Region:Middle East

Author(s):Rebecca

Product Code:KRAA9450

Pages:87

Published On:November 2025

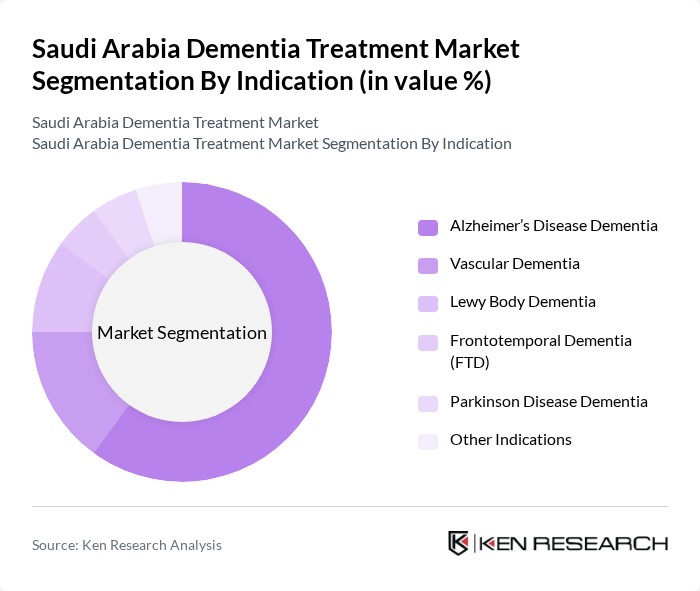

By Indication:The market is segmented into various indications, including Alzheimer’s Disease Dementia, Vascular Dementia, Lewy Body Dementia, Frontotemporal Dementia (FTD), Parkinson Disease Dementia, and Other Indications. Among these,Alzheimer’s Disease Dementiais the most prevalent, accounting for the largest portion of the market due to its high incidence rate and the growing awareness of the disease. The increasing number of diagnosed cases and the demand for effective treatment options are driving the growth of this segment.

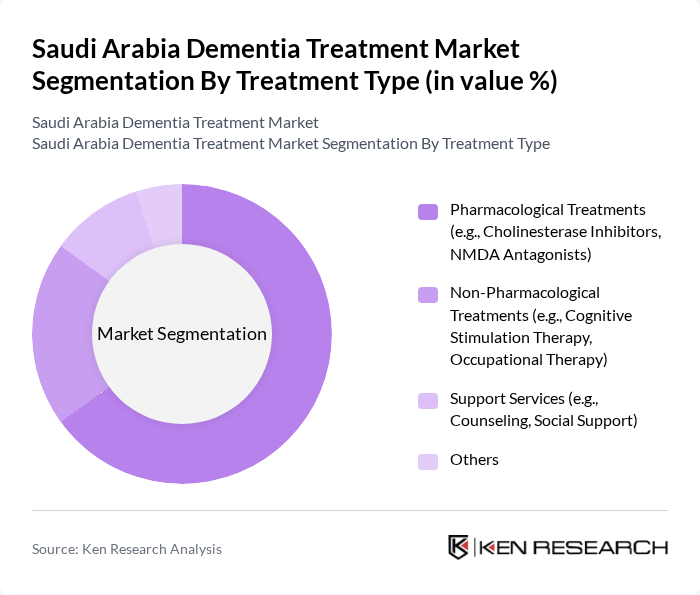

By Treatment Type:The treatment options available in the market include Pharmacological Treatments, Non-Pharmacological Treatments, Support Services, and Others.Pharmacological Treatments, such as Cholinesterase Inhibitors and NMDA Antagonists, dominate the market due to their effectiveness in managing symptoms of dementia. The increasing adoption of these treatments, along with ongoing research and development, is expected to sustain their leading position in the market. Recent trends include the integration of combination therapies and pipeline drugs, as well as a growing emphasis on personalized medicine and telehealth solutions to improve patient outcomes.

