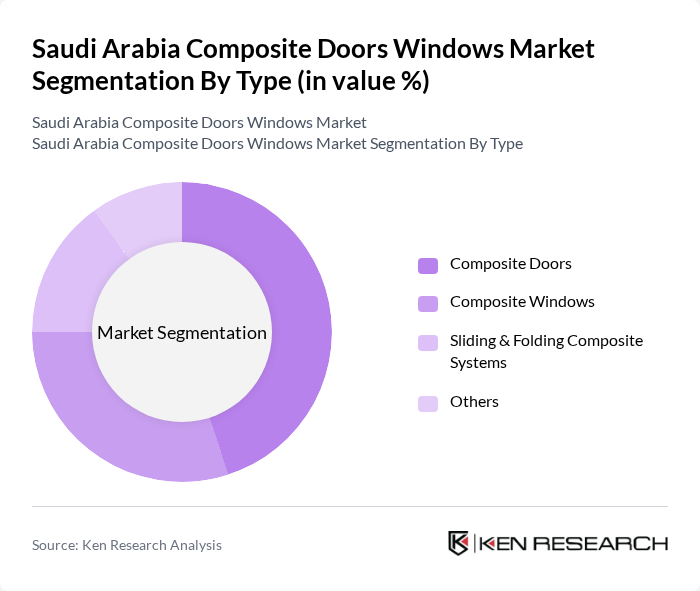

By Type:The market is segmented into various types, including Composite Doors, Composite Windows, Sliding & Folding Composite Systems, and Others. At a global level, composite doors account for a higher share of the composite doors and windows category, driven by robust residential replacement demand, multi-point locking systems, and aesthetics that replicate timber while offering superior performance. In Saudi Arabia, Composite Doors are similarly viewed as a leading application within composite fenestration due to their superior durability, security, and aesthetic appeal, making them a preferred choice for both residential and commercial entrances in harsh climatic conditions. Composite Windows are also gaining traction, particularly in energy-efficient and high-specification buildings where improved thermal and acoustic insulation helps reduce HVAC loads. Sliding & Folding Composite Systems are popular in modern architectural designs for villas, apartments, and hospitality projects that favor large glazed openings and indoor–outdoor connectivity, while the Others category includes niche composite framing and specialty systems used in specific commercial and institutional applications.

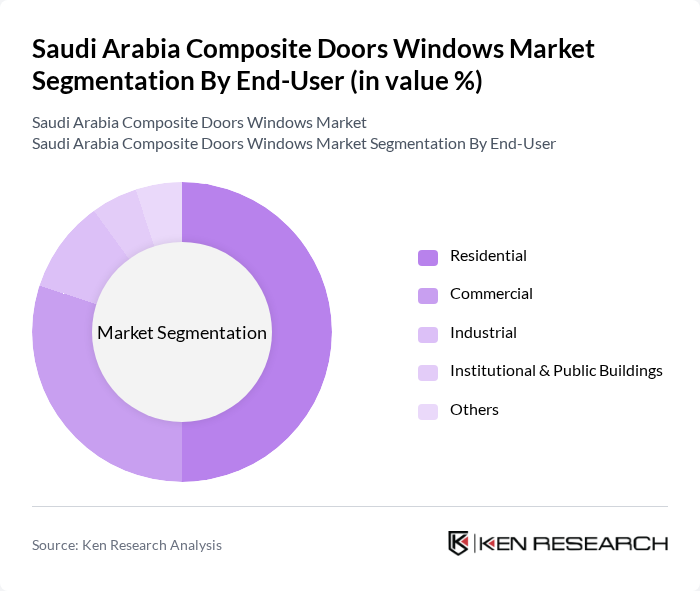

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Institutional & Public Buildings, and Others. The Residential segment is the largest within the broader Saudi doors and windows market, supported by government-backed housing programs, rising homeownership targets, and strong demand for modern, energy-efficient homes under Vision 2030. The Commercial segment follows closely, driven by retail, office, hospitality, and mixed-use developments that increasingly specify durable, high-performance, and aesthetically refined door and window systems. Industrial facilities and logistics assets require robust, low-maintenance fenestration, while Institutional & Public Buildings such as schools, hospitals, and government facilities are progressively adopting composite and advanced materials to meet sustainability, safety, and lifecycle cost objectives. The Others segment comprises specialized applications in renovation, small commercial premises, and niche infrastructure projects.

The Saudi Arabia Composite Doors Windows Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi American Glass Company (Doors & Windows Division), Technal Middle East (Hydal Group – Saudi Operations), Reynaers Aluminium Saudi Arabia, Alfanar Aluminium & Glass (Fenestration Division), Al Jawdaa Factory for uPVC Windows & Doors, Al Jazira Factory for Windows & Doors, Winstar Windows & Doors (Saudi Arabia), Wintek uPVC Windows & Doors, Al Kuhaimi Metal Industries (Doors & Façade Systems), Al Ghurair Construction – Aluminium (Saudi Projects), Gulf Extrusions / Balexco (Aluminium Systems in Saudi Arabia), Deceuninck Saudi Arabia (uPVC Systems), Salam International Trading Co. (Building Materials & Fenestration), Saudi Building Materials Company (SBM), Arabian Extrusions & Local Fabricator Network (Composite Systems) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia composite doors and windows market appears promising, driven by increasing urbanization and a strong governmental push for sustainable construction practices. As the population grows, the demand for energy-efficient solutions will likely rise, supported by ongoing technological advancements in composite materials. Additionally, the integration of smart technology into building materials is expected to enhance product appeal, making them more attractive to tech-savvy consumers seeking modern solutions for their homes and businesses.

| Segment | Sub-Segments |

|---|---|

| By Type | Composite Doors Composite Windows Sliding & Folding Composite Systems Others |

| By End-User | Residential Commercial Industrial Institutional & Public Buildings Others |

| By Region | Riyadh & Central Region Eastern Province Makkah & Western Region Southern & Other Regions |

| By Application | New Construction Renovation & Retrofit Large-Scale Project / Mega-Project Supply Others |

| By Material Composition | PVC / uPVC Composite Fiberglass (GRP / FRP) Wood-Plastic Composite (WPC) Other Hybrid Composites |

| By Design Style | Modern / Contemporary Traditional / Classic Custom & Project-Specific Designs Others |

| By Price Range | Budget Mid-Range Premium Luxury / Project-Specified |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Composite Door Market | 120 | Homeowners, Interior Designers |

| Commercial Window Installations | 90 | Facility Managers, Architects |

| Industrial Applications of Composite Products | 70 | Procurement Managers, Construction Project Leads |

| Retail Sector Demand for Composite Doors | 60 | Retail Managers, Store Designers |

| Market Trends in Sustainable Building Materials | 80 | Sustainability Consultants, Building Code Officials |

The Saudi Arabia Composite Doors Windows Market is valued at approximately USD 30 million, reflecting a five-year historical analysis. This growth is driven by the booming construction sector and increasing demand for energy-efficient building materials.