Region:Middle East

Author(s):Dev

Product Code:KRAD5262

Pages:100

Published On:December 2025

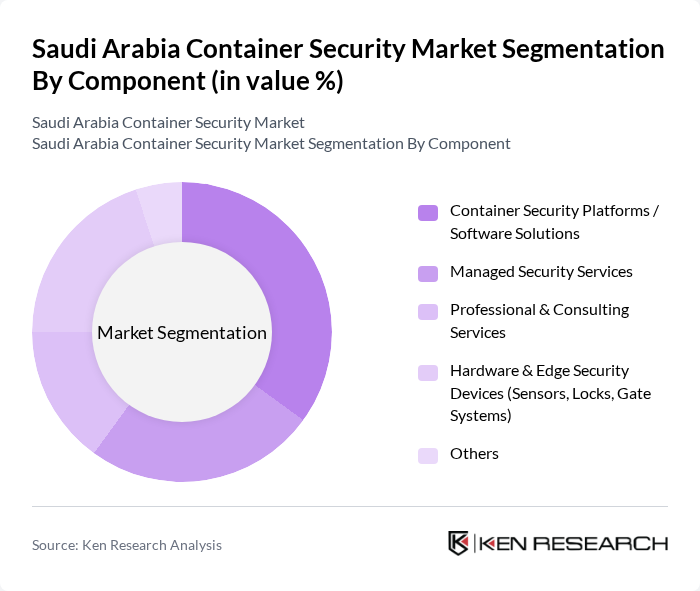

By Component:The components of the market include various solutions and services that enhance container security. The primary subsegments are Container Security Platforms / Software Solutions, Managed Security Services, Professional & Consulting Services, Hardware & Edge Security Devices (Sensors, Locks, Gate Systems), and Others. This structure is consistent with global container security markets, where software platforms and related services together form the core of spending. Among these, Container Security Platforms / Software Solutions are leading due to the increasing adoption of digital solutions for real-time monitoring and management of container security, including cloud-native container security, access control, video analytics, and IoT-based tracking integrated into port community and terminal operating systems.

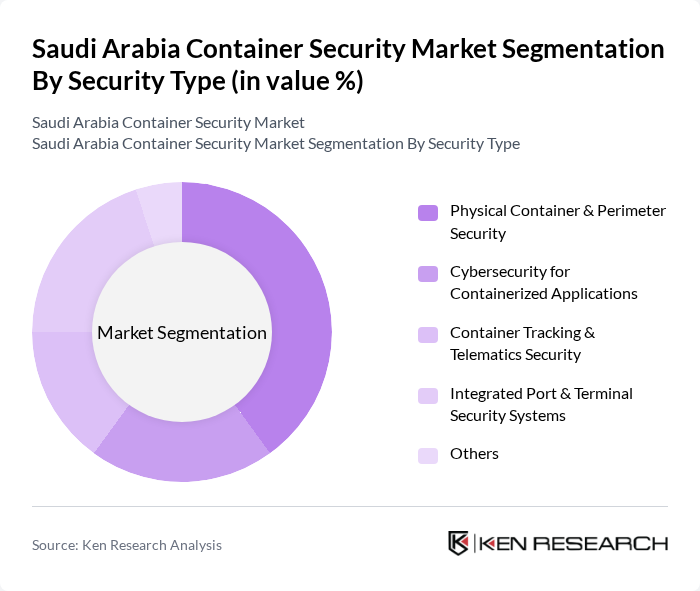

By Security Type:The security types in the market encompass various protective measures, including Physical Container & Perimeter Security, Cybersecurity for Containerized Applications, Container Tracking & Telematics Security, Integrated Port & Terminal Security Systems, and Others. This categorization reflects the convergence of physical security, operational technology security, and IT/container cybersecurity in port and logistics environments. The leading subsegment is Physical Container & Perimeter Security, driven by the necessity for robust physical security measures—such as access control, perimeter intrusion detection, CCTV and video analytics, smart locks, and gate control systems—to protect against theft, smuggling, and damage, while cyber and tracking solutions increasingly complement these controls.

The Saudi Arabia Container Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Ports Authority (Mawani), Saudi Global Ports Company, Red Sea Gateway Terminal Company Ltd., DP World Jeddah, Hutchison Ports Dammam (International Ports Services Co.), Saudi Arabian Oil Company (Saudi Aramco) – Industrial & Port Security, Saudi Arabian Mining Company (Ma’aden) – Logistics & Export Terminal Security, Saudi Arabian Public Transport Company (SAPTCO) Logistics, Saudi Arabian Railways (SAR) – Intermodal & Container Terminals, King Abdullah Port (Ports Development Company), ZATCA – Zakat, Tax and Customs Authority (Customs & Border Container Security), Saudi Telecom Company (stc) – IoT & Container Tracking Solutions, Etihad Etisalat Company (Mobily) – IoT and Telematics for Container Security, Cisco Systems, Inc. – Network & Cybersecurity for Containerized Environments, Honeywell International Inc. – Integrated Port & Critical Infrastructure Security Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the container security market in Saudi Arabia appears promising, driven by ongoing investments in technology and infrastructure. As the nation continues to expand its port facilities, the integration of automated security systems and real-time monitoring solutions will become increasingly prevalent. Additionally, the growing emphasis on cybersecurity will lead to the development of more comprehensive security protocols, ensuring the protection of both physical and digital assets within the container logistics framework.

| Segment | Sub-Segments |

|---|---|

| By Component | Container Security Platforms / Software Solutions Managed Security Services Professional & Consulting Services Hardware & Edge Security Devices (Sensors, Locks, Gate Systems) Others |

| By Security Type | Physical Container & Perimeter Security Cybersecurity for Containerized Applications Container Tracking & Telematics Security Integrated Port & Terminal Security Systems Others |

| By Deployment Mode | On-premise Cloud-based Hybrid |

| By End-User | Port Authorities & Terminal Operators Shipping Lines & Container Operators Logistics & Freight Forwarding Companies Industrial & Energy Sector Shippers (Oil, Gas, Petrochemicals) Government & Defense Agencies (Customs, Border Security) Others |

| By Application | Container Tracking & Location Monitoring Intrusion & Tamper Detection Cargo Condition & Environmental Monitoring Access & Identity Management Compliance & Risk Management / Audit Trail Others |

| By Technology | GPS / GNSS Tracking RFID & NFC IoT Sensors & Telematics Devices Video Surveillance & Analytics Biometric & Smart Access Control Others |

| By Region | Eastern Province Western Province Central Province Southern Province |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Port Security Management | 120 | Port Security Officers, Operations Managers |

| Shipping Company Security Protocols | 100 | Security Managers, Compliance Officers |

| Customs and Border Protection | 90 | Customs Officials, Risk Assessment Analysts |

| Technology Providers for Container Security | 80 | Product Managers, Technical Sales Representatives |

| Logistics and Supply Chain Security | 110 | Supply Chain Directors, Logistics Coordinators |

The Saudi Arabia Container Security Market is valued at approximately USD 50 million, reflecting a five-year historical analysis and recent estimates for container and Kubernetes security expenditures in the country.