The Saudi Arabia Dementia Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Novartis AG, Eli Lilly and Company, Roche Holding AG, Johnson & Johnson, Merck & Co., Inc., AstraZeneca PLC, Biogen Inc., Amgen Inc., Teva Pharmaceutical Industries Ltd., Lundbeck A/S, Otsuka Pharmaceutical Co., Ltd., Takeda Pharmaceutical Company Limited, Sanofi S.A., AbbVie Inc., Eisai Co., Ltd., Daiichi Sankyo Co., Ltd., Sun Pharmaceutical Industries Ltd., Viatris Inc., Hikma Pharmaceuticals PLC, Tabuk Pharmaceuticals Manufacturing Co., Jamjoom Pharma, Spimaco Addwaeih, Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO), Cipla Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dementia treatment market in Saudi Arabia appears promising, driven by ongoing advancements in healthcare technology and increased government support. By future, the integration of digital health solutions and personalized medicine is expected to enhance patient care significantly. Furthermore, the collaboration between local healthcare providers and international organizations will facilitate the adoption of best practices, ultimately improving treatment efficacy and accessibility for dementia patients across the nation.

| Segment | Sub-Segments |

|---|---|

| By Indication | Alzheimer’s Disease Dementia Vascular Dementia Lewy Body Dementia Frontotemporal Dementia (FTD) Parkinson Disease Dementia Other Indications |

| By Treatment Type | Pharmacological Treatments (e.g., Cholinesterase Inhibitors, NMDA Antagonists) Non-Pharmacological Treatments (e.g., Cognitive Stimulation Therapy, Occupational Therapy) Support Services (e.g., Counseling, Social Support) Others |

| By End-User | Hospitals Home Care Providers Nursing Homes Rehabilitation Centers Others |

| By Age Group | 70 Years 80 Years Years and Above Others |

| By Treatment Setting | Inpatient Care Outpatient Care Community Care Others |

| By Geographic Distribution | Central Region Eastern Region Western Region Southern Region Others |

| By Funding Source | Government Funding Private Insurance Out-of-Pocket Payments Others |

| By Caregiver Type | Family Caregivers Professional Caregivers Volunteer Caregivers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 120 | Neurologists, Geriatricians, General Practitioners |

| Pharmaceutical Companies | 70 | Product Managers, Market Access Specialists |

| Caregiver Insights | 60 | Family Caregivers, Professional Caregivers |

| Patient Advocacy Groups | 40 | Advocacy Leaders, Support Group Coordinators |

| Health Policy Experts | 40 | Health Economists, Policy Analysts |

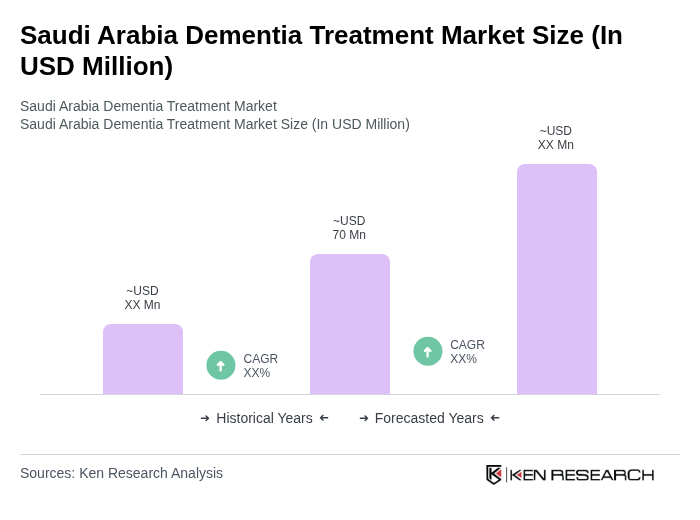

The Saudi Arabia Dementia Treatment Market is valued at approximately USD 70 million, reflecting a five-year historical analysis. This growth is attributed to the increasing prevalence of dementia, heightened awareness of mental health, and advancements in treatment options.