Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7140

Pages:97

Published On:October 2025

Market.png)

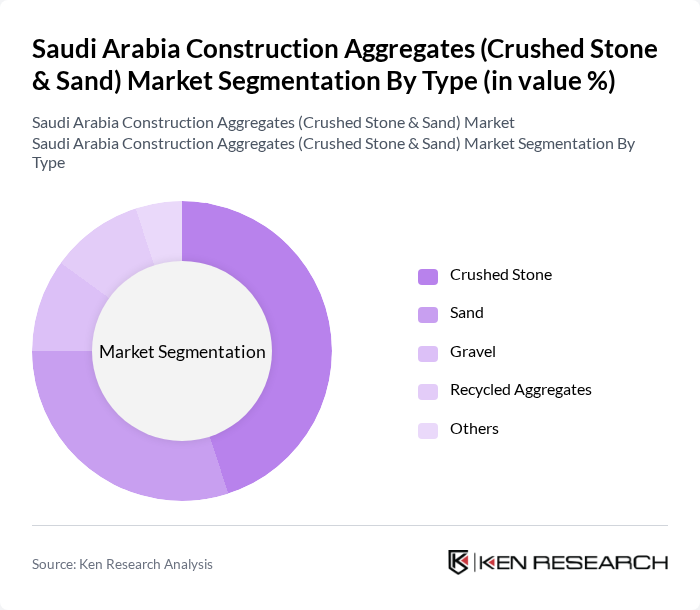

By Type:The market is segmented into various types of construction aggregates, including crushed stone, sand, gravel, recycled aggregates, and others. Among these, crushed stone and sand are the most widely used due to their essential roles in concrete production and road construction. The demand for recycled aggregates is also gaining traction as sustainability becomes a priority in construction practices.

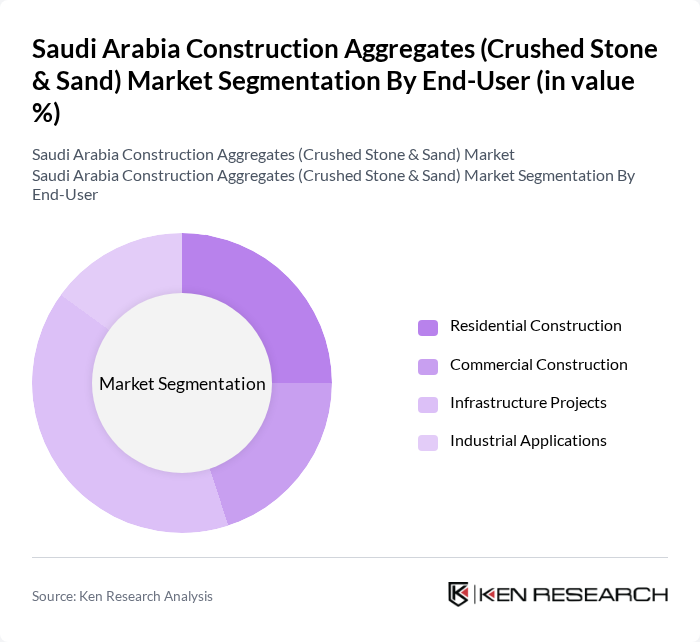

By End-User:The end-user segmentation includes residential construction, commercial construction, infrastructure projects, and industrial applications. Infrastructure projects are the leading segment, driven by government investments in roads, bridges, and public facilities, which require substantial amounts of construction aggregates.

The Saudi Arabia Construction Aggregates (Crushed Stone & Sand) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Readymix Concrete Co., Al Rashed Cement Co., Eastern Province Cement Co., Qassim Cement Co., Riyadh Cement Co., Al-Jazira Concrete Products Co., Al-Ahlia Cement Co., Tabuk Cement Co., Najran Cement Co., Al-Muhaidib Group, Al-Babtain Group, Al-Fozan Group, Al-Habtoor Group, Al-Qatami Global for General Trading & Contracting, Al-Mansoori Specialized Engineering contribute to innovation, geographic expansion, and service delivery in this space.

The future of the construction aggregates market in Saudi Arabia appears promising, driven by ongoing infrastructure projects and urbanization trends. With the government's commitment to Vision 2030, significant investments in smart city developments and renewable energy projects are anticipated. Additionally, the adoption of advanced technologies in production processes is likely to enhance efficiency and sustainability. As the market evolves, companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities and navigate challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Crushed Stone Sand Gravel Recycled Aggregates Others |

| By End-User | Residential Construction Commercial Construction Infrastructure Projects Industrial Applications |

| By Application | Road Construction Concrete Production Asphalt Production Landscaping |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Price Range | Low Price Mid Price High Price |

| By Quality Grade | Standard Grade Premium Grade Specialty Grade |

| By Region | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Project Managers | 100 | Project Managers, Site Engineers |

| Aggregate Suppliers | 80 | Sales Managers, Operations Directors |

| Government Regulatory Bodies | 50 | Policy Makers, Regulatory Officers |

| Construction Material Distributors | 70 | Distribution Managers, Logistics Coordinators |

| End-Users in Construction | 90 | Contractors, Builders |

The Saudi Arabia Construction Aggregates market is valued at approximately USD 1.5 billion, driven by rapid urbanization and significant government infrastructure development initiatives that have increased the demand for materials like crushed stone and sand.