Region:Middle East

Author(s):Rebecca

Product Code:KRAB7767

Pages:89

Published On:October 2025

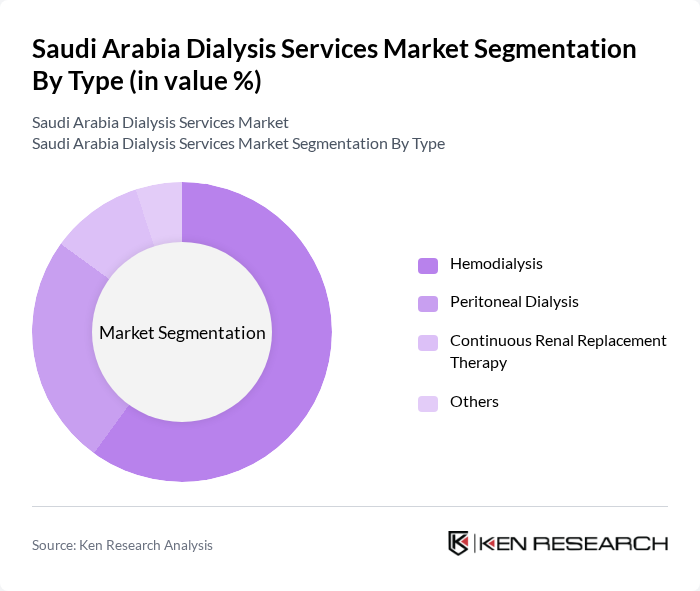

By Type:The segmentation by type includes Hemodialysis, Peritoneal Dialysis, Continuous Renal Replacement Therapy, and Others. Hemodialysis is the most widely used method due to its effectiveness and availability in most healthcare facilities. Peritoneal Dialysis is gaining traction, especially among patients seeking home-based treatment options. Continuous Renal Replacement Therapy is primarily utilized in critical care settings, while the 'Others' category includes emerging technologies and methods.

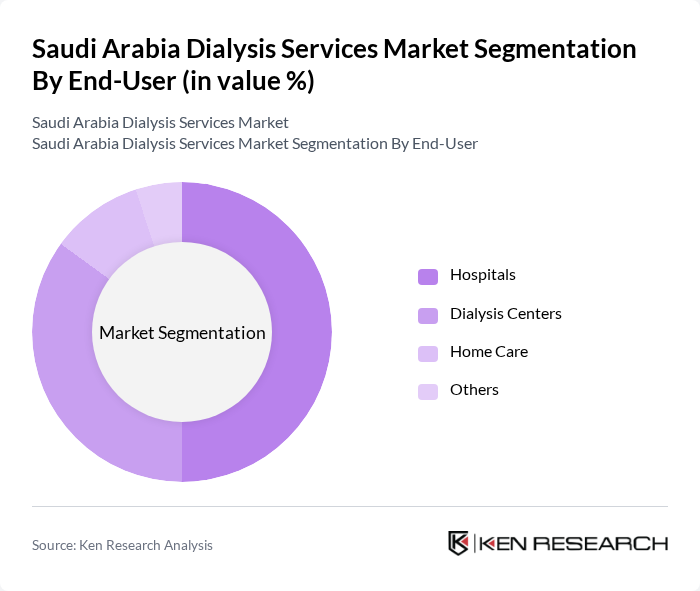

By End-User:The end-user segmentation includes Hospitals, Dialysis Centers, Home Care, and Others. Hospitals are the primary providers of dialysis services, equipped with advanced technology and specialized staff. Dialysis centers are increasingly popular due to their focused services and convenience. Home care options are expanding as patients prefer receiving treatment in a familiar environment, while the 'Others' category includes various healthcare settings that provide dialysis services.

The Saudi Arabia Dialysis Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fresenius Medical Care, DaVita Inc., Baxter International Inc., Nipro Corporation, B. Braun Melsungen AG, Medtronic plc, Asahi Kasei Medical Co., Ltd., Dialysis Clinic, Inc., Renal Care Group, U.S. Renal Care, KfH Kidney Centers, Satellite Healthcare, Otsuka Pharmaceutical Co., Ltd., Astellas Pharma Inc., Sandoz (a Novartis division) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dialysis services market in Saudi Arabia appears promising, driven by increasing health awareness and technological advancements. The integration of telehealth services is expected to enhance patient monitoring and follow-up care, improving treatment adherence. Additionally, the expansion of home dialysis options will cater to the growing demand for patient-centric care, allowing for more flexible treatment schedules and improved quality of life for patients with chronic kidney diseases.

| Segment | Sub-Segments |

|---|---|

| By Type | Hemodialysis Peritoneal Dialysis Continuous Renal Replacement Therapy Others |

| By End-User | Hospitals Dialysis Centers Home Care Others |

| By Patient Demographics | Adult Patients Pediatric Patients Geriatric Patients |

| By Treatment Frequency | In-Center Dialysis Home Dialysis |

| By Payment Model | Private Insurance Government Programs Out-of-Pocket Payments |

| By Geographic Distribution | Urban Areas Rural Areas |

| By Service Provider Type | Public Providers Private Providers Non-Profit Organizations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| In-Center Dialysis Services | 150 | Nephrologists, Dialysis Center Managers |

| Home Dialysis Programs | 100 | Patients, Home Care Coordinators |

| Dialysis Equipment Suppliers | 80 | Sales Representatives, Product Managers |

| Healthcare Policy Impact | 60 | Health Economists, Policy Advisors |

| Patient Experience and Satisfaction | 120 | Dialysis Patients, Caregivers |

The Saudi Arabia Dialysis Services Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the rising prevalence of chronic kidney diseases, increased awareness of renal health, and advancements in dialysis technologies.