Region:Middle East

Author(s):Dev

Product Code:KRAD5317

Pages:84

Published On:December 2025

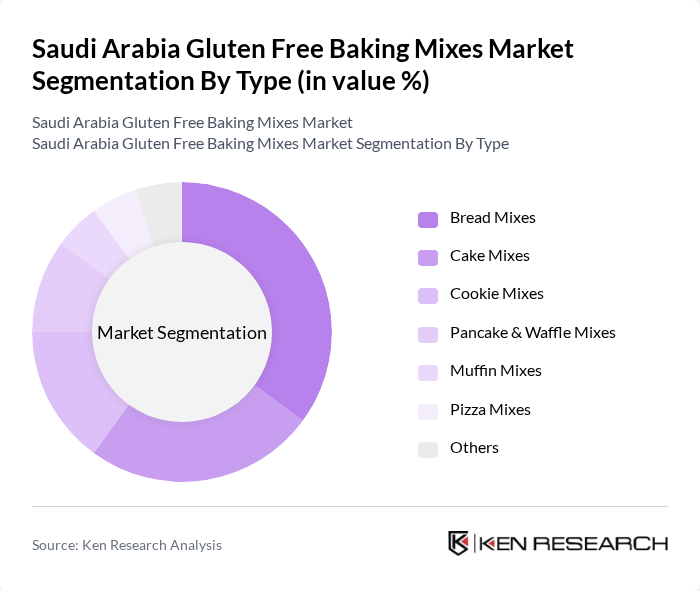

By Type:The market is segmented into various types of gluten-free baking mixes, including bread mixes, cake mixes, cookie mixes, pancake & waffle mixes, muffin mixes, pizza mixes, and others. This structure is consistent with the broader gluten-free bakery and baking mixes category, where bread, cakes, cookies, and other bakery formats are core product groups. Among these, bread mixes are the most popular due to the high demand for gluten-free bread alternatives as staple items in daily consumption, while convenience-focused mixes are increasingly used at home. Cake mixes also see significant usage, particularly among health-conscious consumers looking for indulgent yet gluten-free dessert options, supported by rising availability of gluten-free cakes and muffins in the bakery segment. The increasing availability of these products in supermarkets, hypermarkets, and online channels further drives their popularity by improving access and variety.

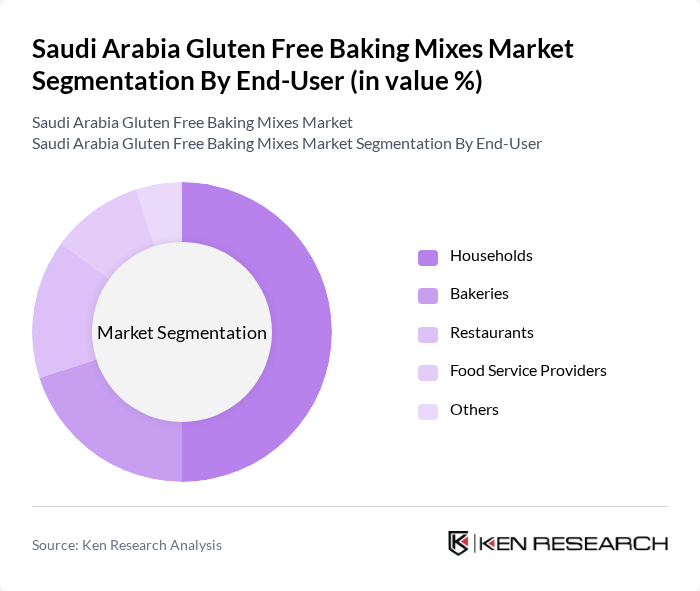

By End-User:The end-user segmentation includes households, bakeries, restaurants, food service providers, and others. Households represent the largest segment, driven by the increasing number of consumers opting for gluten-free diets at home and the growing penetration of gluten-free packaged products for in-home baking and meal preparation. Bakeries and restaurants are also significant contributors, as they adapt their menus to cater to the growing demand for gluten-free bread, cakes, and desserts within the wider gluten-free bakery product segment. The trend towards healthier eating habits, combined with greater availability of gluten-free options in modern foodservice formats, has led to a rise in gluten-free offerings across cafés, quick-service restaurants, and broader food service providers.

The Saudi Arabia Gluten Free Baking Mixes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bob's Red Mill, King Arthur Flour, Betty Crocker, Simple Mills, Almarai Company, Savola Group, National Agricultural Development Company (NADEC), Tanmiah Foods, Sunbulah Group, Modern Food Industries, Saudia Dairy & Foodstuff Company (SADAFCO), United Grain Corporation, Rahmani Group, Halwani Bros. contribute to innovation, geographic expansion, and service delivery in this space, in line with the broader gluten-free products and bakery landscape where multinational brands and major Saudi food companies are actively expanding gluten-free portfolios.

The future of the gluten-free baking mixes market in Saudi Arabia appears promising, driven by increasing health awareness and a growing consumer base seeking gluten-free options. As the market matures, innovations in product formulations and flavors are expected to attract a wider audience. Additionally, the rise of e-commerce platforms will facilitate easier access to these products, enhancing consumer convenience and driving sales growth. Overall, the market is poised for significant expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Bread Mixes Cake Mixes Cookie Mixes Pancake & Waffle Mixes Muffin Mixes Pizza Mixes Others |

| By End-User | Households Bakeries Restaurants Food Service Providers Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Stores Convenience Stores Others |

| By Packaging Type | Bags Boxes Pouches Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Ingredient Type | Brown Rice Flour Tapioca Flour Almond Flour Coconut Flour Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Health-Conscious Consumers Celiac Disease Patients Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 120 | Store Managers, Category Buyers |

| Consumer Preferences | 150 | Health-Conscious Consumers, Gluten-Free Diet Followers |

| Health Professional Insights | 100 | Nutritionists, Dietitians |

| Product Development Feedback | 80 | R&D Managers, Product Innovators |

| Market Distribution Channels | 90 | Distributors, Wholesalers |

The Saudi Arabia Gluten Free Baking Mixes Market is valued at approximately USD 7 million, reflecting a growing demand driven by increased health consciousness and the prevalence of gluten intolerance and celiac disease among the population.