Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9171

Pages:87

Published On:November 2025

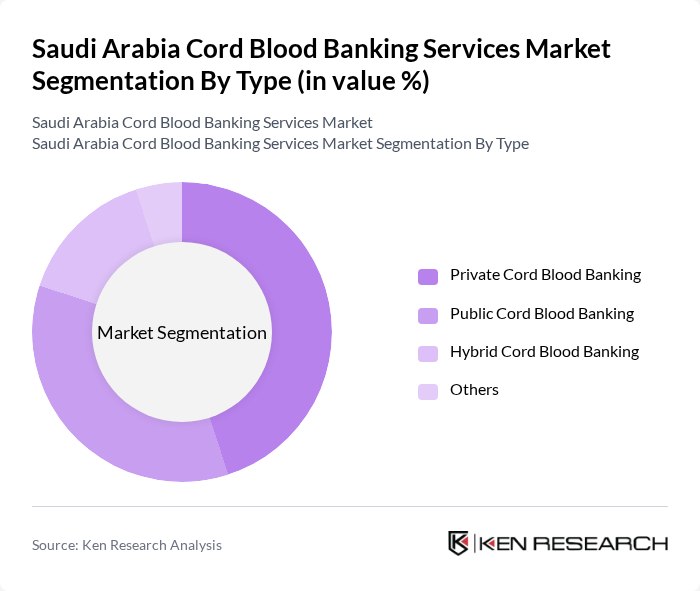

By Type:The market is segmented into Private Cord Blood Banking, Public Cord Blood Banking, Hybrid Cord Blood Banking, and Others.Private Cord Blood Bankingis gaining traction due to increasing consumer preference for personalized healthcare solutions and the perceived long-term benefits of family-exclusive stem cell access.Public Cord Blood Bankingremains significant, offering broader access for patients requiring transplants and supporting national health initiatives.Hybrid modelsare emerging as flexible options, allowing families to benefit from both private and public banking features, including selective access and donation opportunities.

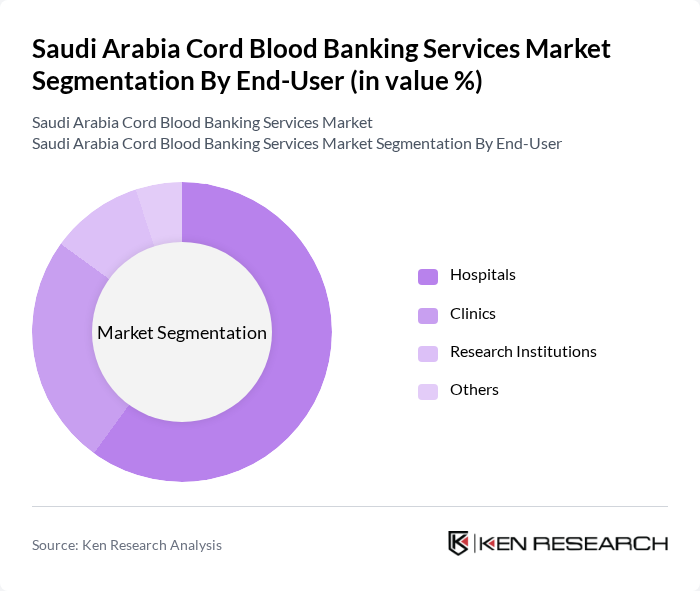

By End-User:The end-user segmentation includes Hospitals, Clinics, Research Institutions, and Others.Hospitalsare the primary end-users, reflecting their central role in childbirth and immediate cord blood collection.Clinicsare increasingly important, especially in urban centers, as families seek specialized and accessible cord blood banking services.Research institutionsare expanding their use of cord blood for clinical trials and regenerative medicine studies, contributing to market growth and innovation.

The Saudi Arabia Cord Blood Banking Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Cord Blood Bank, King Faisal Specialist Hospital & Research Centre, Cryo-Save Arabia, LifeCell International, StemCyte, Cells4Life, Biovault Family, Future Health Biobank, Cord Blood Registry (CBR), Cryo-Cell International, Smart Cells International, Vita 34, PerkinElmer (ViaCord), Reprocell, MedCells Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cord blood banking market in Saudi Arabia appears promising, driven by increasing healthcare investments and a growing emphasis on personalized medicine. As public awareness campaigns gain traction, more families are expected to consider cord blood banking as a viable option. Additionally, advancements in medical technology will likely enhance the efficiency and safety of cord blood collection and storage, further propelling market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Private Cord Blood Banking Public Cord Blood Banking Hybrid Cord Blood Banking Others |

| By End-User | Hospitals Clinics Research Institutions Others |

| By Storage Duration | Short-term Storage (?10 years) Long-term Storage (>10 years) Lifetime Storage Others |

| By Collection Method | In-hospital Collection At-home Collection (with medical supervision) Others |

| By Processing Method | Manual Processing Automated Processing Others |

| By Geographic Distribution | Central Region (Riyadh, Qassim, etc.) Eastern Region (Dammam, Khobar, etc.) Western Region (Jeddah, Makkah, Madinah, etc.) Southern Region (Asir, Jazan, etc.) |

| By Application | Cancer Treatment Blood Disorders Genetic Disorders Immune Disorders Metabolic Disorders Regenerative Medicine Others |

| By Service Type | Collection & Transportation Processing Testing Storage & Preservation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 100 | Hematologists, Oncologists, Regenerative Medicine Specialists |

| Expectant Parents | 120 | Parents considering cord blood banking, New parents |

| Obstetricians and Gynecologists | 60 | Obstetricians, Gynecologists |

| Regulatory Bodies | 40 | Health Policy Makers, Regulatory Affairs Specialists |

| Stem Cell Researchers | 40 | Academic Researchers, Clinical Trial Coordinators |

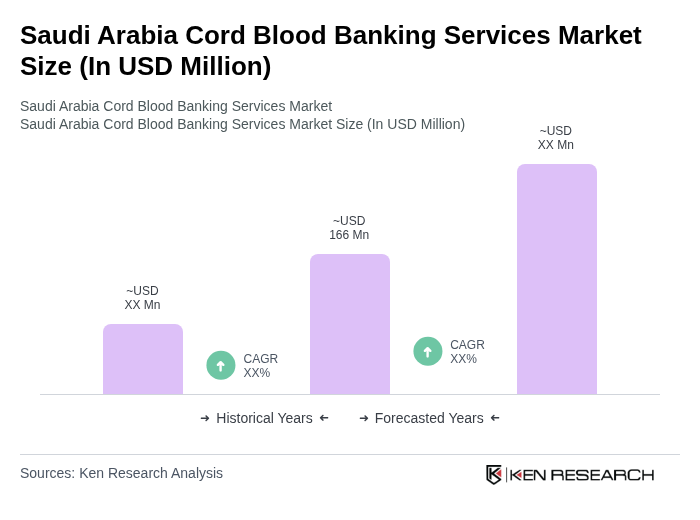

The Saudi Arabia Cord Blood Banking Services Market is valued at approximately USD 166 million, reflecting a significant growth trend driven by increased awareness of cord blood banking benefits and advancements in medical technology.