Region:Middle East

Author(s):Shubham

Product Code:KRAB0791

Pages:82

Published On:August 2025

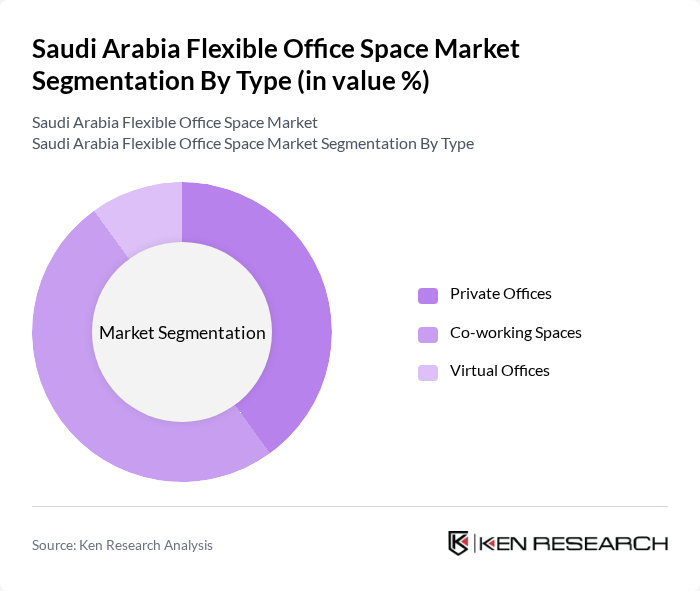

By Type:The flexible office space market can be segmented into three main types: Private Offices, Co-working Spaces, and Virtual Offices. Each of these subsegments caters to different business needs and preferences. Private offices offer dedicated spaces for companies seeking privacy, while co-working spaces provide a collaborative environment for networking and innovation. Virtual offices, on the other hand, cater to businesses that require a professional address without the need for physical office space. The market is witnessing a notable increase in demand for co-working spaces, driven by startups, freelancers, and SMEs seeking cost-effective and flexible solutions .

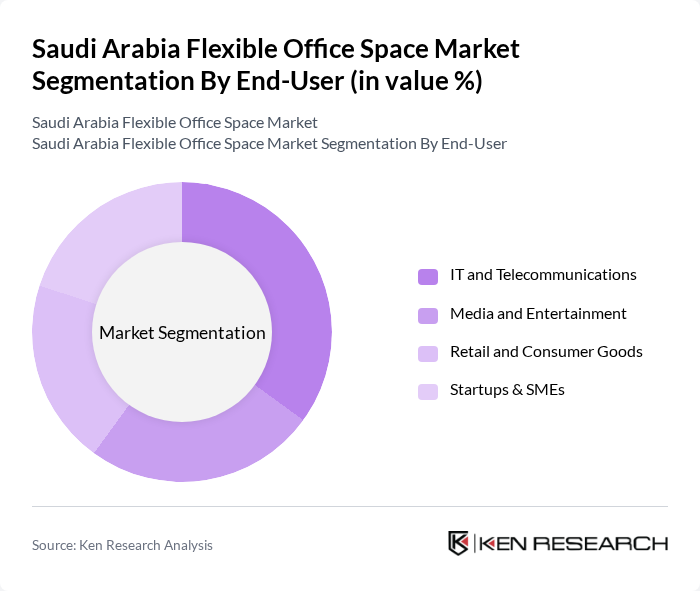

By End-User:The end-user segmentation includes IT and Telecommunications, Media and Entertainment, Retail and Consumer Goods, and Startups & SMEs. The IT and Telecommunications sector is a significant contributor to the demand for flexible office spaces, driven by the need for agile work environments and rapid technological adoption. Media and Entertainment companies favor these spaces for their collaborative nature and creative networking opportunities, while Retail and Consumer Goods businesses utilize them for strategic locations and operational flexibility. Startups and SMEs are increasingly adopting flexible office solutions to minimize overhead costs and enhance scalability, reflecting broader entrepreneurial trends in the country .

The Saudi Arabia Flexible Office Space Market is characterized by a dynamic mix of regional and international players. Leading participants such as WeWork, Regus (IWG plc), Servcorp, The Space, Workinton, Hadya Group (GRAVITA), Impact Hub Riyadh, MyOffice, Business Hub, Urban Station, The Executive Centre, Spaces (IWG plc), Serviced Offices Arabia, The Office Group, Spaces by Design contribute to innovation, geographic expansion, and service delivery in this space.

The future of the flexible office space market in Saudi Arabia appears promising, driven by evolving work patterns and increasing urbanization. As businesses continue to embrace hybrid work models, the demand for flexible office solutions is expected to grow. Additionally, the government's commitment to fostering entrepreneurship will likely create new opportunities for flexible workspace providers, particularly in emerging markets. The integration of technology in workspace management will further enhance operational efficiency and client satisfaction, positioning the market for sustained growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Private Offices Co-working Spaces Virtual Offices |

| By End-User | IT and Telecommunications Media and Entertainment Retail and Consumer Goods Startups & SMEs |

| By City | Riyadh Jeddah Dammam Rest of Saudi Arabia |

| By Service Model | Membership-Based Pay-As-You-Go Long-Term Lease |

| By Industry | Technology Finance Creative Industries Consulting |

| By Amenities Offered | High-Speed Internet Meeting Rooms Event Spaces Administrative Support |

| By Pricing Model | Hourly Rates Daily Rates Monthly Memberships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Users of Flexible Office Spaces | 100 | Real Estate Managers, HR Directors |

| Startups and Entrepreneurs | 60 | Founders, Business Development Managers |

| Flexible Office Space Providers | 40 | Operations Managers, Marketing Directors |

| Industry Experts and Consultants | 50 | Real Estate Analysts, Market Researchers |

| Government and Regulatory Bodies | 40 | Policy Makers, Economic Development Officers |

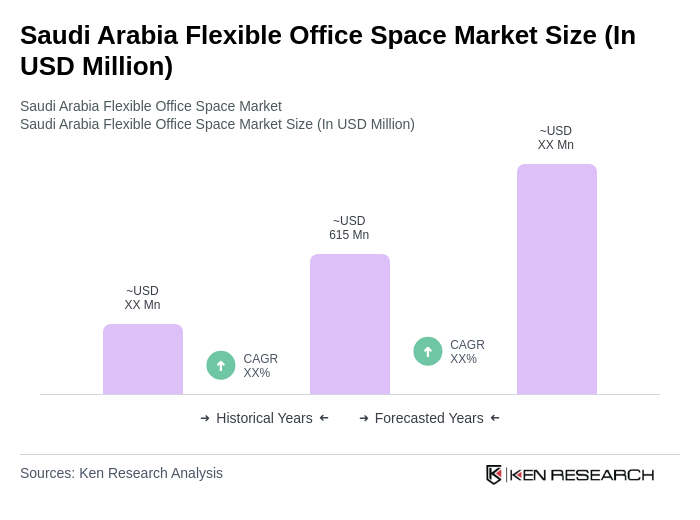

The Saudi Arabia Flexible Office Space Market is valued at approximately USD 615 million, reflecting a significant growth trend driven by the increasing demand for flexible workspaces, particularly among startups and SMEs, as well as the rise of remote and hybrid working models.