Region:Middle East

Author(s):Dev

Product Code:KRAD0443

Pages:89

Published On:August 2025

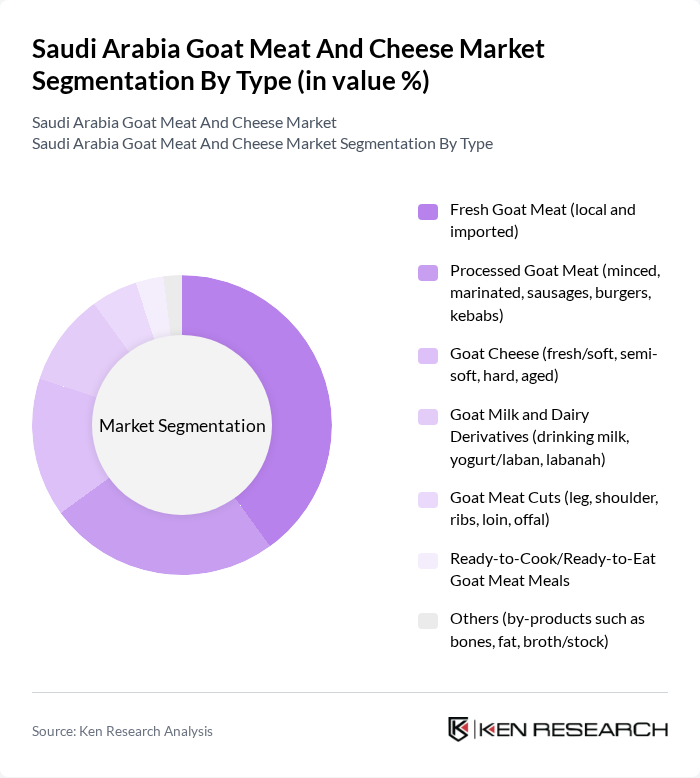

By Type:The market is segmented into various types, including Fresh Goat Meat (local and imported), Processed Goat Meat (minced, marinated, sausages, burgers, kebabs), Goat Cheese (fresh/soft, semi-soft, hard, aged), Goat Milk and Dairy Derivatives (drinking milk, yogurt/laban, labanah), Goat Meat Cuts (leg, shoulder, ribs, loin, offal), Ready-to-Cook/Ready-to-Eat Goat Meat Meals, and Others (by-products such as bones, fat, broth/stock). Among these, Fresh Goat Meat is currently the leading subsegment due to its high demand in traditional dishes and the growing preference for fresh, locally sourced products.

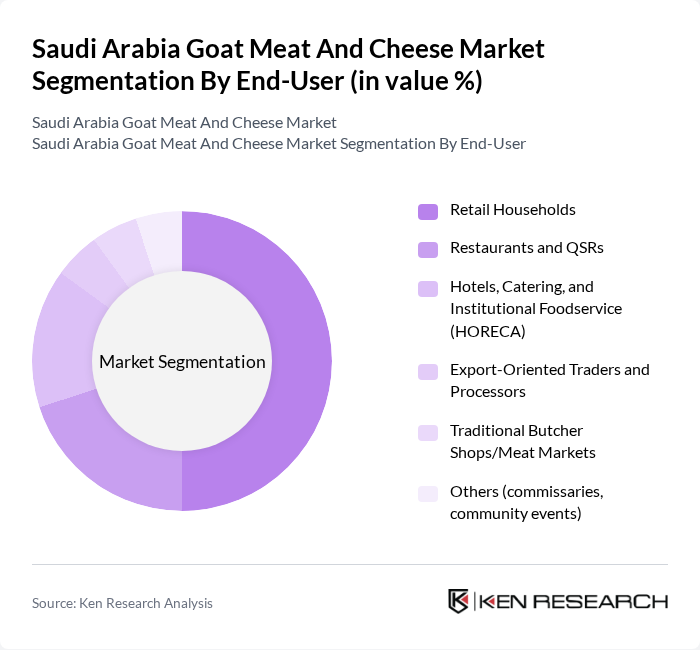

By End-User:The end-user segmentation includes Retail Households, Restaurants and QSRs, Hotels, Catering, and Institutional Foodservice (HORECA), Export-Oriented Traders and Processors, Traditional Butcher Shops/Meat Markets, and Others (commissaries, community events). The Retail Households segment is the most significant contributor to the market, driven by the increasing consumption of goat meat and cheese in home-cooked meals and the growing trend of healthy eating.

