Region:Middle East

Author(s):Dev

Product Code:KRAB0983

Pages:90

Published On:October 2025

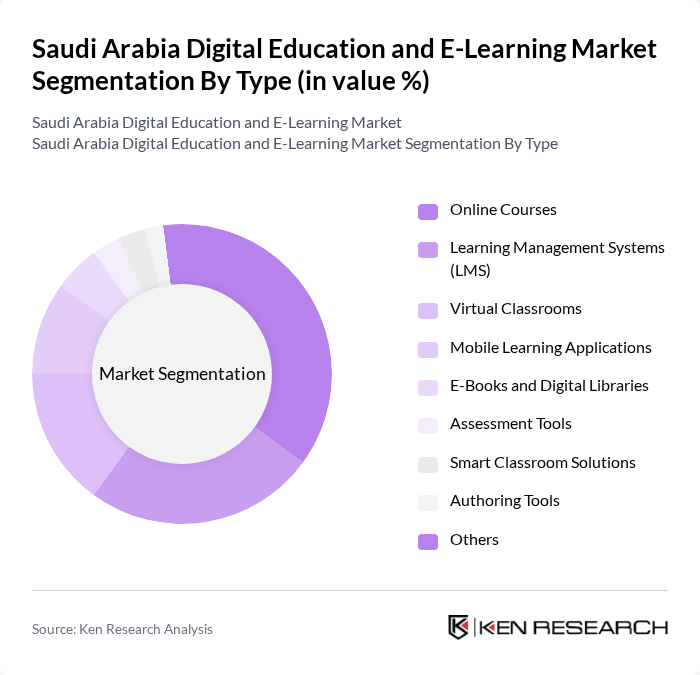

By Type:The market is segmented into various types, including Online Courses, Learning Management Systems (LMS), Virtual Classrooms, Mobile Learning Applications, E-Books and Digital Libraries, Assessment Tools, Smart Classroom Solutions, Authoring Tools, and Others. Among these, Online Courses and Learning Management Systems are particularly prominent due to their flexibility and scalability, catering to diverse learning needs. The market also includes self-paced online education and instructor-led online education segments.

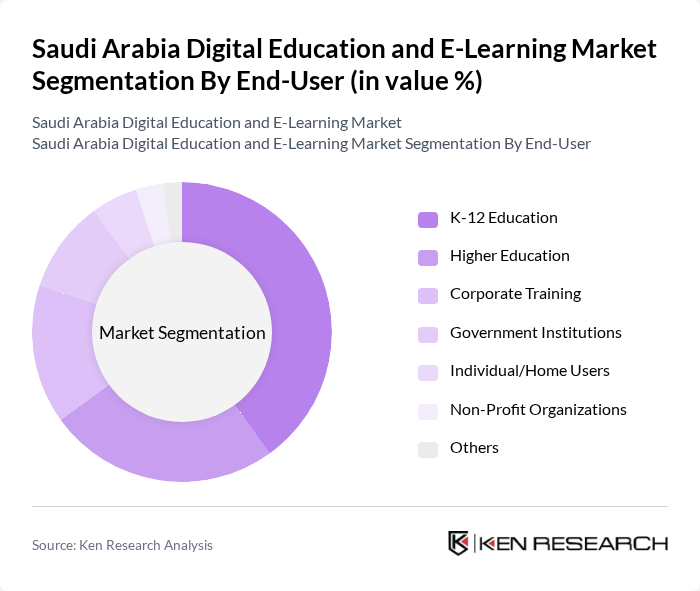

By End-User:The end-user segmentation includes K-12 Education, Higher Education, Corporate Training, Government Institutions, Individual/Home Users, Non-Profit Organizations, and Others. The K-12 Education segment is leading due to the increasing integration of digital tools in schools, enhancing student engagement and learning outcomes. The private K-12 education market is experiencing significant growth with an expected 14% compound annual growth rate through 2030.

The Saudi Arabia Digital Education and E-Learning Market is characterized by a dynamic mix of regional and international players. Leading participants such as Madrasati (Ministry of Education, Saudi Arabia), Rwaq, Noon Academy, Classera, Edraak, Doroob (Human Resources Development Fund), Future Institute, Coursera, Blackboard, Moodle, Udacity, Skillsoft, LinkedIn Learning, Google Classroom, Canvas, FutureLearn, Pluralsight, Zoom Video Communications contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital education and e-learning market in Saudi Arabia appears promising, driven by ongoing government support and increasing adoption of technology in education. As institutions embrace hybrid learning models, the integration of advanced technologies like AI and data analytics will enhance personalized learning experiences. Furthermore, the growing emphasis on corporate training programs will likely lead to increased collaboration between educational institutions and businesses, fostering a more skilled workforce equipped for the demands of the digital economy.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Learning Management Systems (LMS) Virtual Classrooms Mobile Learning Applications E-Books and Digital Libraries Assessment Tools Smart Classroom Solutions Authoring Tools Others |

| By End-User | K-12 Education Higher Education Corporate Training Government Institutions Individual/Home Users Non-Profit Organizations Others |

| By Content Type | Academic Content Professional Development Vocational Training Language Learning Test Preparation Multimedia Content Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning Self-Paced Learning Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Model One-Time Purchase Others |

| By Geographic Reach | Local Regional International Others |

| By User Demographics | Age Group Educational Background Professional Status Gender Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 Digital Learning Platforms | 120 | School Administrators, Teachers |

| Higher Education E-Learning Solutions | 80 | University Professors, IT Directors |

| Vocational Training E-Learning Programs | 60 | Training Coordinators, Curriculum Developers |

| Corporate E-Learning Initiatives | 50 | HR Managers, Learning & Development Specialists |

| Student Engagement in E-Learning | 100 | Students, Educational Consultants |

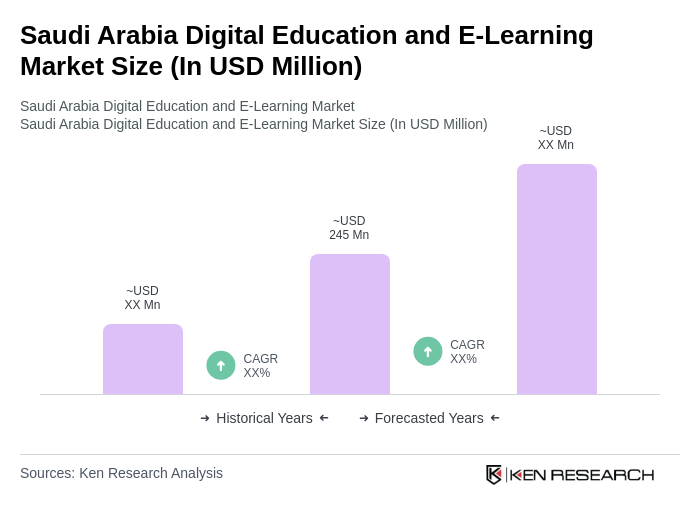

The Saudi Arabia Digital Education and E-Learning Market is valued at approximately USD 245 million, reflecting significant growth driven by technology adoption, government initiatives, and increasing demand for flexible learning solutions among students and professionals.