Region:Middle East

Author(s):Shubham

Product Code:KRAD3621

Pages:84

Published On:November 2025

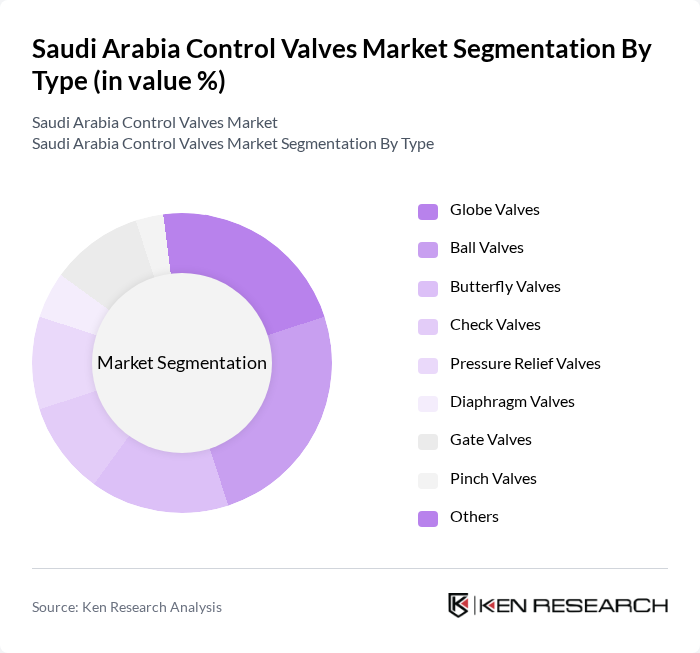

By Type:The control valves market can be segmented into various types, including globe valves, ball valves, butterfly valves, check valves, pressure relief valves, diaphragm valves, gate valves, pinch valves, and others. Each type serves specific applications and industries, with varying demand based on functionality, pressure handling, and material compatibility. Ball valves are widely used for their reliability and tight shutoff, while globe valves are preferred for precise flow regulation. Butterfly and check valves are common in water and wastewater treatment, and pressure relief valves are essential for safety in high-pressure applications .

The ball valves segment is currently dominating the market due to their versatility, ease of operation, and ability to provide a tight seal, making them ideal for various applications in the oil and gas, water treatment, and chemical industries. The increasing focus on automation and process control in these sectors has led to a higher adoption rate of ball valves, which are favored for their reliability and efficiency. The adoption of smart valve technologies, including AI-powered monitoring and predictive maintenance, is further enhancing the demand for this segment .

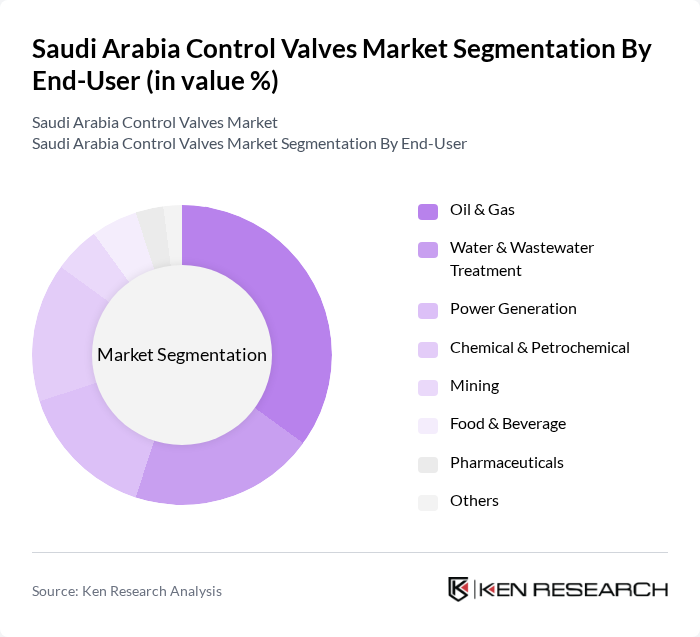

By End-User:The control valves market is segmented by end-user industries, including oil and gas, water and wastewater treatment, power generation, chemical and petrochemical, mining, food and beverage, pharmaceuticals, and others. Each industry has unique requirements and applications for control valves, influencing market dynamics. Oil and gas, chemical, and power sectors require valves with high durability and precision, while water and wastewater treatment emphasize corrosion resistance and low maintenance .

The oil and gas sector is the leading end-user of control valves, driven by the extensive use of these components in exploration, production, and refining processes. The need for precise control over fluid flow and pressure in harsh environments makes control valves indispensable in this industry. Additionally, ongoing investments in oil and gas infrastructure, as well as the push for enhanced operational efficiency and digitalization, are further solidifying the dominance of this segment in the market .

The Saudi Arabia Control Valves Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emerson Electric Co., Flowserve Corporation, Valmet Corporation, KSB SE & Co. KGaA, Honeywell International Inc., Metso Corporation, Pentair plc, Schlumberger Limited, Parker Hannifin Corporation, Yokogawa Electric Corporation, AUMA Riester GmbH & Co. KG, Badger Meter, Inc., AVK Holding A/S, Spirax-Sarco Engineering plc, Zwick Armaturen GmbH, Saudi Mechanical Industries Co. (SMI), SAMSON AG, Cameron (a Schlumberger company), Velan Inc., Al-Jazira Water Treatment Chemicals contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia control valves market is poised for significant growth, driven by technological advancements and increasing automation across industries. The integration of IoT and digitalization is expected to enhance operational efficiency, while the focus on sustainability will push manufacturers to innovate. As the government continues to invest in infrastructure and renewable energy projects, the demand for advanced control solutions will rise, creating a dynamic environment for market players to explore new opportunities and partnerships.

| Segment | Sub-Segments |

|---|---|

| By Type | Globe Valves Ball Valves Butterfly Valves Check Valves Pressure Relief Valves Diaphragm Valves Gate Valves Pinch Valves Others |

| By End-User | Oil & Gas Water & Wastewater Treatment Power Generation Chemical & Petrochemical Mining Food & Beverage Pharmaceuticals Others |

| By Application | Flow Control Pressure Control Temperature Control Level Control Isolation Safety Relief Others |

| By Material | Stainless Steel Cast Iron Bronze Alloy Steel Plastic Others |

| By Size | Up to 2 Inches –6 Inches –12 Inches Above 12 Inches Others |

| By Industry | Oil & Gas Power Generation Water & Wastewater Chemicals & Petrochemicals Mining Food & Beverage Pharmaceuticals Others |

| By Region | Central Region (Riyadh) Eastern Region (Dammam, Jubail) Western Region (Jeddah, Makkah) Southern Region Northern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector Control Valves | 45 | Procurement Managers, Operations Engineers |

| Water Treatment Facilities | 38 | Facility Managers, Maintenance Supervisors |

| Petrochemical Industry Applications | 42 | Process Engineers, Quality Control Managers |

| Power Generation Control Systems | 35 | Plant Managers, Instrumentation Engineers |

| Manufacturing Sector Valve Usage | 40 | Production Managers, Supply Chain Coordinators |

The Saudi Arabia Control Valves Market is valued at approximately USD 150 million, driven by increasing automation demands in industries such as oil and gas, along with infrastructure expansion and a focus on energy efficiency and digitalization.