Region:Middle East

Author(s):Dev

Product Code:KRAD7837

Pages:88

Published On:December 2025

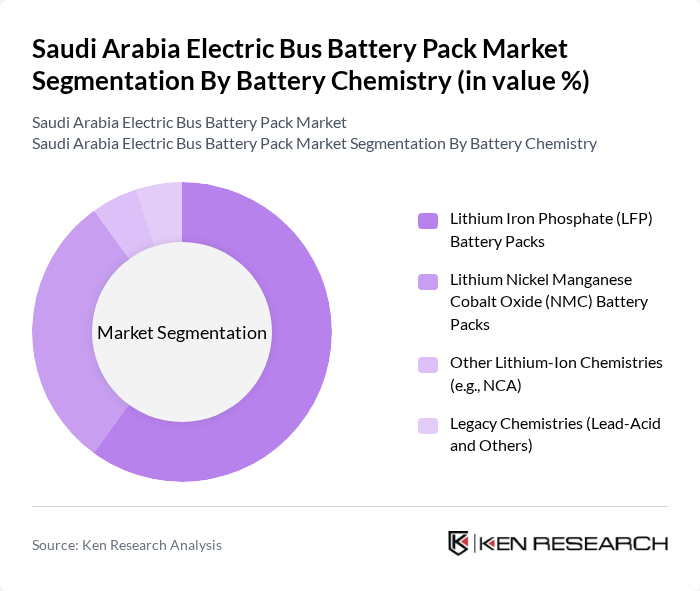

By Battery Chemistry:The battery chemistry segment includes various types of battery technologies used in electric bus battery packs. The dominant sub-segments are Lithium Iron Phosphate (LFP) and Lithium Nickel Manganese Cobalt Oxide (NMC) battery packs, which mirror the chemistries used in global and regional electric bus deployments. LFP batteries are favored for their thermal stability, safety, long cycle life, and competitive cost profile, which makes them particularly attractive for high?temperature operating environments such as Saudi Arabia, while NMC batteries are preferred where higher energy density and longer route range are prioritized. The market is witnessing a gradual shift towards LFP for city buses and shuttle fleets as operators focus on total cost of ownership, robustness in hot climates, and the reduced reliance on cobalt-containing chemistries.

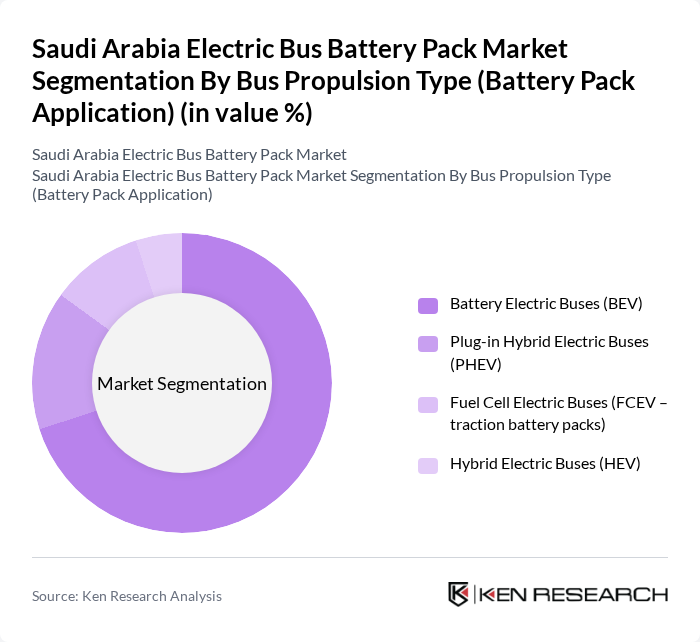

By Bus Propulsion Type (Battery Pack Application):This segment categorizes electric buses based on their propulsion systems. The leading sub-segment is Battery Electric Buses (BEV), which are fully electric and have no internal combustion engine, aligning with the dominant BEV share in Saudi Arabia’s electric bus market and in broader regional trends. This is followed by Plug-in Hybrid Electric Buses (PHEV) and Hybrid Electric Buses (HEV), which are being adopted on routes where charging infrastructure is still maturing, while Fuel Cell Electric Buses (FCEV) remain a niche but fast-growing option in flagship green hydrogen and mega-project corridors. The increasing focus on zero-emission public transport, supported by city?level pilots, smart?city projects, and the build?out of charging corridors, is driving the demand for BEVs and positioning them as the most popular choice among fleet operators for new electric bus procurements.

