Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3712

Pages:89

Published On:November 2025

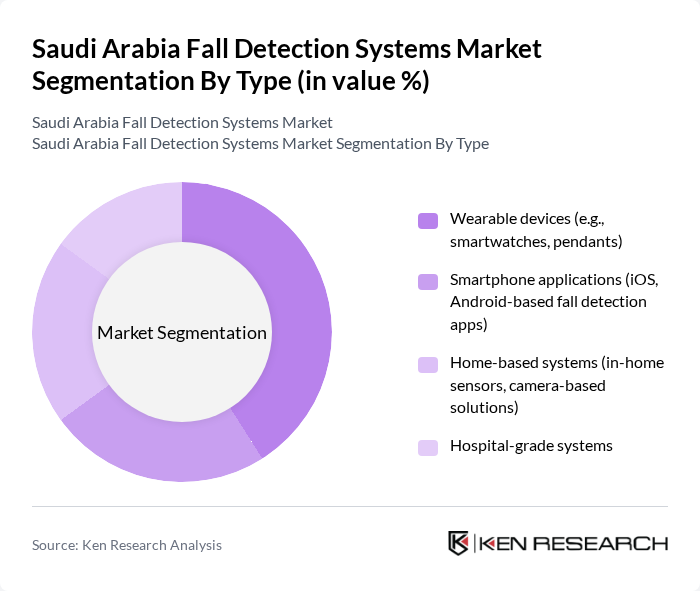

By Type:The market is segmented into various types of fall detection systems, including wearable devices, smartphone applications, home-based systems, and hospital-grade systems. Among these, wearable devices are gaining significant traction due to their convenience and ease of use. They allow users to monitor their health and safety in real-time, making them a preferred choice for elderly individuals and their caregivers. The increasing adoption of smartwatches and health monitoring pendants is driving the growth of this segment, as they offer integrated features that enhance user experience and safety. Wearable devices account for the largest share, reflecting a global trend where this segment leads due to continuous innovation and user preference for non-intrusive monitoring .

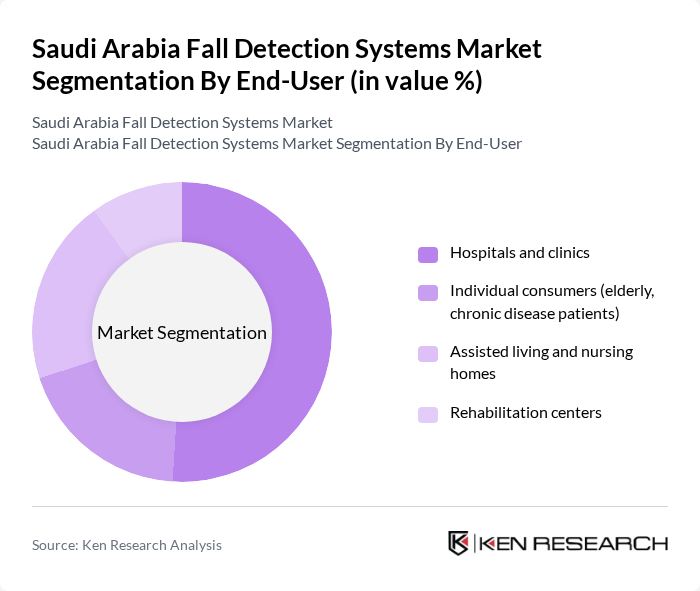

By End-User:The end-user segmentation includes hospitals and clinics, individual consumers, assisted living and nursing homes, and rehabilitation centers. Hospitals and clinics are the leading end-users of fall detection systems, driven by the need for enhanced patient safety and compliance with regulatory standards. The increasing focus on patient-centered care and the integration of technology in healthcare settings are propelling the demand for these systems. Additionally, the growing elderly population in assisted living facilities is also contributing to the rise in adoption among individual consumers. The adoption rate among hospitals and clinics is particularly high due to regulatory mandates and the emphasis on reducing fall-related incidents .

The Saudi Arabia Fall Detection Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Honeywell, Siemens Healthineers, Medtronic, GE Healthcare, Bosch Healthcare Solutions, Tunstall Healthcare, Life Alert, AlertOne Services, SafeWise, Vayyar Imaging, CarePredict, GrandCare Systems, iFall, FallCall Solutions, Al Faisaliah Medical Systems (Saudi Arabia), United Medical Supplies (Saudi Arabia), Senso4Care, MobileHelp, Bay Alarm Medical contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fall detection systems market in Saudi Arabia appears promising, driven by demographic changes and technological advancements. As the elderly population continues to grow, the demand for innovative monitoring solutions will likely increase. Additionally, the integration of AI and smart home technologies will enhance system capabilities, making them more user-friendly and efficient. This evolving landscape presents opportunities for companies to develop tailored solutions that meet the specific needs of the aging population, ensuring safety and peace of mind for families.

| Segment | Sub-Segments |

|---|---|

| By Type | Wearable devices (e.g., smartwatches, pendants) Smartphone applications (iOS, Android-based fall detection apps) Home-based systems (in-home sensors, camera-based solutions) Hospital-grade systems |

| By End-User | Hospitals and clinics Individual consumers (elderly, chronic disease patients) Assisted living and nursing homes Rehabilitation centers |

| By Region | Riyadh (Central Region) Eastern Province Makkah & Madinah (Western Region) Southern Region |

| By Technology | Sensor-based systems (accelerometers, gyroscopes) Camera-based systems (vision AI, video analytics) AI-driven analytics (machine learning, predictive algorithms) Hybrid systems (multi-modal detection) |

| By Application | Home safety monitoring Clinical healthcare monitoring Emergency response integration Remote patient monitoring |

| By Investment Source | Private investments (venture capital, private equity) Government funding (Vision 2030, Ministry of Health) International grants (WHO, World Bank) Corporate partnerships |

| By Policy Support | Government subsidies Tax incentives Research grants Regulatory fast-track programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Facilities | 100 | Hospital Administrators, Geriatric Care Specialists |

| Home Care Providers | 70 | Home Health Aides, Care Coordinators |

| Technology Developers | 50 | Product Managers, R&D Engineers |

| Caregiver Insights | 60 | Family Caregivers, Professional Caregivers |

| Regulatory Bodies | 40 | Policy Makers, Health Regulators |

The Saudi Arabia Fall Detection Systems Market is valued at approximately USD 20 million, reflecting a significant growth trend driven by an increasing aging population and advancements in technology that enhance the effectiveness of these systems.