Region:Middle East

Author(s):Dev

Product Code:KRAD7628

Pages:98

Published On:December 2025

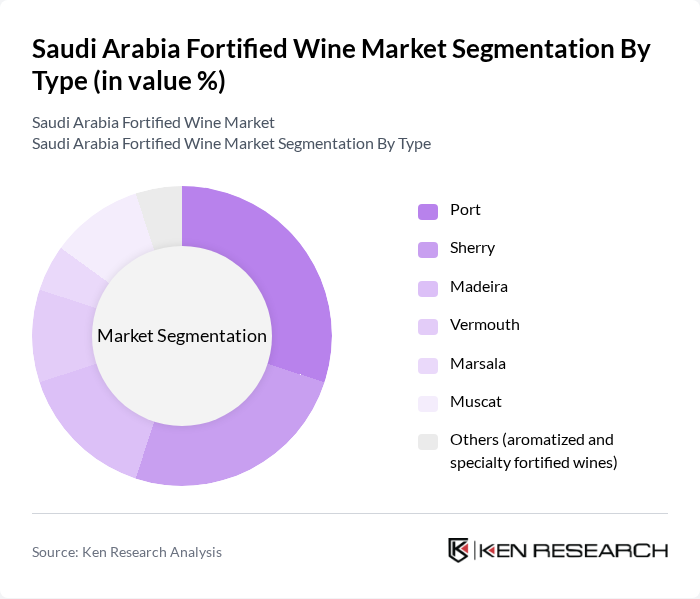

By Type:The fortified wine market in Saudi Arabia is segmented into various types, including Port, Sherry, Madeira, Vermouth, Marsala, Muscat, and others. Each type caters to different consumer preferences and occasions, with Port and Sherry being particularly popular among consumers seeking rich flavors and higher alcohol content. The diversity in types allows for a broad appeal across various demographics, enhancing market growth.

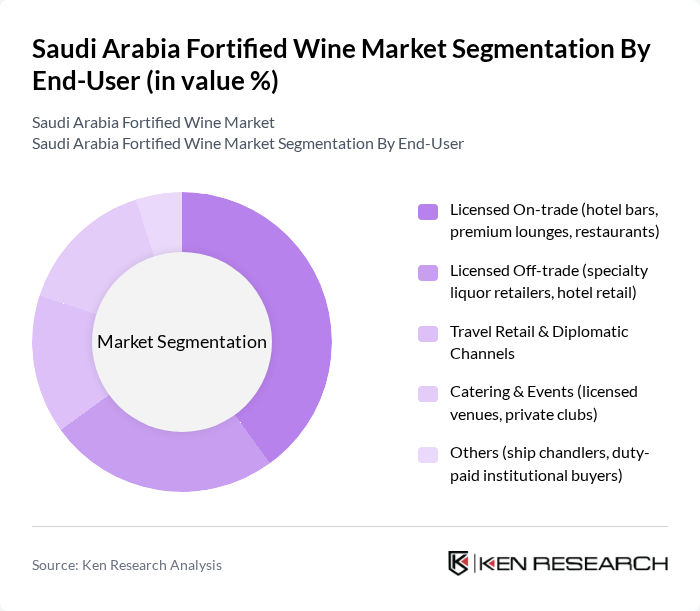

By End-User:The end-user segmentation of the fortified wine market includes licensed on-trade, licensed off-trade, travel retail and diplomatic channels, catering and events, and others. The licensed on-trade segment, which includes hotel bars and premium lounges, is particularly significant due to the high demand for premium beverages in social settings. This segment is expected to continue leading the market as consumer preferences shift towards premium experiences.

