Region:Middle East

Author(s):Rebecca

Product Code:KRAB7746

Pages:100

Published On:October 2025

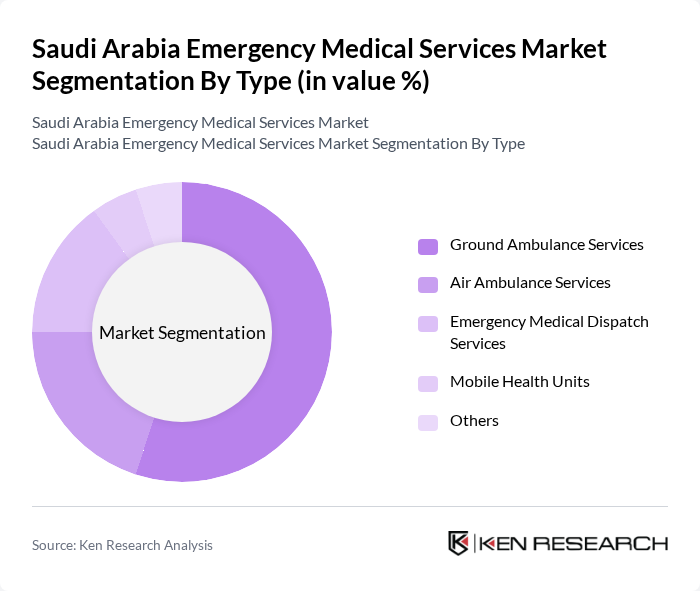

By Type:The market is segmented into various types, including Ground Ambulance Services, Air Ambulance Services, Emergency Medical Dispatch Services, Mobile Health Units, and Others. Ground Ambulance Services dominate the market due to their widespread availability and essential role in urban and rural emergency response. Air Ambulance Services are gaining traction, particularly in remote areas where ground transport may be inadequate. Emergency Medical Dispatch Services are crucial for coordinating responses, while Mobile Health Units provide essential care in underserved regions.

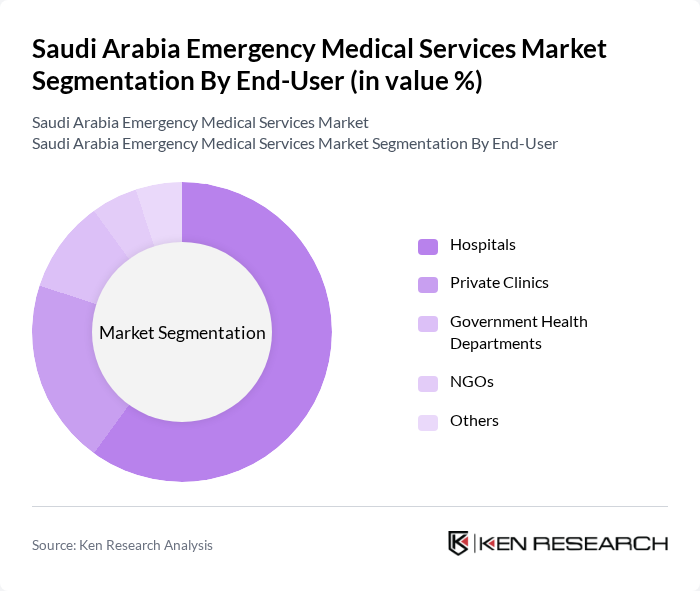

By End-User:The end-user segmentation includes Hospitals, Private Clinics, Government Health Departments, NGOs, and Others. Hospitals are the primary end-users, as they require immediate medical services for patients. Private Clinics also contribute significantly, especially in urban areas where they provide quick access to emergency care. Government Health Departments play a vital role in public health initiatives, while NGOs often assist in disaster response and humanitarian efforts.

The Saudi Arabia Emergency Medical Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Red Crescent Authority, Al Nahdi Medical Company, Al-Faisal Holding, Saudi Arabian Oil Company (Saudi Aramco), King Faisal Specialist Hospital & Research Centre, Dallah Healthcare Company, Al-Muhaidib Group, Al-Hokair Group, Al-Jazeera Medical Services, Al-Salam International Hospital, Saudi German Hospital, Dr. Sulaiman Al Habib Medical Group, Al-Mawashi Company, Al-Bilad Medical Services, Al-Muhaidib Medical Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia Emergency Medical Services market appears promising, driven by ongoing government investments and technological advancements. As the population continues to grow, the demand for efficient EMS will increase, prompting further enhancements in infrastructure and service delivery. The integration of AI and telemedicine will likely revolutionize patient care, while public-private partnerships may emerge to address operational challenges, ensuring that EMS can meet the evolving needs of the population effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Ground Ambulance Services Air Ambulance Services Emergency Medical Dispatch Services Mobile Health Units Others |

| By End-User | Hospitals Private Clinics Government Health Departments NGOs Others |

| By Service Model | Public EMS Private EMS Hybrid EMS |

| By Geographic Coverage | Urban Areas Rural Areas Remote Areas |

| By Response Time | Immediate Response (0-5 minutes) Rapid Response (6-10 minutes) Standard Response (11-15 minutes) |

| By Equipment Type | Basic Life Support (BLS) Equipment Advanced Life Support (ALS) Equipment Specialized Medical Equipment |

| By Funding Source | Government Funding Private Investment Insurance Reimbursements Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ground Ambulance Services | 100 | EMS Managers, Operations Directors |

| Air Ambulance Services | 70 | Flight Paramedics, Air Operations Managers |

| Emergency Response Protocols | 80 | Healthcare Administrators, Policy Makers |

| Patient Transport Services | 60 | Logistics Coordinators, Hospital Administrators |

| Training and Certification Programs | 50 | Training Coordinators, EMS Educators |

The Saudi Arabia Emergency Medical Services Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased healthcare investments and the rising demand for rapid medical response across urban and rural areas.