Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3083

Pages:80

Published On:October 2025

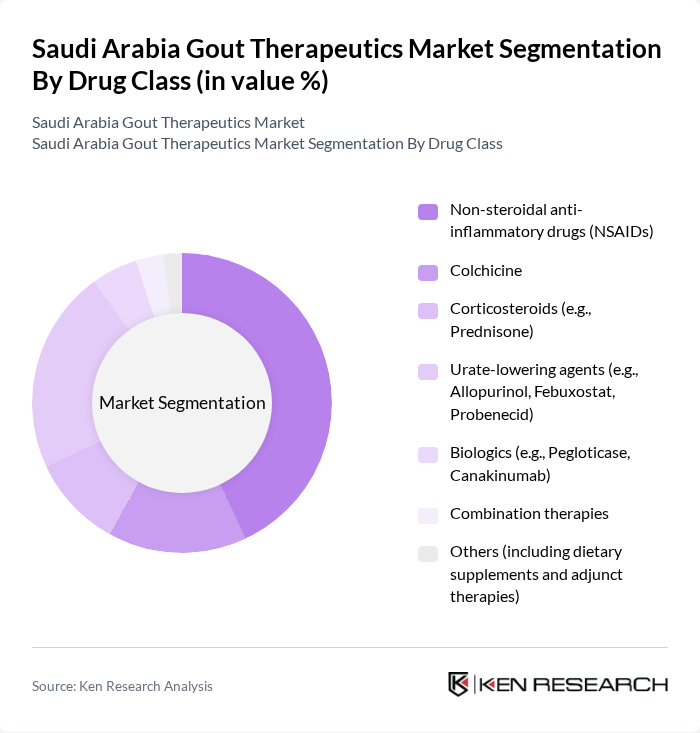

By Drug Class:The market is segmented into various drug classes, including Non-steroidal anti-inflammatory drugs (NSAIDs), Colchicine, Corticosteroids (e.g., Prednisone), Urate-lowering agents (e.g., Allopurinol, Febuxostat, Probenecid), Biologics (e.g., Pegloticase, Canakinumab), Combination therapies, and Others (including dietary supplements and adjunct therapies). Among these, NSAIDs hold the largest revenue share, while urate-lowering agents represent the fastest-growing segment due to their effectiveness in managing uric acid levels and preventing recurrent gout attacks .

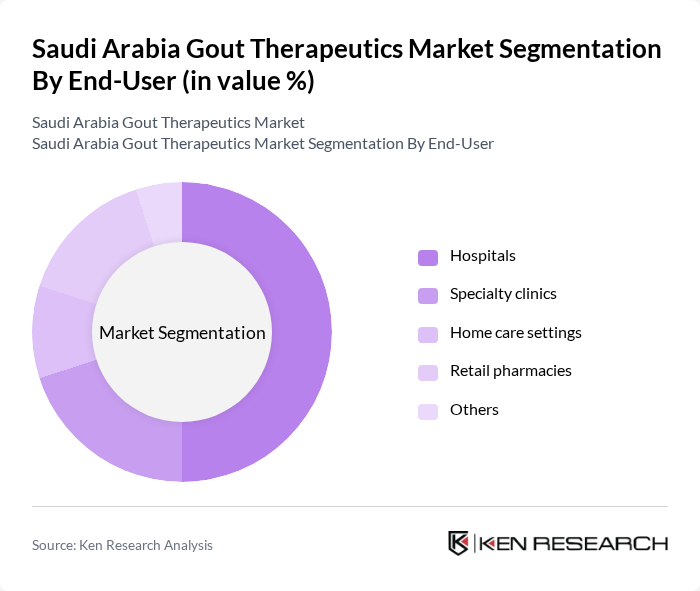

By End-User:The market is segmented by end-users, including Hospitals, Specialty clinics, Home care settings, Retail pharmacies, and Others. Hospitals are the leading end-user segment, primarily due to their capacity to provide comprehensive care, access to a wide range of gout therapeutics, and specialized medical staff for patient management .

The Saudi Arabia Gout Therapeutics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novartis AG, Takeda Pharmaceutical Company Limited, Amgen Inc., Sanofi S.A., Pfizer Inc., Horizon Therapeutics plc, Teva Pharmaceutical Industries Ltd., AbbVie Inc., GSK plc, Astellas Pharma Inc., UCB S.A., Eli Lilly and Company, Bayer AG, Merck & Co., Inc., Bristol-Myers Squibb Company, AstraZeneca PLC, Regeneron Pharmaceuticals Inc., Zydus Lifesciences Ltd., Teijin Pharma Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the gout therapeutics market in Saudi Arabia appears promising, driven by increasing healthcare investments and a focus on innovative treatment solutions. The integration of digital health technologies is expected to enhance patient engagement and adherence to treatment plans. Additionally, the growing emphasis on preventive healthcare will likely lead to earlier diagnosis and management of gout, ultimately improving patient outcomes and expanding the market for therapeutics in the region.

| Segment | Sub-Segments |

|---|---|

| By Drug Class | Non-steroidal anti-inflammatory drugs (NSAIDs) Colchicine Corticosteroids (e.g., Prednisone) Urate-lowering agents (e.g., Allopurinol, Febuxostat, Probenecid) Biologics (e.g., Pegloticase, Canakinumab) Combination therapies Others (including dietary supplements and adjunct therapies) |

| By End-User | Hospitals Specialty clinics Home care settings Retail pharmacies Others |

| By Distribution Channel | Hospital pharmacies Retail pharmacies Online pharmacies Direct sales Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| By Patient Demographics | Age group (Adults, Elderly) Gender (Male, Female) Socioeconomic status (Low, Middle, High) |

| By Treatment Duration | Short-term treatment Long-term management Acute flare management |

| By Pricing Strategy | Premium pricing Competitive pricing Value-based pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Rheumatology Clinics | 60 | Rheumatologists, Clinic Managers |

| Pharmacy Sector | 50 | Pharmacists, Pharmacy Owners |

| Patient Insights | 80 | Gout Patients, Caregivers |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Policy Analysts |

| Insurance Providers | 40 | Health Insurance Executives, Claims Managers |

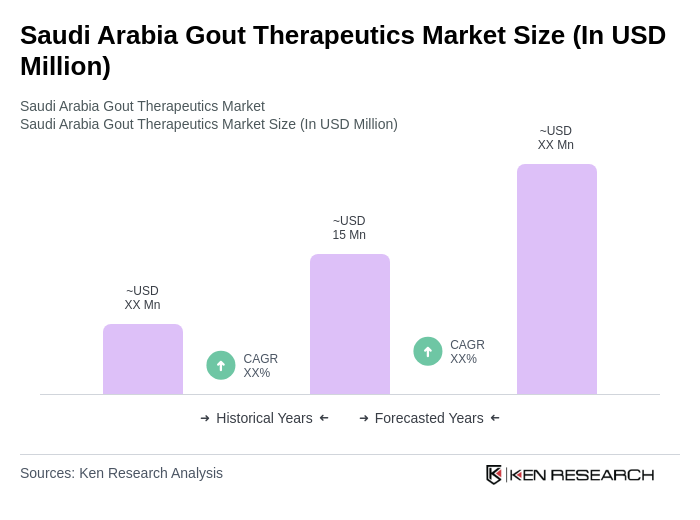

The Saudi Arabia Gout Therapeutics Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This valuation is influenced by the rising prevalence of gout and the introduction of innovative treatment options.