Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0053

Pages:80

Published On:August 2025

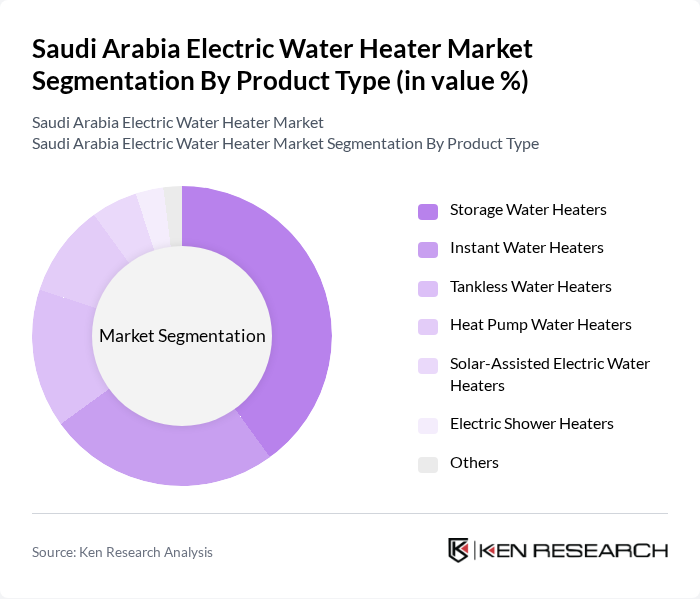

By Product Type:The electric water heater market can be segmented into various product types, including storage water heaters, instant water heaters, tankless water heaters, heat pump water heaters, solar-assisted electric water heaters, electric shower heaters, and others. Among these, storage water heaters are the most popular due to their ability to provide a consistent supply of hot water, making them ideal for residential use. Instant water heaters are also gaining traction, particularly in urban areas where space is limited and quick heating is preferred .

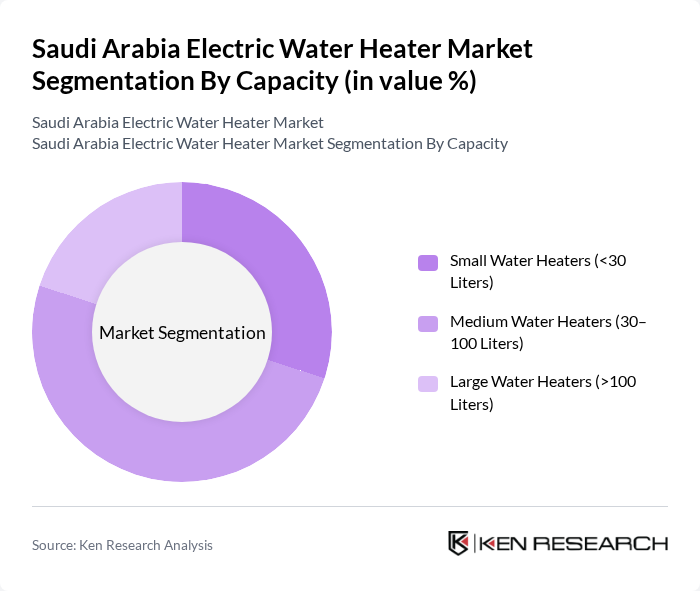

By Capacity:The market can also be segmented based on the capacity of electric water heaters, which includes small water heaters (<30 liters), medium water heaters (30–100 liters), and large water heaters (>100 liters). The medium capacity segment is currently leading the market, as it caters to the needs of both residential and commercial users, providing a balance between size and efficiency. Small water heaters are popular in urban settings where space is a constraint, while large water heaters are preferred in industrial applications .

The Saudi Arabia Electric Water Heater Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ariston Thermo S.p.A., Rheem Manufacturing Company, A.O. Smith Corporation, Bosch Thermotechnology, Stiebel Eltron GmbH & Co. KG, Haier Group Corporation, Panasonic Corporation, Electrolux AB, Ferroli S.p.A., Baxi Heating UK Limited, Vaillant Group, Rinnai Corporation, Noritz Corporation, Mitsubishi Electric Corporation, Alessa Industries Co., Zamil Air Conditioners & Home Appliances Co., Alfanar Company, Al-Hajery Trading Company contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabian electric water heater market is poised for significant transformation, driven by technological advancements and changing consumer preferences. The integration of smart technologies and IoT capabilities is expected to enhance product functionality, making electric water heaters more appealing. Additionally, as sustainability becomes a priority, manufacturers will likely focus on developing eco-friendly products that align with government initiatives. This evolving landscape presents opportunities for innovation and growth, positioning the market for a robust future.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Storage Water Heaters Instant Water Heaters Tankless Water Heaters Heat Pump Water Heaters Solar-Assisted Electric Water Heaters Electric Shower Heaters Others |

| By Capacity | Small Water Heaters (<30 Liters) Medium Water Heaters (30–100 Liters) Large Water Heaters (>100 Liters) |

| By End-User | Residential Commercial Industrial |

| By Application | Domestic Use Hospitality Sector Healthcare Facilities Manufacturing Processes |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale Distributors |

| By Price Range | Budget Segment Mid-Range Segment Premium Segment |

| By Brand Preference | Local Brands International Brands Emerging Brands |

| By Region | Central Western Eastern Southern Northern |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Electric Water Heater Users | 100 | Homeowners, Renters |

| Commercial Electric Water Heater Buyers | 60 | Facility Managers, Procurement Officers |

| Retail Appliance Distributors | 40 | Sales Managers, Product Line Managers |

| Installation Service Providers | 50 | Service Technicians, Business Owners |

| Energy Efficiency Advocates | 40 | Policy Makers, Environmental Consultants |

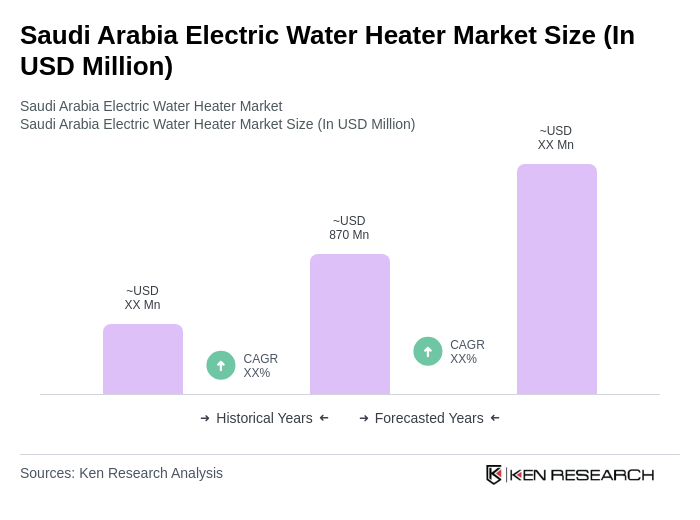

The Saudi Arabia Electric Water Heater Market is valued at approximately USD 870 million, reflecting a significant growth trend driven by urbanization, rising disposable incomes, and increasing demand for energy-efficient appliances.