Region:Middle East

Author(s):Geetanshi

Product Code:KRAD6019

Pages:100

Published On:December 2025

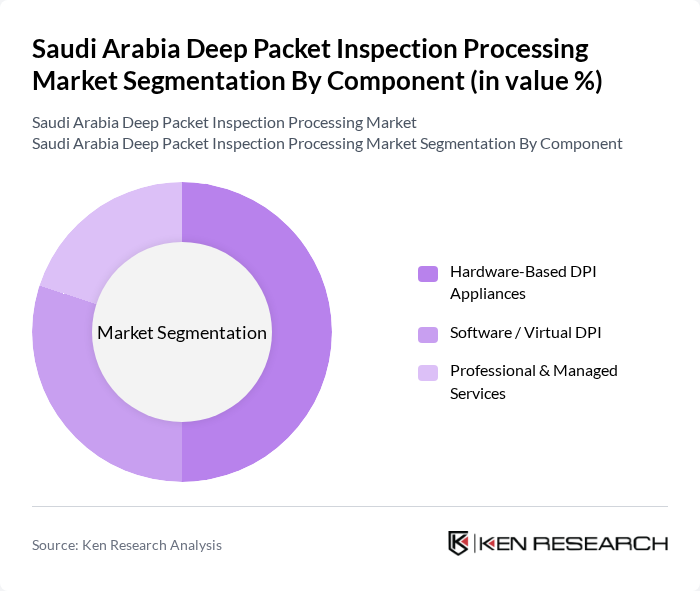

By Component:

The components of the market include Hardware-Based DPI Appliances, Software / Virtual DPI, and Professional & Managed Services. Among these, Hardware-Based DPI Appliances dominate the market due to their reliability and performance in handling high traffic volumes. Organizations prefer these appliances for their ability to provide real-time analysis and threat detection. Software / Virtual DPI is gaining traction as businesses move towards cloud-based solutions, while Professional & Managed Services are increasingly sought after for their expertise in managing complex network environments.

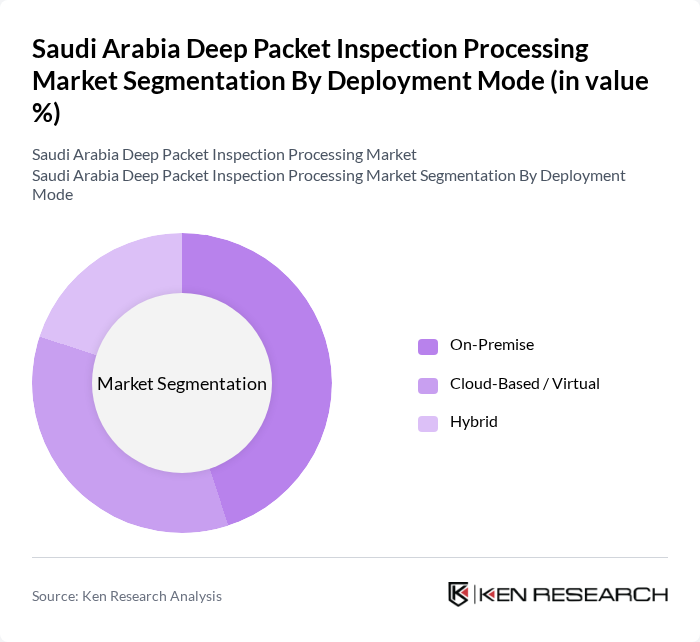

By Deployment Mode:

The deployment modes in the market include On-Premise, Cloud-Based / Virtual, and Hybrid. On-Premise solutions are preferred by organizations that require complete control over their data and security measures. However, Cloud-Based / Virtual deployments are rapidly gaining popularity due to their scalability and cost-effectiveness. Hybrid models are also emerging as organizations seek to balance the benefits of both on-premise and cloud solutions, allowing for flexibility in managing their network security.

The Saudi Arabia Deep Packet Inspection Processing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Huawei Technologies Co., Ltd., Palo Alto Networks, Inc., Fortinet, Inc., Check Point Software Technologies Ltd., Juniper Networks, Inc., NETSCOUT Systems, Inc., Sandvine Corporation, Allot Ltd., F5, Inc., Broadcom Inc. (including Symantec Enterprise security assets), BAE Systems plc, Viavi Solutions Inc., STC Solutions (Saudi Telecom Company), Elm Company (Al-Elm Information Security Company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the deep packet inspection processing market in Saudi Arabia appears promising, driven by technological advancements and increasing digitalization. As organizations prioritize cybersecurity and data management, the integration of AI and machine learning into DPI solutions will enhance their effectiveness. Furthermore, the expansion of 5G networks will create new opportunities for real-time data processing, enabling businesses to leverage DPI for improved network performance and security. Strategic partnerships among technology providers will also play a crucial role in fostering innovation and market growth.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware-Based DPI Appliances Software / Virtual DPI Professional & Managed Services |

| By Deployment Mode | On-Premise Cloud-Based / Virtual Hybrid |

| By Application | Intrusion Detection & Prevention Network & Traffic Management / QoS Data Loss Prevention & Compliance Monitoring Lawful Interception & Content Filtering |

| By End User | Telecom Operators & ISPs Government & Defense Enterprises (BFSI, Oil & Gas, Utilities) Cloud & Managed Service Providers |

| By Industry Vertical | BFSI IT & Telecom Government & Public Sector Energy, Oil & Gas Retail & E-commerce Healthcare Others |

| By Region | Central Region (including Riyadh) Eastern Region (including Dammam, Dhahran, Jubail) Western Region (including Jeddah, Makkah, Madinah) Southern & Northern Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Service Providers | 120 | Network Engineers, IT Managers |

| Cybersecurity Firms | 90 | Cybersecurity Analysts, Data Privacy Officers |

| Government Regulatory Bodies | 50 | Regulatory Officials, Policy Makers |

| Enterprise Users of DPI Solutions | 80 | IT Directors, Compliance Managers |

| Academic Institutions Researching DPI | 40 | Researchers, Professors in IT and Telecommunications |

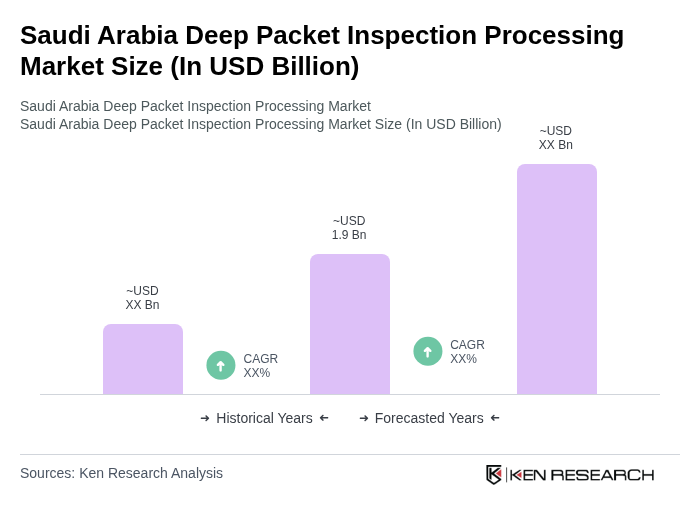

The Saudi Arabia Deep Packet Inspection Processing Market is valued at approximately USD 1.9 billion, reflecting a significant growth driven by increasing demand for network security solutions and the rise in cyber threats.