The Saudi Arabia Electric Bus Battery Pack Market is characterized by a dynamic mix of regional and international players. Leading participants such as BYD Auto Co., Ltd., Yutong Bus Co., Ltd., Higer Bus Company Limited, Anhui Ankai Automobile Co., Ltd., Tata Motors Limited, Mercedes-Benz AG (Juffali Commercial Vehicles), AB Volvo (Zahid Tractor & H.M. Co. Ltd.), Isuzu Motors Saudi Arabia Company Limited, Saudi Public Transport Company (SAPTCO), NEOM Company (Mobility & Public Transport Division), Red Sea Global (Sustainable Transport Division), Lucid Group, Inc. (Saudi EV Manufacturing Ecosystem Partner), Saudi Arabian Mining Company (Ma’aden) – Industrial & Site Fleets, CEER Company (Saudi EV Brand – Future Bus & Pack Demand Anchor), Huawei Digital Power (Battery & Charging Systems Partner) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric bus battery pack market in Saudi Arabia appears promising, driven by government initiatives and technological advancements. In future, the government aims to increase the electric bus fleet to 1,000 units, significantly enhancing public transport sustainability. Additionally, the integration of smart city initiatives will likely foster the development of charging infrastructure, further supporting the electrification of public transport. This evolving landscape presents a unique opportunity for stakeholders to capitalize on emerging trends.

| Segment | Sub-Segments |

|---|---|

| By Battery Chemistry | Lithium Iron Phosphate (LFP) Battery Packs Lithium Nickel Manganese Cobalt Oxide (NMC) Battery Packs Other Lithium-Ion Chemistries (e.g., NCA) Legacy Chemistries (Lead-Acid and Others) |

| By Bus Propulsion Type (Battery Pack Application) | Battery Electric Buses (BEV) Plug-in Hybrid Electric Buses (PHEV) Fuel Cell Electric Buses (FCEV – traction battery packs) Hybrid Electric Buses (HEV) |

| By Application | Urban Transit (City Buses, BRT Corridors) Intercity and Regional Services Shuttle and Feeder Services (Airports, Campuses, Industrial) Mega-Projects and Smart Cities (NEOM, Red Sea, Qiddiya, Others) |

| By Battery Pack Capacity | Below 100 kWh –250 kWh –400 kWh Above 400 kWh |

| By Charging & Energy Replenishment Method | Depot / Overnight Charging Opportunity / Pantograph Charging Fast DC Charging (Public and Dedicated) Battery Swapping and Emerging Models |

| By Customer Type | Public Transport Authorities and Government Operators Private and Contracted Fleet Operators Corporate and Industrial Fleets (Oil & Gas, Mining, Logistics) Educational and Institutional Fleets |

| By Region | Central Region (Riyadh and Surrounding Areas) Western Region (Jeddah, Makkah, Madinah, Red Sea Corridor) Eastern Region (Dammam, Dhahran, Jubail) Northern and Southern Regions (Incl. NEOM and Other Projects) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Bus Manufacturers | 90 | Product Managers, R&D Engineers |

| Battery Suppliers | 70 | Sales Directors, Technical Specialists |

| Public Transport Authorities | 50 | Transport Planners, Fleet Managers |

| Government Policy Makers | 40 | Regulatory Affairs Officers, Environmental Analysts |

| Electric Vehicle Charging Infrastructure Providers | 60 | Business Development Managers, Operations Directors |

The Saudi Arabia Electric Bus Battery Pack Market is valued at approximately USD 80 million, driven by the increasing demand for sustainable public transportation solutions and advancements in battery technology.