Region:Middle East

Author(s):Shubham

Product Code:KRAA1801

Pages:94

Published On:August 2025

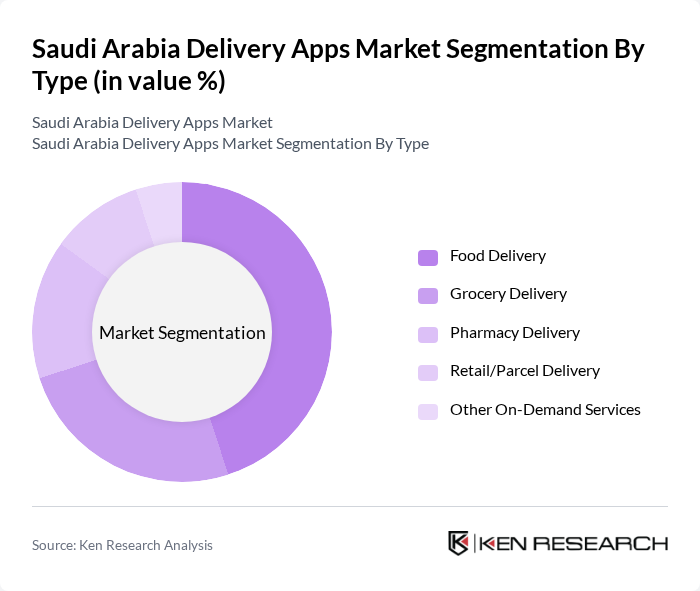

By Type:The market is segmented into various types, including food delivery, grocery delivery, pharmacy delivery, retail/parcel delivery, and other on-demand services. Among these, food delivery has emerged as the dominant segment, driven by the increasing number of restaurants partnering with delivery platforms and the growing consumer preference for convenience. Grocery delivery is also gaining traction, supported by quick-commerce expansions and partnerships with retailers. The pharmacy delivery segment is expanding due to the increasing demand for healthcare access and the convenience of home delivery.

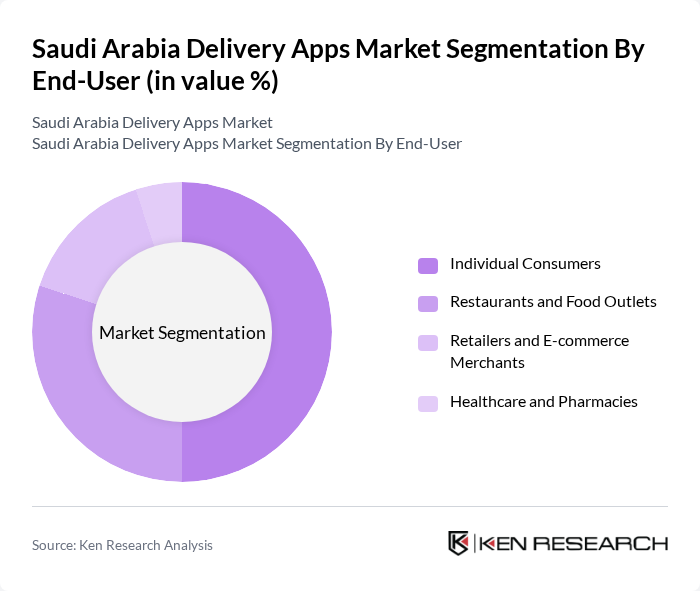

By End-User:The end-user segmentation includes individual consumers, restaurants and food outlets, retailers and e-commerce merchants, and healthcare and pharmacies. Individual consumers represent the largest segment, driven by the increasing trend of online ordering for convenience. Restaurants and food outlets are also significant players, as they rely on delivery apps to reach a broader customer base. Retailers and e-commerce merchants are leveraging delivery services and last-mile partnerships to enhance their logistics capabilities, while healthcare and pharmacies are increasingly adopting delivery solutions to meet consumer needs.

The Saudi Arabia Delivery Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as HungerStation (Delivery Hero), Jahez, Mrsool, Talabat, The Chefz, Lugmety, Careem (Careem Food & Careem Quick/Grocery), Noon Minutes (incl. Noon Grocery/Food), ToYou (ToYou App), Shgardi, Jahez Logisti (Last-mile for merchants), Nana, ZidShip (Zid Ship), Wasl/Xpress (Aramex last-mile partnerships), Dook contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia delivery apps market appears promising, driven by technological advancements and evolving consumer preferences. As artificial intelligence and machine learning become integral to logistics and customer service, delivery apps will enhance operational efficiency and user experience. Additionally, the growing emphasis on sustainability will likely lead to the adoption of eco-friendly delivery practices, aligning with global trends and consumer expectations for responsible business operations.

| Segment | Sub-Segments |

|---|---|

| By Type | Food Delivery Grocery Delivery Pharmacy Delivery Retail/Parcel Delivery Other On-Demand Services |

| By End-User | Individual Consumers Restaurants and Food Outlets Retailers and E-commerce Merchants Healthcare and Pharmacies |

| By Delivery Model | On-Demand Delivery Scheduled Delivery Subscription and Membership Programs |

| By Payment Method | Cash on Delivery Cards (Credit/Debit) Mobile Wallets and Online Payments |

| By Geographic Coverage | Riyadh Jeddah Dammam/Khobar Other Cities and Towns |

| By Customer Demographics | Age Groups Income Levels Lifestyle Preferences |

| By Service Features | Real-Time Tracking Customer Support Promotions and Discounts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Delivery Services | 150 | Restaurant Owners, Delivery App Users |

| Grocery Delivery Market | 100 | Grocery Store Managers, Consumers |

| Logistics and Supply Chain | 80 | Logistics Managers, Supply Chain Analysts |

| Consumer Behavior Insights | 120 | Frequent Users, Occasional Users |

| Technology Adoption in Delivery Apps | 90 | IT Managers, Product Development Teams |

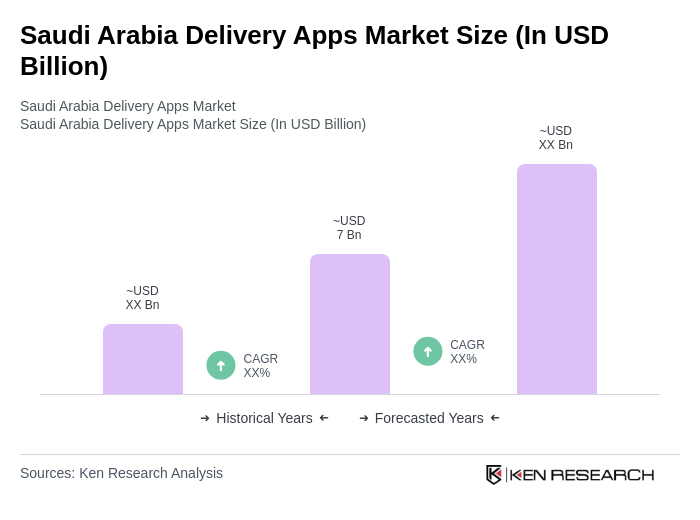

The Saudi Arabia Delivery Apps Market is valued at approximately USD 7 billion, reflecting significant growth driven by increased smartphone penetration, e-commerce adoption, and changing consumer preferences for convenience and speed in service delivery.