Region:Middle East

Author(s):Shubham

Product Code:KRAC2857

Pages:82

Published On:October 2025

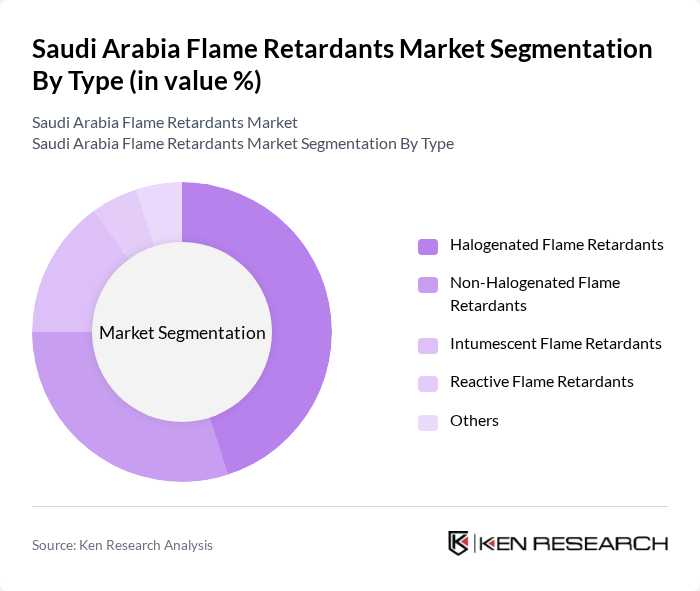

By Type:The flame retardants market is segmented into Halogenated Flame Retardants, Non-Halogenated Flame Retardants, Intumescent Flame Retardants, Reactive Flame Retardants, and Others. Halogenated Flame Retardants currently hold the largest share due to their proven effectiveness and cost-efficiency in industrial and construction applications. However, environmental concerns and regulatory pressures are driving a shift toward Non-Halogenated Flame Retardants, including phosphorus-based and mineral-based solutions. Intumescent Flame Retardants are increasingly adopted in construction for their superior fire protection and low toxicity profiles.

By End-User:The end-user segmentation includes Construction, Automotive, Electronics, Textiles, and Others. The Construction sector is the dominant end-user, driven by stringent fire safety codes, mega-projects, and the increasing number of infrastructure developments. The Automotive industry is a significant consumer, with manufacturers focusing on enhanced vehicle safety and compliance with international standards. The Electronics sector is growing due to rising demand for fire-resistant materials in consumer electronics and industrial equipment. The Textiles sector is adapting to new safety standards, especially in public and hospitality applications.

The Saudi Arabia Flame Retardants Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Albemarle Corporation, Lanxess AG, Clariant AG, ICL Group Ltd., Italmatch Chemicals S.p.A, J.M. Huber Corporation, Nabaltec AG, ADEKA CORPORATION contribute to innovation, geographic expansion, and service delivery in this space.

The future of the flame retardants market in Saudi Arabia appears promising, driven by ongoing investments in infrastructure and heightened safety awareness. As the construction and automotive sectors continue to expand, the demand for innovative flame retardant solutions will likely increase. Furthermore, the shift towards sustainable materials and eco-friendly alternatives is expected to shape product development, aligning with global trends. Companies that adapt to these changes and invest in research and development will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Halogenated Flame Retardants Non-Halogenated Flame Retardants Intumescent Flame Retardants Reactive Flame Retardants Others |

| By End-User | Construction Automotive Electronics Textiles Others |

| By Application | Coatings Plastics Textiles Building Materials Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| By Price Range | Low Price Mid Price High Price |

| By Regulatory Compliance | UL 94 Standards ASTM Standards REACH Compliance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Flame Retardants | 100 | Project Managers, Safety Officers |

| Textile Manufacturing Applications | 60 | Production Managers, Quality Control Specialists |

| Automotive Sector Usage | 50 | Design Engineers, Compliance Managers |

| Electronics and Electrical Applications | 70 | Product Development Engineers, Regulatory Affairs Managers |

| Fire Safety Regulations Impact | 40 | Regulatory Compliance Officers, Industry Consultants |

The Saudi Arabia Flame Retardants Market is valued at approximately USD 150 million, driven by industrial applications, regulatory emphasis on fire safety, and government investments in sustainable infrastructure and smart cities.