Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3838

Pages:91

Published On:October 2025

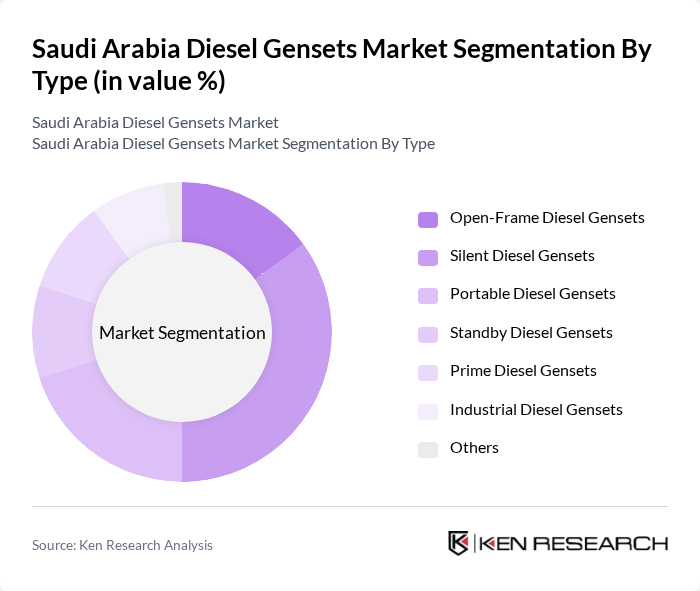

By Type:

The diesel gensets market can be segmented into various types, including Open-Frame Diesel Gensets, Silent Diesel Gensets, Portable Diesel Gensets, Standby Diesel Gensets, Prime Diesel Gensets, Industrial Diesel Gensets, and Others. Among these, Silent Diesel Gensets are currently dominating the market due to their noise reduction capabilities, making them ideal for residential and commercial applications in urban environments where noise pollution regulations are becoming stricter. The growing awareness of noise pollution and the need for quieter operations in urban areas have led to increased adoption of silent models across hospitality, BFSI, and healthcare sectors. Additionally, the demand for Portable Diesel Gensets is rising, driven by their versatility and ease of use in various applications, including events and emergency backup, particularly during peak summer loads when air-conditioning reliance creates frequent power demand surges.

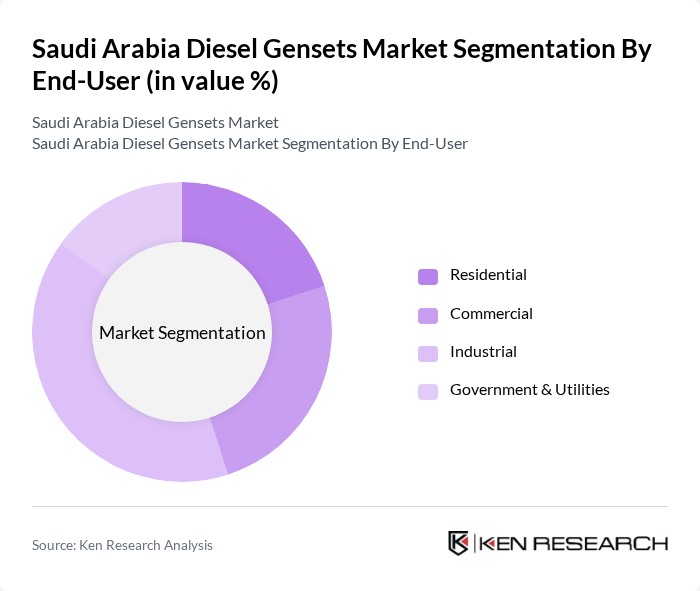

By End-User:

The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Industrial segment is the leading end-user of diesel gensets, driven by the robust growth of the manufacturing and oil & gas sectors in Saudi Arabia, with diesel gensets remaining essential due to the demands of the oil and gas industry for continuous power supply. The increasing need for uninterrupted power supply in industrial operations, coupled with the expansion of infrastructure projects and refinery activities in the Eastern Province, has significantly boosted the demand for large-scale backup generators in this segment. The Commercial sector is also witnessing substantial growth, particularly in urban areas where businesses require reliable backup power solutions, with specific acceleration in IT and ITES sectors driving data center developments requiring generators in the 375-750 kVA range.

The Saudi Arabia Diesel Gensets Market is characterized by a dynamic mix of regional and international players. Leading participants such as Caterpillar Inc., Cummins Inc., Kohler Co., Perkins Engines Company Limited, Rolls-Royce Power Systems (MTU), Generac Holdings Inc., Atlas Copco AB, Wärtsilä Corporation, Yanmar Holdings Co., Ltd., Honda Motor Co., Ltd., FG Wilson (Engineering) Ltd, Doosan Infracore Co., Ltd., HIMOINSA S.L., Mitsubishi Heavy Industries, Ltd., J.C. Bamford Excavators Ltd (JCB) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the diesel gensets market in Saudi Arabia appears promising, driven by ongoing infrastructure projects and industrial growth. As the government continues to diversify its energy sources, the integration of renewable energy with diesel gensets is likely to gain traction. Additionally, advancements in technology will enhance genset efficiency and reduce emissions, aligning with global sustainability trends. The market is expected to adapt to these changes, ensuring that diesel gensets remain a viable power solution in the evolving energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Open-Frame Diesel Gensets Silent Diesel Gensets Portable Diesel Gensets Standby Diesel Gensets Prime Diesel Gensets Industrial Diesel Gensets Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Construction Sites Events and Entertainment Emergency Backup Telecommunications Oil & Gas Operations Mining Operations Others |

| By Sales Channel | Direct Sales Distributors Online Sales Rental Services |

| By Distribution Mode | Retail Outlets Wholesale Markets Online Platforms Direct Delivery |

| By Price Range | Low-End Gensets Mid-Range Gensets High-End Gensets |

| By Fuel Efficiency | Standard Efficiency High Efficiency Ultra High Efficiency |

| By Power Rating | Below 75 kVA (Dominant in residential, small commercial, and construction applications) –350 kVA (Fastest growing, driven by commercial, data center, healthcare, and hospitality sectors) –750 kVA (Industrial, large commercial, and infrastructure projects) Above 750 kVA (Critical for oil & gas, heavy industry, and large-scale infrastructure) |

| By Portability | Stationary Portable |

| By Frequency | Hz Hz Dual Frequency |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Applications | 100 | Plant Managers, Operations Directors |

| Commercial Sector Usage | 70 | Facility Managers, Energy Procurement Officers |

| Residential Backup Solutions | 50 | Homeowners, Property Managers |

| Telecommunications Sector | 40 | Network Operations Managers, Technical Directors |

| Construction Industry | 90 | Project Managers, Site Supervisors |

The Saudi Arabia Diesel Gensets Market is valued at approximately USD 1.4 billion, driven by increasing demand for reliable power solutions across various sectors, including construction, oil and gas, and telecommunications.