Region:Middle East

Author(s):Rebecca

Product Code:KRAD4234

Pages:84

Published On:December 2025

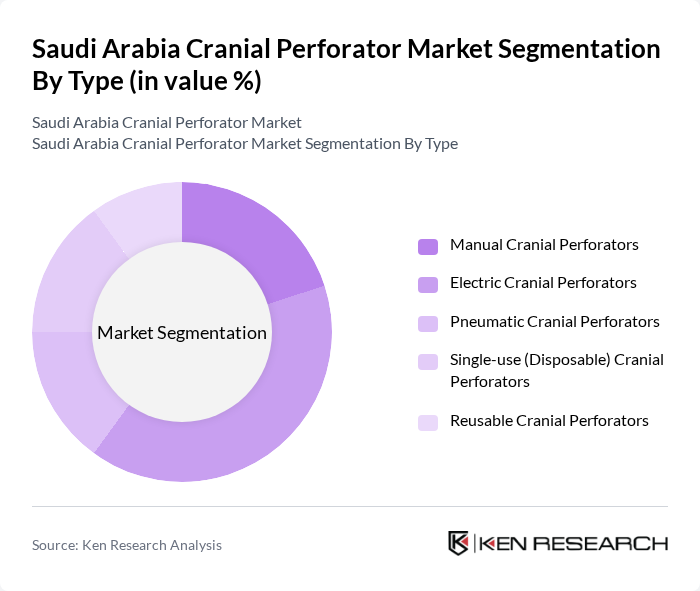

By Type:The market is segmented into various types of cranial perforators, including Manual Cranial Perforators, Electric Cranial Perforators, Pneumatic Cranial Perforators, Single-use (Disposable) Cranial Perforators, and Reusable Cranial Perforators. Among these, Electric Cranial Perforators are gaining traction due to their efficiency and precision in surgical procedures. The demand for Single-use Cranial Perforators is also on the rise, driven by the increasing emphasis on infection control and patient safety in surgical settings.

By End-User:The end-user segmentation includes Tertiary Care Hospitals, Specialty Neurosurgery Centers, Trauma and Emergency Care Centers, Academic & Research Institutions, and Others. Tertiary Care Hospitals are the leading end-users due to their comprehensive services and advanced surgical capabilities. The increasing number of neurosurgeries performed in these hospitals is a significant factor contributing to their dominance in the market. Specialty Neurosurgery Centers are also emerging as key adopters, particularly in urban centers where dedicated neurosurgical care is expanding under national health transformation initiatives.

The Saudi Arabia Cranial Perforator Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Stryker Corporation, Johnson & Johnson (DePuy Synthes), B. Braun Melsungen AG (Aesculap Division), Integra LifeSciences Holdings Corporation, Zimmer Biomet Holdings, Inc., Adeor Medical AG, De Soutter Medical Ltd, GPC Medical Ltd, Braun Surgical SA, Karl Storz SE & Co. KG, Natus Medical Incorporated, Micromar Indústria e Comércio de Produtos Hospitalares Ltda., Aygun Surgical Instruments Co., Inc., Local & Regional Distributors (e.g., Al Faisaliah Medical Systems, Gulf Medical Co.) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia cranial perforator market is poised for significant growth, driven by technological advancements and an increasing focus on patient-centric healthcare solutions. As the healthcare infrastructure expands, particularly in underserved areas, the adoption of minimally invasive surgical techniques is expected to rise. Additionally, the integration of artificial intelligence in surgical procedures will enhance precision and efficiency, further propelling market growth. Collaborative efforts with international medical device companies will also play a crucial role in advancing local capabilities and improving patient care.

| Segment | Sub-Segments |

|---|---|

| By Type | Manual Cranial Perforators Electric Cranial Perforators Pneumatic Cranial Perforators Single-use (Disposable) Cranial Perforators Reusable Cranial Perforators |

| By End-User | Tertiary Care Hospitals Specialty Neurosurgery Centers Trauma and Emergency Care Centers Academic & Research Institutions Others |

| By Clinical Application | Traumatic Brain Injury (TBI) & Emergency Craniotomy Brain Tumor & Oncological Neurosurgery Hydrocephalus & Cerebrospinal Fluid Drainage Procedures Functional & Epilepsy Surgery Pediatric Neurosurgery Others |

| By Distribution Channel | Direct Sales to Hospitals Local Medical Device Distributors Tender-Based / Government Procurement Online & E?procurement Portals Others |

| By Region | Central Region (including Riyadh) Western Region (including Makkah & Madinah) Eastern Region (including Dammam & Khobar) Southern Region Northern Region |

| By Price / Technology Tier | Economy Segment Mid-range Segment Premium Segment (Advanced Safety & High-speed Systems) |

| By Patient Group | Adult Pediatric Geriatric |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Neurosurgery Departments in Major Hospitals | 100 | Neurosurgeons, Department Heads |

| Medical Device Distributors | 70 | Sales Managers, Product Specialists |

| Healthcare Procurement Officers | 80 | Procurement Managers, Supply Chain Directors |

| Clinical Research Organizations | 50 | Clinical Researchers, Project Managers |

| Regulatory Bodies and Health Authorities | 40 | Regulatory Affairs Specialists, Policy Makers |

The Saudi Arabia Cranial Perforator Market is valued at approximately USD 2.4 million, reflecting a five-year historical analysis. This valuation is influenced by the rising prevalence of neurological disorders and advancements in surgical techniques.