Region:Middle East

Author(s):Dev

Product Code:KRAC3432

Pages:95

Published On:October 2025

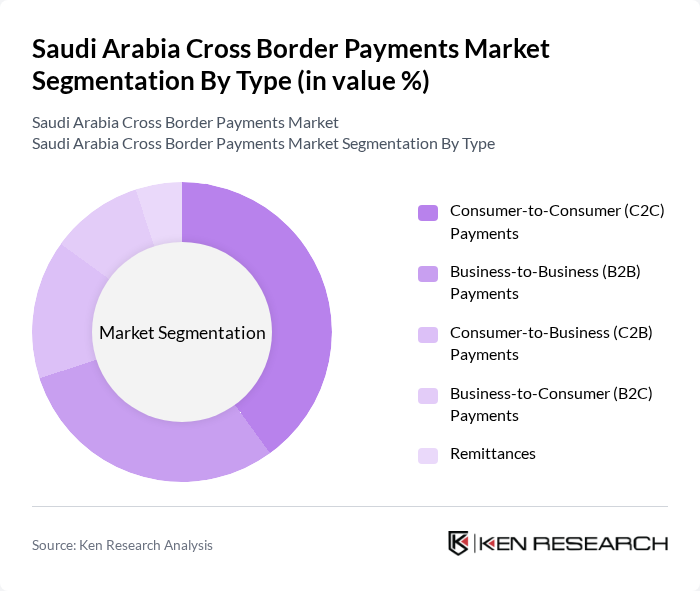

By Type:The segmentation by type includes various forms of cross-border payments, each catering to different needs and user bases. The dominant sub-segment is Consumer-to-Consumer (C2C) Payments, driven by the high volume of remittances sent by expatriates to their families back home. Business-to-Business (B2B) Payments also hold a significant share, as companies engage in international trade and require efficient payment solutions. Consumer-to-Business (C2B) and Business-to-Consumer (B2C) Payments are growing as e-commerce expands, while Remittances remain a critical component of the market. Inbound payments from travel and tourism, including Hajj and Umrah pilgrimages, also contribute significantly to cross-border payment flows, with Q1 2025 seeing a 10% year-on-year increase to USD 13.2 billion.

By End-User:The end-user segmentation highlights the diverse range of customers utilizing cross-border payment services. Individuals, including expatriate workers, represent the largest segment due to their frequent remittance needs. Small and Medium Enterprises (SMEs) are increasingly adopting cross-border payment solutions to facilitate international trade. Large Corporations also play a significant role, leveraging these services for global operations, while Government Entities utilize cross-border payments for various international transactions.

The Saudi Arabia Cross Border Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Payments, STC Pay, Al Rajhi Bank, SNB (Saudi National Bank), Samba Financial Group, Arab National Bank, Banque Saudi Fransi, Riyad Bank, Alinma Bank, PayTabs, HyperPay, Tamara, PayFort (an Amazon company), Western Union, MoneyGram, Wise (formerly TransferWise), Payoneer, Stripe, Visa, Mastercard contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cross-border payments market in Saudi Arabia looks promising, driven by technological advancements and increasing consumer demand for seamless payment solutions. The adoption of real-time payment systems and mobile payment platforms is expected to enhance transaction efficiency. Additionally, the emergence of open banking will facilitate better integration of services, allowing for more innovative payment solutions. As the market evolves, stakeholders must focus on addressing regulatory challenges and enhancing security measures to build consumer trust and drive growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Consumer-to-Consumer (C2C) Payments Business-to-Business (B2B) Payments Consumer-to-Business (C2B) Payments Business-to-Consumer (B2C) Payments Remittances |

| By End-User | Individuals (including expatriate workers) Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Payment Method | Bank Transfers Credit/Debit Cards E-Wallets / Digital Wallets Money Transfer Operators (MTOs) Cryptocurrency |

| By Transaction Size | Low-Value Transactions (e.g., <$500) Mid-Value Transactions (e.g., $500–$10,000) High-Value Transactions (e.g., >$10,000) |

| By Geographic Focus | Middle East & North Africa (MENA) Asia-Pacific Europe North America |

| By Industry | Retail & E-commerce Travel, Tourism & Hospitality Financial Services Oil & Gas / Energy Construction & Contracting |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Cross-Border Transactions | 100 | Bank Executives, Compliance Officers |

| Fintech Solutions for Payments | 60 | Product Managers, Business Development Leads |

| SME International Trade Payments | 110 | Business Owners, Financial Managers |

| Consumer Payment Preferences | 85 | End Users, Digital Payment Users |

| Regulatory Impact on Payment Systems | 50 | Regulatory Analysts, Policy Makers |

The Saudi Arabia Cross Border Payments Market is valued at approximately USD 56 billion, driven by increasing international trade, expatriate remittances, and the adoption of digital payment solutions. This market has shown significant growth over the past five years.