Region:Middle East

Author(s):Rebecca

Product Code:KRAC3323

Pages:80

Published On:October 2025

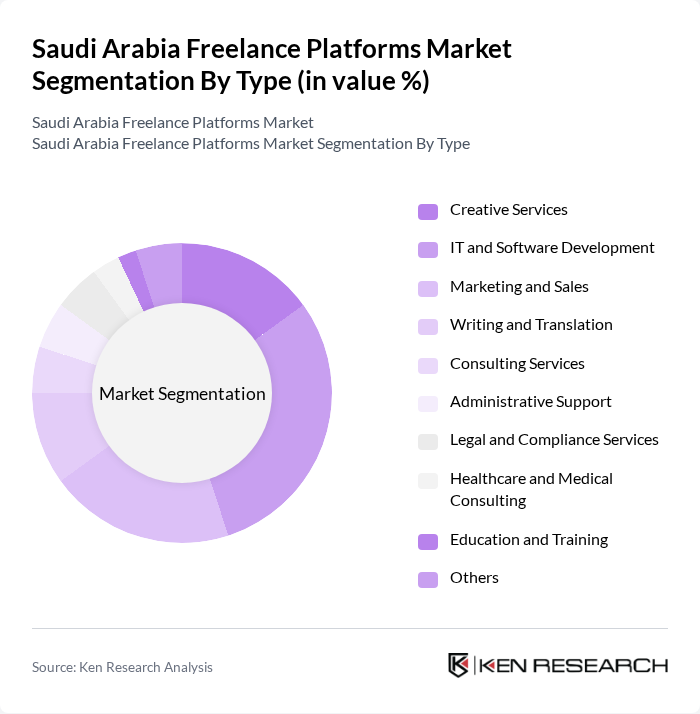

By Type:The market is segmented into various types of services offered on freelance platforms. The primary subsegments include Creative Services, IT and Software Development, Marketing and Sales, Writing and Translation, Consulting Services, Administrative Support, Legal and Compliance Services, Healthcare and Medical Consulting, Education and Training, and Others. Among these, IT and Software Development has emerged as a leading segment due to the high demand for tech solutions and digital transformation across industries. Creative Services and Marketing & Sales also show robust growth, supported by the Kingdom’s focus on entertainment, cultural development, and digital marketing initiatives .

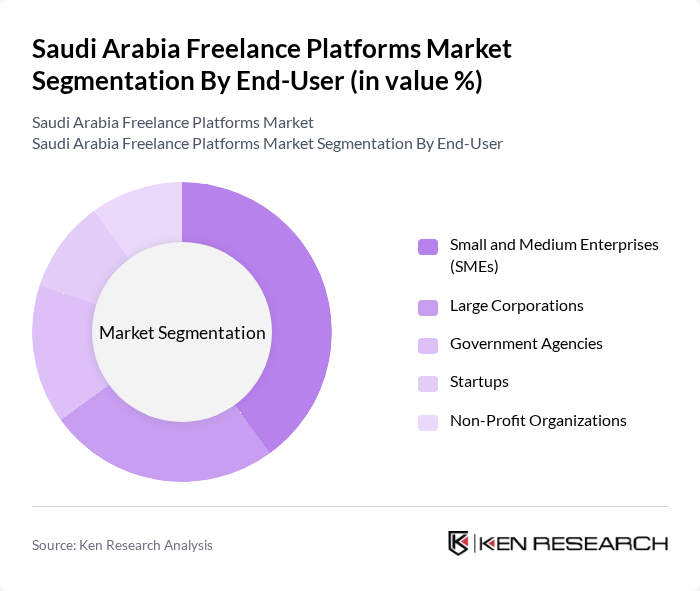

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Corporations, Government Agencies, Startups, and Non-Profit Organizations. SMEs are the dominant end-user segment, as they increasingly leverage freelance platforms to access specialized skills without the overhead costs associated with full-time hires. This trend is driven by the need for flexibility and cost efficiency in a competitive market. Startups are also rapidly adopting freelance models, with nearly 68% planning to integrate freelance-based services into their operations by 2026 .

The Saudi Arabia Freelance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ureed, Marn, Freelance Yard, Shift, Upwork, Fiverr, Freelancer.com, Toptal, PeoplePerHour, 99designs, DesignCrowd, FlexJobs, WorkGenius, Paro, Freelancer.com.sa contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia freelance platforms market appears promising, driven by ongoing digital transformation and a cultural shift towards remote work. As more individuals embrace freelancing, the demand for specialized services is expected to rise. Additionally, the integration of advanced technologies, such as AI and machine learning, will enhance platform functionalities, improving user experiences. The government's continued support for entrepreneurship will further bolster this sector, creating a vibrant ecosystem for freelancers and clients alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Creative Services IT and Software Development Marketing and Sales Writing and Translation Consulting Services Administrative Support Legal and Compliance Services Healthcare and Medical Consulting Education and Training Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Corporations Government Agencies Startups Non-Profit Organizations |

| By Service Delivery Model | Project-Based Services Hourly Services Retainer Services Managed Services |

| By Payment Method | Credit/Debit Cards Bank Transfers E-Wallets Integrated Platform Payments |

| By Geographic Reach | Local Freelancers Regional Freelancers International Freelancers |

| By Industry | Technology Healthcare Education Finance Media & Entertainment Construction & Engineering |

| By Client Type | Individual Clients Business Clients Government Clients Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freelance IT Professionals | 100 | Software Developers, IT Consultants |

| Creative Freelancers | 80 | Graphic Designers, Content Writers |

| Marketing and Sales Freelancers | 70 | Digital Marketers, Sales Consultants |

| Administrative Support Freelancers | 50 | Virtual Assistants, Administrative Coordinators |

| Freelance Educators and Trainers | 40 | Online Tutors, Corporate Trainers |

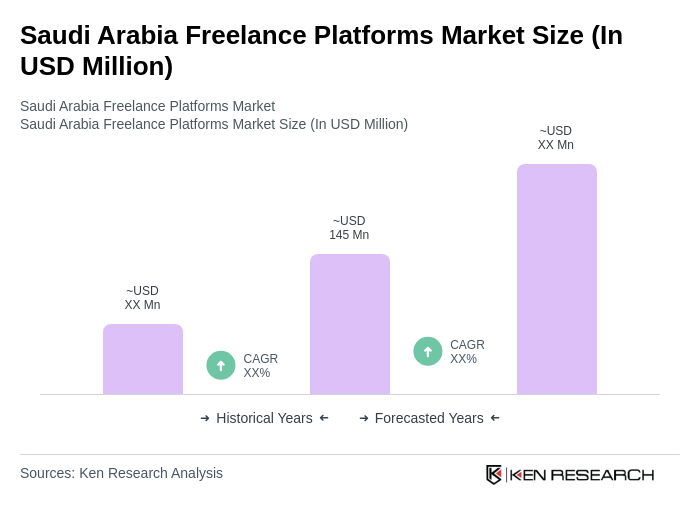

The Saudi Arabia Freelance Platforms Market is valued at approximately USD 145 million, reflecting significant growth driven by the increasing adoption of digital platforms, remote working trends, and a rising number of skilled professionals seeking flexible job opportunities.