Region:Middle East

Author(s):Dev

Product Code:KRAD0476

Pages:98

Published On:August 2025

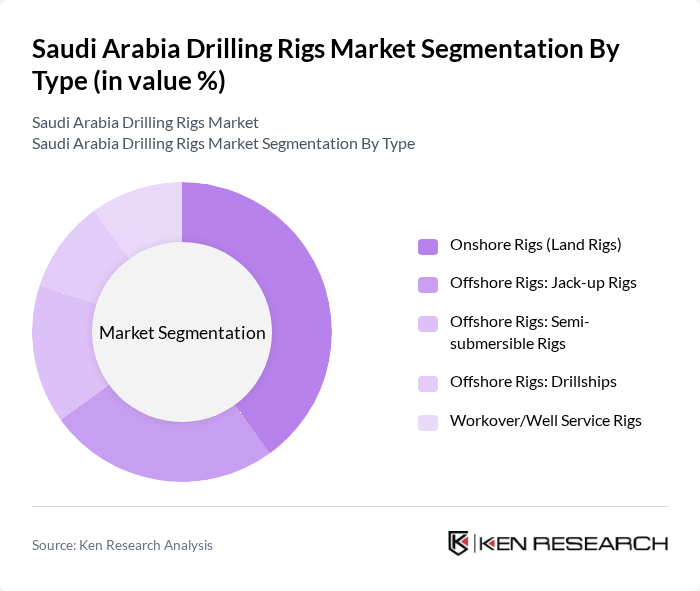

By Type:The drilling rigs market can be segmented into various types, including Onshore Rigs (Land Rigs), Offshore Rigs: Jack-up Rigs, Offshore Rigs: Semi-submersible Rigs, Offshore Rigs: Drillships, and Workover/Well Service Rigs. Each type serves specific operational needs and is utilized based on the geographical and geological conditions of the drilling sites.

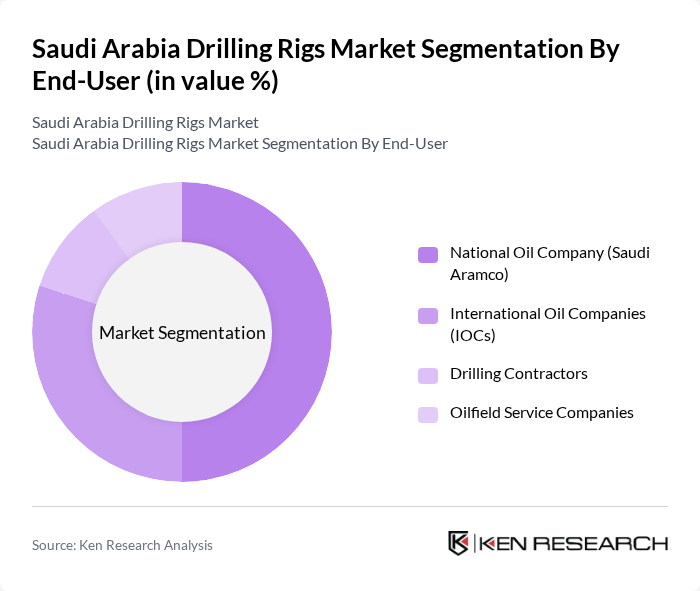

By End-User:The end-user segmentation includes National Oil Company (Saudi Aramco), International Oil Companies (IOCs), Drilling Contractors, and Oilfield Service Companies. Each of these end-users plays a crucial role in the demand for drilling rigs, with Saudi Aramco being the largest consumer due to its extensive operations across the kingdom.

The Saudi Arabia Drilling Rigs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco, ARO Drilling (Saudi Aramco Rowan Offshore Drilling Company), Arabian Drilling Company, ADES Holding Company, Schlumberger Limited (SLB), Halliburton Company, Baker Hughes Company, Weatherford International plc, Nabors Industries Ltd., KCA Deutag, Saipem S.p.A., Shelf Drilling Ltd., Seadrill Limited, Noble Corporation, Sinopec (China Petrochemical Corporation) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia drilling rigs market is poised for significant transformation as the industry adapts to evolving energy demands and technological advancements. With a strong focus on automation and digitalization, companies are expected to invest heavily in innovative drilling solutions. Additionally, the government's commitment to diversifying energy sources will likely lead to increased exploration of unconventional oil resources, further shaping the market landscape. Overall, the future appears promising, driven by strategic investments and a proactive approach to energy security.

| Segment | Sub-Segments |

|---|---|

| By Type | Onshore Rigs (Land Rigs) Offshore Rigs: Jack-up Rigs Offshore Rigs: Semi-submersible Rigs Offshore Rigs: Drillships Workover/Well Service Rigs |

| By End-User | National Oil Company (Saudi Aramco) International Oil Companies (IOCs) Drilling Contractors Oilfield Service Companies |

| By Application | Exploration (Wildcat and Appraisal) Development Drilling Production/Workover Plug & Abandonment/Decommissioning |

| By Sales Channel | Direct Contracts/Tenders Long-term Framework Agreements EPC/EPCI Consortia |

| By Distribution Mode | Domestic (In-Kingdom Total Value Add—IKTVA Compliant) Imports (Out-of-Kingdom) |

| By Price Range | Dayrate: <$50,000 Dayrate: $50,000–$150,000 Dayrate: >$150,000 |

| By Component | Rig Power & Drawworks Systems Top Drives, Mud Pumps & Solid Control BOPs & Well Control Equipment Drill Strings & Bits Digital/Automation Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Onshore Drilling Operations | 120 | Drilling Managers, Operations Supervisors |

| Offshore Drilling Projects | 90 | Project Engineers, Safety Officers |

| Drilling Equipment Suppliers | 70 | Sales Managers, Product Development Engineers |

| Regulatory Compliance in Drilling | 50 | Compliance Officers, Environmental Managers |

| Market Trends and Innovations | 60 | Industry Analysts, Research and Development Heads |

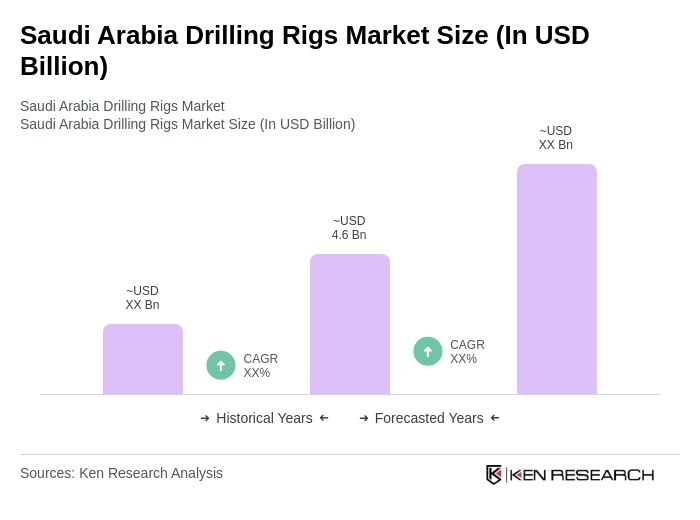

The Saudi Arabia Drilling Rigs Market is valued at approximately USD 4.6 billion, driven by significant oil reserves and ongoing investments in oil and gas exploration and production, particularly in offshore drilling activities.