Region:Middle East

Author(s):Dev

Product Code:KRAD0404

Pages:83

Published On:August 2025

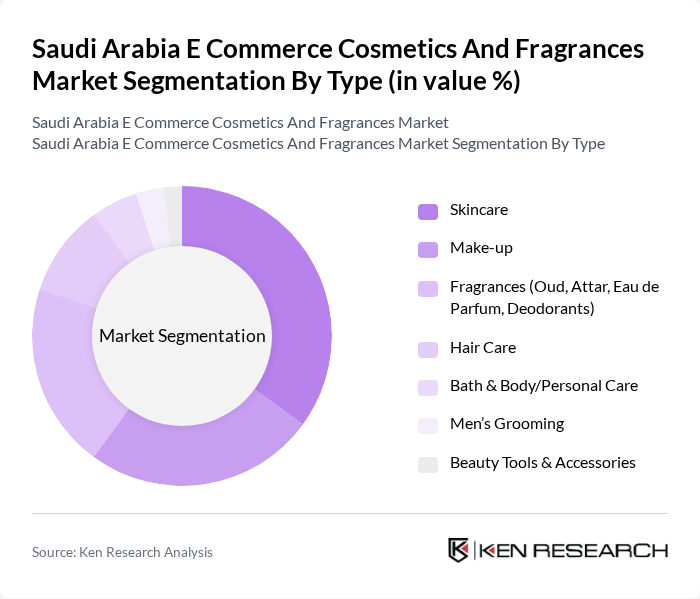

By Type:The market is segmented into various types, including skincare, make-up, fragrances, hair care, bath & body/personal care, men’s grooming, and beauty tools & accessories. Among these, skincare products dominate the market due to the increasing awareness of skincare routines, high engagement with dermocosmetics, and rising demand for natural and premium formulations; social media and K-beauty/J-beauty trends further reinforce skincare-led baskets online.

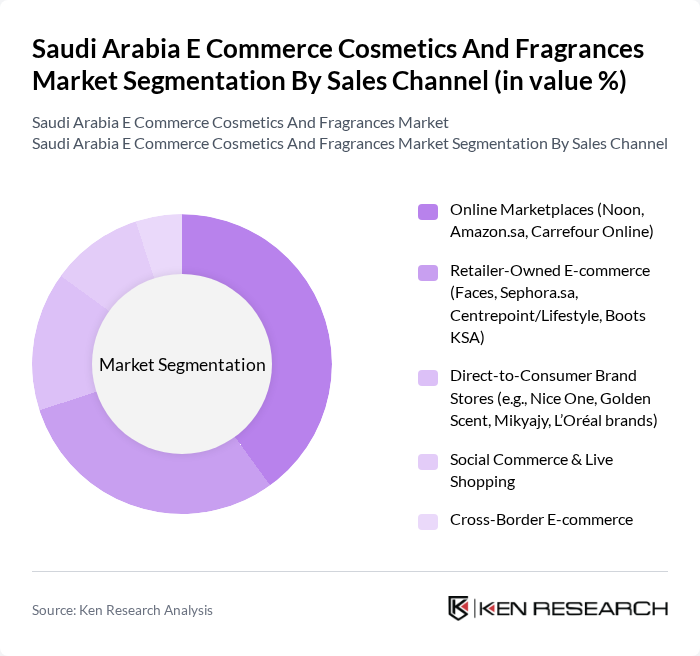

By Sales Channel:The market is also segmented by sales channels, including online marketplaces, retailer-owned e-commerce, direct-to-consumer brand stores, social commerce & live shopping, and cross-border e-commerce. Online marketplaces are leading the segment due to their reach, price comparison, assortment breadth, and fulfillment networks, with retailer-owned sites and specialty beauty e-tailers leveraging exclusive brands, loyalty, and omnichannel services. Social commerce continues to rise as brands and influencers convert discovery to purchase via shoppable content and live formats.

