Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0028

Pages:85

Published On:August 2025

By Type:The market is segmented into various types of gift cards, including physical gift cards, digital (e-gift) cards, prepaid incentive cards, reloadable gift cards, promotional gift cards, seasonal gift cards, multi-brand gift cards, open-loop gift cards, closed-loop gift cards, and others. Among these,digital (e-gift) cardsare gaining significant traction due to their convenience, instant delivery, and the increasing trend of online shopping. The adoption of digital cards is further supported by the integration of these solutions with mobile wallets and e-commerce platforms, making them the preferred choice for both consumers and businesses .

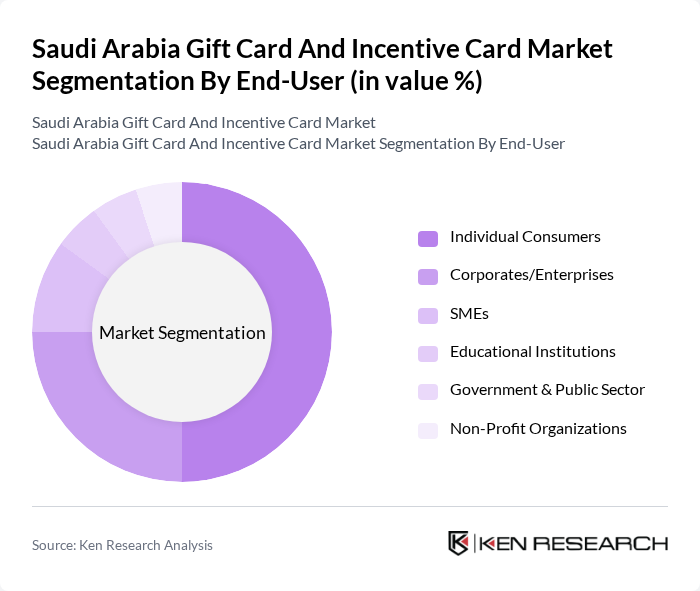

By End-User:The end-user segmentation includes individual consumers, corporates/enterprises, SMEs, educational institutions, government & public sector, and non-profit organizations.Individual consumersrepresent the largest segment, driven by the popularity of gift cards for personal gifting, online shopping, and digital payments. Corporates and enterprises are also significant users, leveraging gift and incentive cards for employee rewards and customer engagement programs .

The Saudi Arabia Gift Card And Incentive Card Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Pay, Amazon.sa, Jarir Bookstore, Carrefour Saudi Arabia, Lulu Hypermarket, Al Nahdi Medical Company, Extra Stores (United Electronics Company), Othaim Markets, Panda Retail Company (HyperPanda), Noon.com, Tamimi Markets, SACO, Al-Futtaim Group (IKEA Saudi Arabia, Toys R Us), Al-Jazira Capital, Tango Card, Swile, and Ininal contribute to innovation, geographic expansion, and service delivery in this space .

The future of the gift card and incentive card market in Saudi Arabia appears promising, driven by technological advancements and changing consumer preferences. As digital payment systems become more integrated into daily life, the convenience of gift cards will likely attract a broader customer base. Additionally, the increasing trend of personalization in gift cards will enhance their appeal, making them a preferred choice for gifting. The market is poised for growth as businesses adapt to these evolving consumer demands and preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Physical Gift Cards Digital (E-Gift) Cards Prepaid Incentive Cards Reloadable Gift Cards Promotional Gift Cards Seasonal Gift Cards Multi-brand Gift Cards Open-loop Gift Cards Closed-loop Gift Cards Others |

| By End-User | Individual Consumers Corporates/Enterprises SMEs Educational Institutions Government & Public Sector Non-Profit Organizations |

| By Sales Channel | Online Retailers/E-commerce Platforms Physical Retail Stores Corporate Direct Sales Mobile Applications Supermarkets & Hypermarkets Financial Institutions/Banks |

| By Distribution Mode | Direct Distribution Indirect Distribution (Distributors, Aggregators) |

| By Price Range | Low-End Gift Cards (Below SAR 100) Mid-Range Gift Cards (SAR 100–500) High-End Gift Cards (Above SAR 500) |

| By Occasion | Birthdays Holidays (Eid, Ramadan, National Day, etc.) Corporate Events Weddings Graduation Employee Recognition Customer Loyalty/Rewards |

| By Customization Options | Personalized Messages Custom Designs Themed Gift Cards Co-branded Gift Cards Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Gift Card Usage | 100 | Retail Managers, Marketing Directors |

| Consumer Preferences for Incentive Cards | 100 | General Consumers, Loyalty Program Managers |

| Corporate Incentive Programs | 80 | HR Managers, Corporate Executives |

| Digital vs. Physical Gift Cards | 80 | IT Managers, E-commerce Directors |

| Market Trends in Gift Card Redemption | 40 | Financial Analysts, Consumer Behavior Researchers |

The Saudi Arabia Gift Card and Incentive Card Market is valued at approximately USD 3.3 billion, reflecting significant growth driven by digital payment adoption, e-commerce expansion, and increasing gifting trends among consumers and corporates.