The Saudi Arabia Goat Meat and Cheese Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Jazeera Poultry & Meat Co. (Saudi Arabia), Al Kabeer Group (Saudi Arabia/UAE), Almunajem Foods Company, Tanmiah Food Company, Halwani Bros. Co., Savola Foods Company, NADEC – National Agricultural Development Company, Almarai Company, Al Watania Food, Lactalis Group (Président, Galbani, Société – goat cheese imports), Savencia Fromage & Dairy (St. Môret, Chavroux – goat cheese), Fonterra (imported cheese portfolio), Arla Foods (Castello, specialty cheese), Local Goat Farms/Brands (e.g., Al Qassim-based farms, Abha/Asir artisanal producers), Saudi Meat & Livestock Company – SALIC/Tejarah (import/logistics interface) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia goat meat and cheese market is poised for significant growth, driven by increasing health consciousness and a shift towards sustainable farming practices. As consumers become more aware of the nutritional benefits of goat products, demand is expected to rise. Additionally, the expansion of online sales channels will facilitate access to goat meat and cheese, allowing producers to reach a broader audience. Collaborations with local chefs and restaurants will further enhance market visibility and consumer engagement.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Goat Meat (local and imported) Processed Goat Meat (minced, marinated, sausages, burgers, kebabs) Goat Cheese (fresh/soft, semi-soft, hard, aged) Goat Milk and Dairy Derivatives (drinking milk, yogurt/laban, labanah) Goat Meat Cuts (leg, shoulder, ribs, loin, offal) Ready-to-Cook/Ready-to-Eat Goat Meat Meals Others (by-products such as bones, fat, broth/stock) |

| By End-User | Retail Households Restaurants and QSRs Hotels, Catering, and Institutional Foodservice (HORECA) Export-Oriented Traders and Processors Traditional Butcher Shops/Meat Markets Others (commissaries, community events) |

| By Distribution Channel | Supermarkets/Hypermarkets (e.g., Panda, Carrefour, Danube, Tamimi) Online Grocery and Marketplaces Specialty Cheese and Gourmet Stores Direct Farm and Cooperative Sales Traditional Butchers and Wet Markets Others (B2B distributors, wholesale) |

| By Price Range | Premium (imported/aged cheeses, specialty cuts) Mid-Range Budget/Economy Others (promotional/private label) |

| By Packaging Type | Vacuum Sealed (cuts, processed meat) Canned (meat/ready meals) Chilled MAP/Tray Packs Frozen Packs Others (paper wrap, waxed cheese, bulk foodservice) |

| By Product Form | Whole/Carcass Sliced/Portioned Cuts Ground/Minced Cubed/Strips Others (crumbled cheese, grated) |

| By Quality | Organic/Halal-Certified Premium Conventional Others (free-range, antibiotic-free) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Goat Meat Producers | 90 | Farm Owners, Livestock Managers |

| Cheese Manufacturers | 80 | Production Managers, Quality Control Supervisors |

| Retail Outlets | 110 | Store Managers, Category Buyers |

| Consumers of Goat Products | 140 | Health-conscious Shoppers, Culinary Enthusiasts |

| Food Service Providers | 70 | Restaurant Owners, Catering Managers |

The Saudi Arabia Goat Meat and Cheese Market is valued at approximately USD 1.15 billion, with recent assessments indicating a market value around USD 1.2 billion. This growth is driven by increasing consumer demand for goat meat and cheese due to their nutritional benefits and cultural significance.