Region:Middle East

Author(s):Shubham

Product Code:KRAC2866

Pages:90

Published On:October 2025

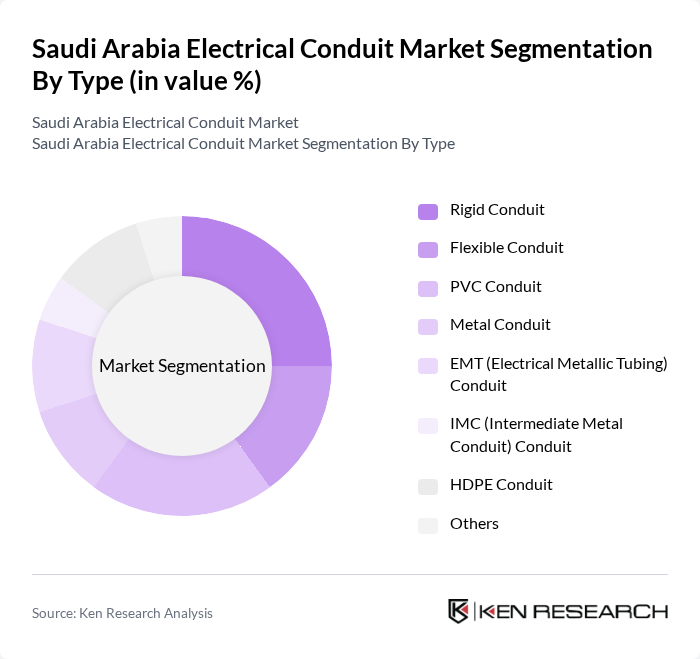

By Type:The market is segmented into various types of conduits, includingRigid Conduit, Flexible Conduit, PVC Conduit, Metal Conduit, EMT (Electrical Metallic Tubing) Conduit, IMC (Intermediate Metal Conduit) Conduit, HDPE Conduit, and Others. Each type serves specific applications and industries, catering to diverse consumer needs. Rigid conduit remains the largest segment by revenue, while flexible conduit is experiencing the fastest growth due to increasing demand for adaptable wiring solutions in modern construction and industrial automation.

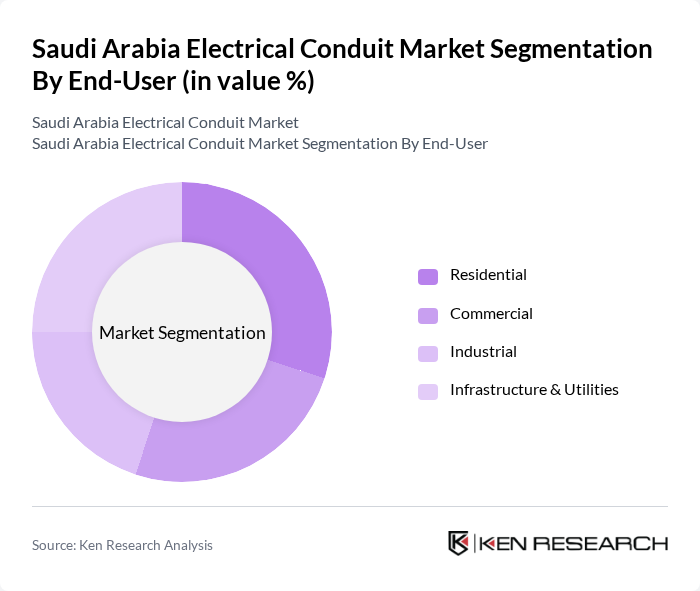

By End-User:The market is segmented based on end-users, includingResidential, Commercial, Industrial, and Infrastructure & Utilities. Each segment has unique requirements and contributes differently to the overall market dynamics. The residential and infrastructure & utilities segments are the largest contributors, driven by ongoing housing projects and utility upgrades, while commercial and industrial segments are expanding due to growth in smart buildings and manufacturing facilities.

The Saudi Arabia Electrical Conduit Market is characterized by a dynamic mix of regional and international players. Leading participants such asAlfanar Company, Saudi Cable Company, Al-Jazira Factory for Plastic Products (JFPPC), Amiantit Group, Al-Babtain Power & Telecom Co., Al-Rajhi Steel, Al-Khodari Sons Company, Al-Suwaidi Industrial Services, Al-Muhaidib Group, Al-Faisaliah Group, Al-Hokair Group, Schneider Electric Saudi Arabia, ABB Electrical Industries Co. Ltd. (Saudi Arabia), Legrand Saudi Arabia, Atkore International (Middle East Operations)contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia electrical conduit market is poised for significant growth driven by ongoing infrastructure projects and a shift towards renewable energy. As urbanization accelerates, the demand for advanced electrical systems will increase, necessitating innovative conduit solutions. Additionally, the integration of smart technologies and IoT in electrical infrastructure will further enhance market dynamics. Companies that adapt to these trends and invest in sustainable practices will likely gain a competitive edge in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Rigid Conduit Flexible Conduit PVC Conduit Metal Conduit EMT (Electrical Metallic Tubing) Conduit IMC (Intermediate Metal Conduit) Conduit HDPE Conduit Others |

| By End-User | Residential Commercial Industrial Infrastructure & Utilities |

| By Application | Electrical Wiring Installations Telecommunications & Data Cabling Power Transmission & Distribution Renewable Energy Projects Oil & Gas Facilities |

| By Distribution Channel | Direct Sales Authorized Distributors Online Retail Wholesale |

| By Material | Steel Aluminum PVC (Polyvinyl Chloride) HDPE (High-Density Polyethylene) Others |

| By Price Range | Low Price Mid Price High Price |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Electrical Installations | 100 | Project Managers, Electrical Engineers |

| Electrical Contractors and Installers | 80 | Business Owners, Lead Technicians |

| Regulatory Compliance and Standards | 50 | Compliance Officers, Safety Inspectors |

| Infrastructure Development Projects | 40 | Urban Planners, Government Officials |

| Market Trends and Innovations | 60 | Industry Analysts, R&D Managers |

The Saudi Arabia Electrical Conduit Market is valued at approximately USD 67 million, driven by the rapid expansion of the construction sector, urbanization, and significant infrastructure investments.