Region:Middle East

Author(s):Shubham

Product Code:KRAD6628

Pages:87

Published On:December 2025

Market.png)

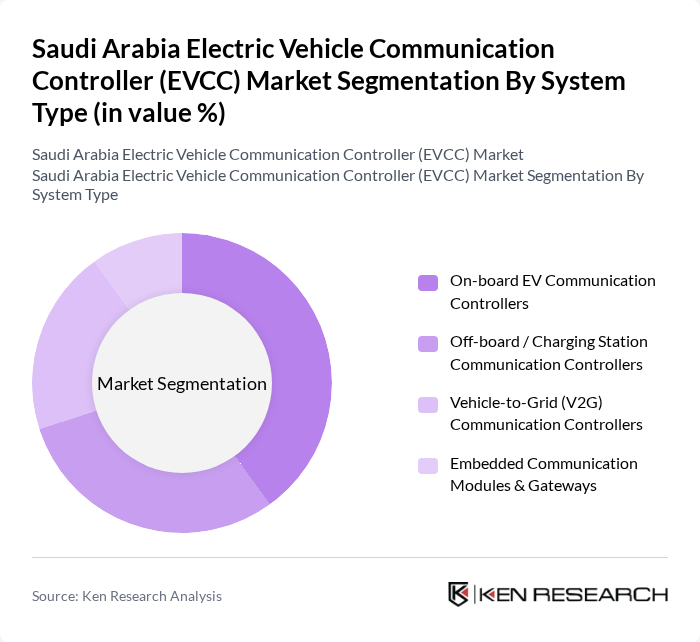

By System Type:The EVCC market can be segmented into four main system types: On-board EV Communication Controllers, Off-board / Charging Station Communication Controllers, Vehicle-to-Grid (V2G) Communication Controllers, and Embedded Communication Modules & Gateways. This structure reflects the way communication intelligence is distributed between vehicles, charging equipment, and backend platforms in modern EV ecosystems. Among these, the On-board EV Communication Controllers are currently leading the market due to their critical role in enabling standardized communication between the vehicle and AC and DC charging infrastructure, including support for functions such as charging authorization, power negotiation, and cybersecurity. The increasing number of electric vehicles on the road, combined with the entry of global OEMs and local assembly initiatives, has driven demand for these controllers, as they are essential for efficient charging, load management, and future?ready features such as plug?and?charge and bidirectional charging.

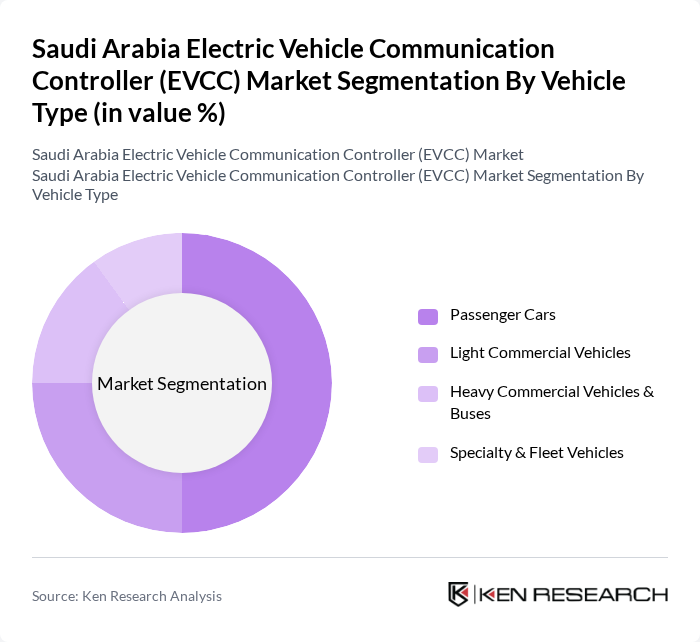

By Vehicle Type:The market is also segmented by vehicle type, which includes Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles & Buses, and Specialty & Fleet Vehicles. The Passenger Cars segment is the most dominant, aligned with the fact that passenger vehicles currently account for the bulk of electric vehicle adoption in Saudi Arabia, supported by incentives, growing model availability, and consumer?focused charging expansion in major cities. This segment's growth is further supported by government?backed initiatives to localize electric passenger vehicle production, increased corporate and government fleet electrification, and rising awareness of environmental sustainability and total cost of ownership benefits among consumers.

The Saudi Arabia Electric Vehicle Communication Controller (EVCC) Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Ltd., Siemens AG, Schneider Electric SE, Delta Electronics, Inc., Huawei Digital Power Technologies Co., Ltd., KEBA AG, Alfen N.V., Webasto Group, NXP Semiconductors N.V., Infineon Technologies AG, STMicroelectronics N.V., Texas Instruments Incorporated, EVBox Group, Wallbox N.V., Saudi Electric Vehicle Charging Company (SEVC) contribute to innovation, geographic expansion, and service delivery in this space, supplying components and systems for networked AC and DC chargers, power electronics, and secure communication interfaces compatible with global standards.

The future of the Saudi Arabia Electric Vehicle Communication Controller market appears promising, driven by ongoing technological innovations and government initiatives. As the country continues to invest in EV infrastructure and promote sustainable transportation, the adoption of advanced communication technologies is expected to rise. Furthermore, the integration of renewable energy sources into the EV ecosystem will enhance the overall efficiency and appeal of electric vehicles, paving the way for a more robust market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By System Type | On-board EV Communication Controllers Off-board / Charging Station Communication Controllers Vehicle-to-Grid (V2G) Communication Controllers Embedded Communication Modules & Gateways |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles & Buses Specialty & Fleet Vehicles |

| By Application | AC Charging (Mode 2/Mode 3) Communication DC Fast Charging (Mode 4) Communication Vehicle-to-Infrastructure (V2I) & Smart Charging Management Vehicle-to-Grid (V2G) & Energy Management |

| By Communication Standard | ISO 15118 / Plug & Charge CHAdeMO CCS (Combined Charging System) OCPP and Backend Communication Protocols |

| By Connectivity Technology | PLC (Power Line Communication) Cellular (4G/5G) & C?V2X Wi?Fi / Bluetooth Low Energy Ethernet & Other Wired Interfaces |

| By End-User | Residential Charging Operators Commercial & Workplace Charging Operators Public Fast-Charging Network Operators Fleet & Depot Charging Operators |

| By Region | Central Region (Riyadh & Surrounding Areas) Western Region (Makkah, Madinah, Jeddah) Eastern Region (Dammam, Dhahran, Khobar) Northern & Southern Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Vehicle Manufacturers | 90 | Product Managers, R&D Directors |

| Charging Infrastructure Providers | 80 | Operations Managers, Business Development Executives |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

| Automotive Industry Experts | 70 | Consultants, Market Analysts |

| Consumer Focus Groups | 60 | Potential EV Buyers, Current EV Owners |

The Saudi Arabia Electric Vehicle Communication Controller (EVCC) Market is valued at approximately USD 0.9 billion. This valuation is based on a five-year historical analysis and reflects the growing adoption of electric vehicles and investments in charging infrastructure.