The Saudi Arabia E Commerce Cosmetics And Fragrances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sephora Saudi Arabia (Sephora.sa), Faces (Chalhoub Group), Nice One (Niceonesa.com), Golden Scent, Amazon.sa, Noon, Centrepoint & Lifestyle (Landmark Group), Ounass, Boots KSA, Abdul Samad Al Qurashi, Arabian Oud, Ajmal Perfumes, L’Oréal Middle East, Estée Lauder Companies, Coty Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabian e-commerce cosmetics and fragrances market appears promising, driven by technological advancements and changing consumer preferences. The integration of artificial intelligence and machine learning in online shopping experiences is expected to enhance personalization, making it easier for consumers to find products that suit their needs. Additionally, the rise of social media platforms as shopping channels will likely continue to influence purchasing decisions, creating new avenues for brands to engage with consumers effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Skincare Make-up Fragrances (Oud, Attar, Eau de Parfum, Deodorants) Hair Care Bath & Body/Personal Care Men’s Grooming Beauty Tools & Accessories |

| By Sales Channel | Online Marketplaces (Noon, Amazon.sa, Carrefour Online) Retailer-Owned E-commerce (Faces, Sephora.sa, Centrepoint/Lifestyle, Boots KSA) Direct-to-Consumer Brand Stores (e.g., Nice One, Golden Scent, Mikyajy, L’Oréal brands) Social Commerce & Live Shopping Cross-Border E-commerce |

| By Consumer Demographics | Age Group (18–24, 25–34, 35–44, 45+) Gender Income Level Lifestyle & Preference (Clean/Organic, Halal, Luxury, Value) |

| By Packaging Type | Bottles & Sprays Jars Tubes & Pumps Sachets & Minis/Travel Sizes Gift Sets & Discovery Kits |

| By Brand Positioning | Luxury & Prestige Premium/Mid-Range Mass & Value Niche/Indie & Artisanal |

| By Product Origin | Local & Regional Brands International Brands Private Labels/Exclusive Lines |

| By Price Range | Premium Mid-Range Budget Value Packs & Bundles |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Cosmetics | 150 | Female Consumers, Ages 18-45 |

| Fragrance Purchase Behavior | 100 | Male and Female Consumers, Ages 25-50 |

| Online Shopping Experience | 120 | Frequent Online Shoppers, Ages 20-40 |

| Brand Loyalty in Cosmetics | 80 | Brand Loyal Customers, Ages 30-55 |

| Influence of Social Media on Purchases | 90 | Social Media Users, Ages 18-35 |

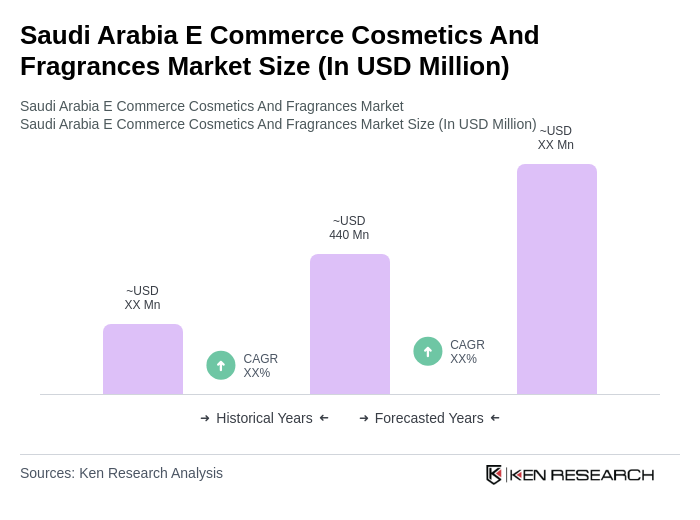

The Saudi Arabia E Commerce Cosmetics and Fragrances Market is valued at approximately USD 440 million, reflecting strong online engagement in beauty and fragrance categories, driven by digital adoption and platform expansion.