Region:Middle East

Author(s):Shubham

Product Code:KRAB7436

Pages:94

Published On:October 2025

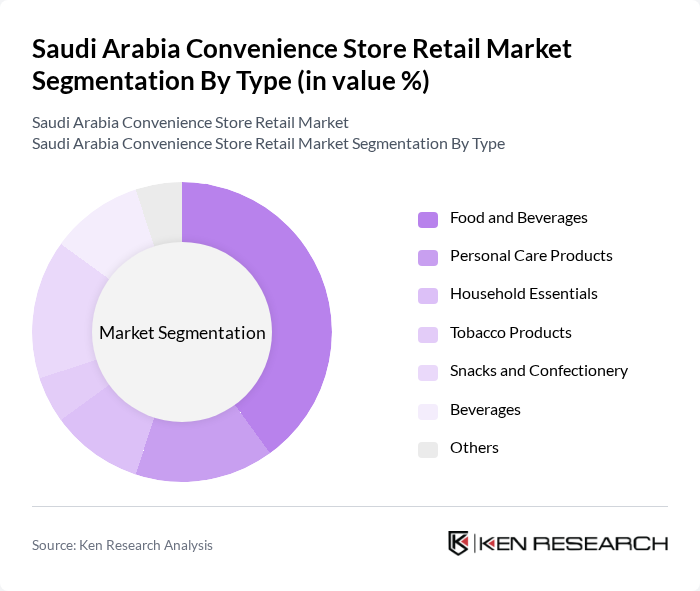

By Type:The convenience store market is segmented into various types, including Food and Beverages, Personal Care Products, Household Essentials, Tobacco Products, Snacks and Confectionery, Beverages, and Others. Among these, Food and Beverages dominate the market due to the increasing consumer preference for ready-to-eat meals and beverages that cater to busy lifestyles. The demand for convenience in food options has led to a significant rise in this segment, making it a key driver of market growth.

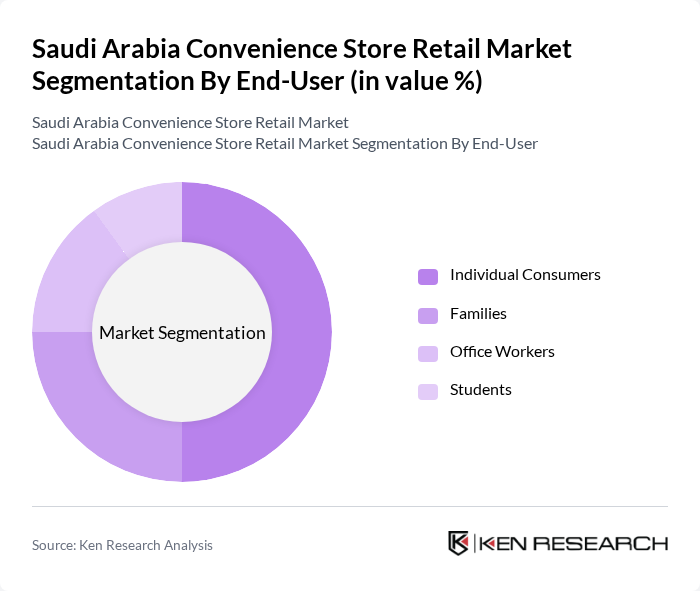

By End-User:The end-user segmentation includes Individual Consumers, Families, Office Workers, and Students. Individual Consumers represent the largest segment, driven by the growing trend of on-the-go shopping and the need for quick access to daily essentials. The convenience of purchasing items in small quantities appeals to busy individuals, making this segment a significant contributor to the overall market.

The Saudi Arabia Convenience Store Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Othaim Markets, Panda Retail Company, LuLu Hypermarket, Carrefour (Majid Al Futtaim), Tamimi Markets, Danube Company, Al Nahdi Medical Company, United Pharmacies, Al Jazeera Markets, Saco World, Othaim Holding, Al-Faisaliah Group, Al-Muhaidib Group, Al-Hokair Group, Al-Mansour Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the convenience store market in Saudi Arabia appears promising, driven by ongoing urbanization and evolving consumer preferences. As disposable incomes rise, convenience stores are likely to expand their product offerings, focusing on health-conscious and ready-to-eat options. Additionally, the integration of technology, such as mobile payment solutions, will enhance customer experiences. Retailers that adapt to these trends and invest in innovative solutions will be well-positioned to thrive in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Food and Beverages Personal Care Products Household Essentials Tobacco Products Snacks and Confectionery Beverages Others |

| By End-User | Individual Consumers Families Office Workers Students |

| By Sales Channel | Online Sales In-Store Sales |

| By Distribution Mode | Direct Distribution Wholesalers |

| By Price Range | Low Price Mid Price Premium Price |

| By Location | Urban Areas Suburban Areas Rural Areas |

| By Product Category | Organic Products Non-Organic Products Imported Products Local Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Convenience Store Owners | 100 | Store Owners, Franchise Operators |

| Consumer Shopping Behavior | 150 | Regular Convenience Store Shoppers |

| Supply Chain and Logistics | 80 | Supply Chain Managers, Distribution Coordinators |

| Market Trends and Insights | 70 | Retail Analysts, Market Researchers |

| Product Category Preferences | 90 | Consumers, Product Category Managers |

The Saudi Arabia Convenience Store Retail Market is valued at approximately USD 5 billion, reflecting a significant growth trend driven by urbanization, changing consumer preferences, and increased disposable income among consumers seeking convenience in shopping.