The Saudi Arabia Fortified Wine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accolade Wines, E. & J. Gallo Winery, The Wine Group, Sogrape Vinhos, Symington Family Estates, Sogrape’s Sandeman (Port & Sherry), González Byass (including Tio Pepe, Croft), Campari Group (including Cinzano, Averna, Aperol), Bacardi Limited (including Martini & Rossi), Pernod Ricard (including Lillet, Dubonnet), S.A. D.O.C. Port Wine Companies Association Members (key exporting houses), Local and Regional Licensed Importers & Distributors in Saudi Arabia, Middle East Duty Free Retailers Handling Fortified Wine Portfolios, Travel Retail Operators Serving Saudi Arabia Inbound/Outbound Routes, HoReCa Procurement Groups Partnering with International Fortified Wine Brands contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fortified wine market in Saudi Arabia appears cautiously optimistic, driven by evolving consumer preferences and a burgeoning hospitality sector in the context of broader economic diversification under Vision 2030. As the government continues to promote tourism and diversify the economy, opportunities for fortified wine brands may arise in strictly regulated and niche channels that comply with national laws. However, overcoming cultural barriers and regulatory challenges will be crucial for sustained growth. The market is likely to see innovative approaches to product offerings and marketing strategies that align with local customs and preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Port Sherry Madeira Vermouth Marsala Muscat Others (aromatized and specialty fortified wines) |

| By End-User | Licensed On-trade (hotel bars, premium lounges, restaurants) Licensed Off-trade (specialty liquor retailers, hotel retail) Travel Retail & Diplomatic Channels Catering & Events (licensed venues, private clubs) Others (ship chandlers, duty-paid institutional buyers) |

| By Distribution Channel | Direct Importers & Agents Specialized Beverage Distributors Hotel & Restaurant Procurement Channels Travel Retail & Duty-Free Operators E-commerce and Marketplace Platforms (where licensed) Others |

| By Packaging Type | Glass Bottles (standard and premium) Bag-in-Box Cans & Single-Serve Formats Bulk (for HoReCa and re-packaging) Others |

| By Price Range | Premium & Luxury (imported, aged, heritage labels) Mid-Range (mainstream imported brands) Value / Economy (entry-level fortified wines) Private Label & House Brands |

| By Occasion | Tourism & Hospitality Consumption Corporate & Formal Events Gifting (expatriates and diplomatic) Personal / At-Home Consumption (licensed segments) Others |

| By Region | Northern and Central Region (including Riyadh) Western Region (including Jeddah, Makkah, Madinah) Eastern Region (including Dammam, Khobar) Southern Region Others (special economic and tourism zones) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Insights | 150 | Store Managers, Wine Buyers |

| Consumer Preferences Survey | 100 | Wine Consumers, Age 21-50 |

| Distributor Feedback | 100 | Sales Representatives, Distribution Managers |

| Expert Opinions | 50 | Sommeliers, Wine Critics |

| Market Trend Analysis | 75 | Market Analysts, Industry Consultants |

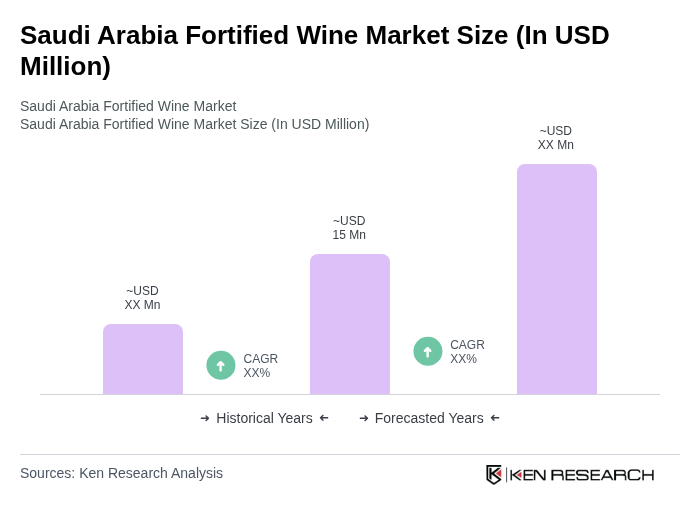

The Saudi Arabia Fortified Wine Market is valued at approximately USD 15 million, reflecting a growing consumer interest in premium alcoholic beverages, tourism, and hospitality sectors, particularly under the Vision 2030 economic diversification initiative.