Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1259

Pages:91

Published On:November 2025

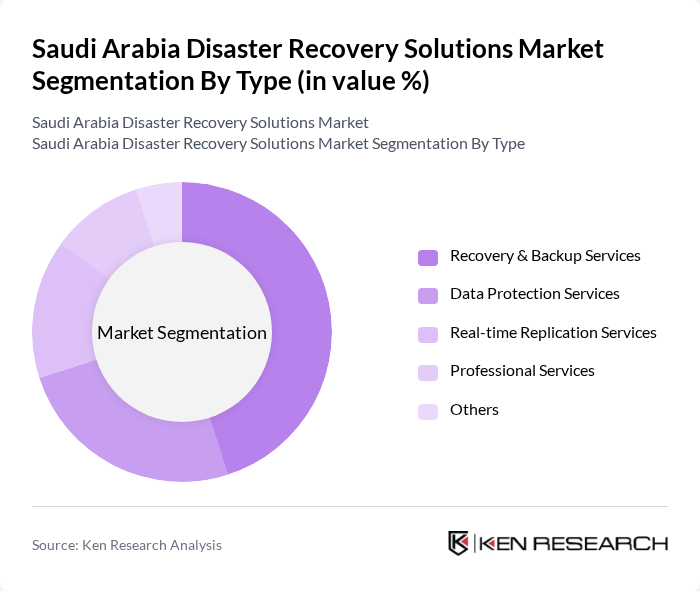

By Type:The market is segmented into various types of disaster recovery solutions, including Recovery & Backup Services, Data Protection Services, Real-time Replication Services, Professional Services, and Others. Among these,Recovery & Backup Servicesare leading due to their critical role in ensuring data integrity and availability during disruptions. Organizations increasingly prioritize these services to mitigate risks associated with data loss and downtime. The adoption of cloud-based backup and disaster recovery as a service (DRaaS) models is accelerating, driven by cost efficiency, scalability, and regulatory compliance needs.

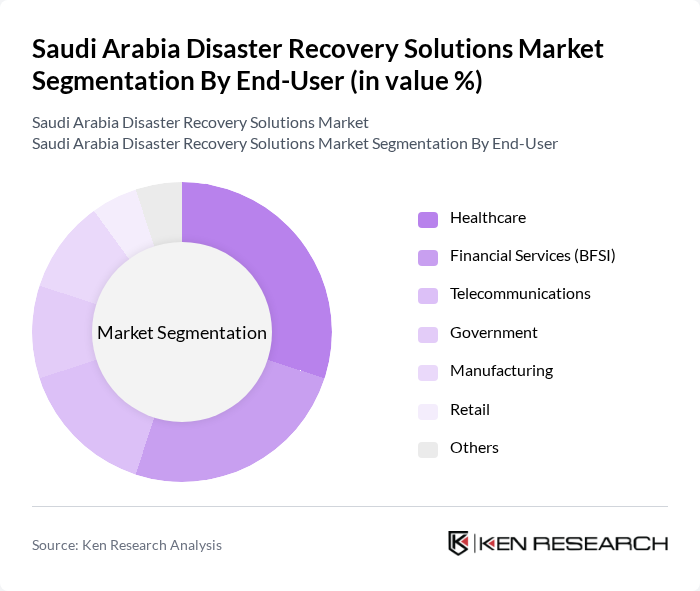

By End-User:The disaster recovery solutions market is segmented by end-users, including Healthcare, Financial Services (BFSI), Telecommunications, Government, Manufacturing, Retail, and Others. TheHealthcaresector is a leading end-user, driven by stringent regulatory requirements for data protection and the critical nature of patient information. This sector's increasing reliance on digital health solutions and electronic medical records further fuels the demand for robust disaster recovery strategies. Financial services and telecommunications also represent significant demand segments due to high data sensitivity and uptime requirements.

The Saudi Arabia Disaster Recovery Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Dell Technologies, Microsoft Corporation, Oracle Corporation, VMware, Inc., Acronis International GmbH, Commvault Systems, Inc., Veritas Technologies LLC, Zerto, Inc., Arcserve LLC, Rubrik, Inc., Cohesity, Inc., Barracuda Networks, Inc., Datto, Inc., StorageCraft Technology Corporation, Amazon Web Services (AWS), STC Solutions (Saudi Telecom Company), Sahara Net, Mobily (Etihad Etisalat Company), NourNet contribute to innovation, geographic expansion, and service delivery in this space.

The future of the disaster recovery solutions market in Saudi Arabia appears promising, driven by increasing investments in technology and infrastructure resilience. As businesses recognize the importance of robust recovery strategies, the integration of advanced technologies such as AI and machine learning is expected to enhance recovery processes. Additionally, the government's commitment to improving disaster management frameworks will likely create a more favorable environment for market growth, fostering innovation and collaboration among stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Recovery & Backup Services Data Protection Services Real-time Replication Services Professional Services Others |

| By End-User | Healthcare Financial Services (BFSI) Telecommunications Government Manufacturing Retail Others |

| By Industry Vertical | Government Energy and Utilities Retail Manufacturing IT & Telecom Others |

| By Service Model | Infrastructure as a Service (IaaS) Software as a Service (SaaS) Platform as a Service (PaaS) Disaster Recovery as a Service (DRaaS) Others |

| By Deployment Type | On-Premises Cloud-Based Hybrid Others |

| By Geographic Region | Central Region Eastern Region Western Region Southern Region Others |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Disaster Management Agencies | 60 | Policy Makers, Disaster Response Coordinators |

| Private Sector Recovery Solutions Providers | 50 | Business Development Managers, Operations Directors |

| Non-Governmental Organizations (NGOs) | 40 | Program Managers, Field Coordinators |

| Local Businesses Implementing Recovery Solutions | 45 | Business Owners, Risk Management Officers |

| Academic and Research Institutions | 40 | Researchers, Professors in Disaster Management |

The Saudi Arabia Disaster Recovery Solutions Market is valued at approximately USD 690 million, reflecting a significant growth driven by increasing cyber threats, rapid digitalization, and the need for data protection and business continuity among organizations.