Region:Middle East

Author(s):Rebecca

Product Code:KRAC9756

Pages:85

Published On:November 2025

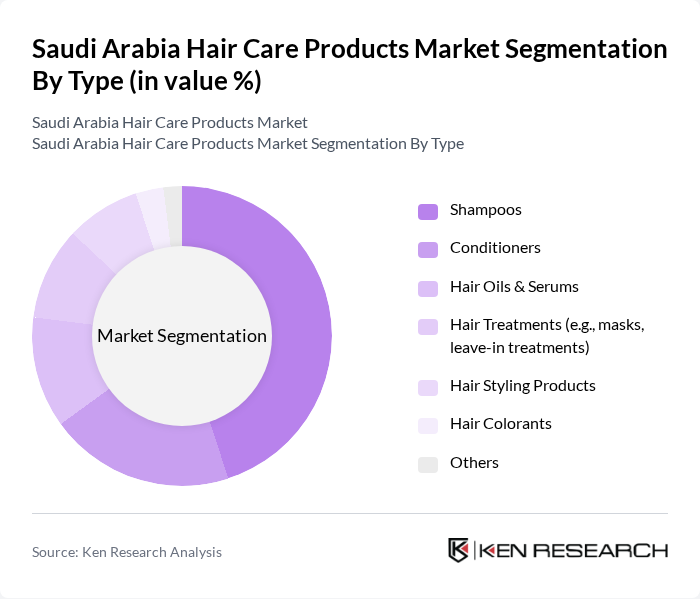

By Type:The hair care products market can be segmented into shampoos, conditioners, hair oils & serums, hair treatments (such as masks and leave-in treatments), hair styling products, hair colorants, and others. Among these, shampoos are the most popular, accounting for the largest segment due to their frequent use and essential role in daily hair care routines. Conditioners, hair oils, and treatments are also gaining traction as consumers increasingly seek specialized solutions for scalp health, damage repair, and hydration. The trend toward natural and organic formulations, including herbal and halal-certified products, is accelerating, with brands innovating to meet demand for clean ingredients and targeted benefits.

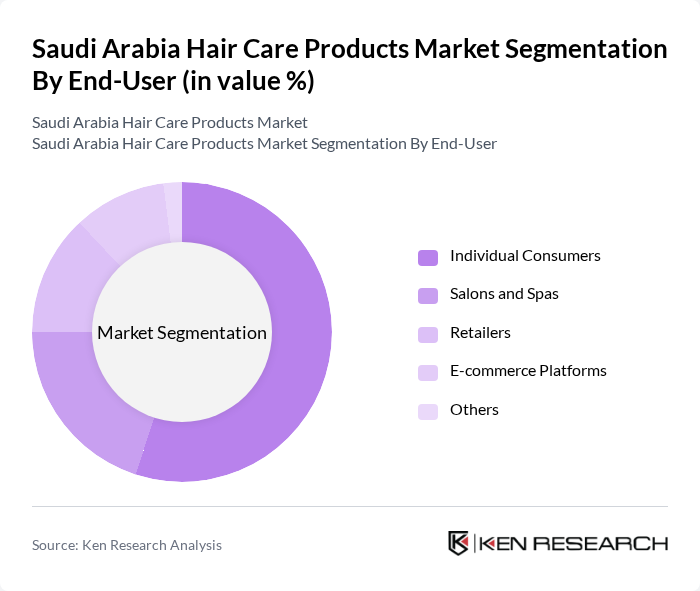

By End-User:The end-user segmentation includes individual consumers, salons and spas, retailers, e-commerce platforms, and others. Individual consumers represent the largest segment, driven by the growing trend of personal grooming, self-care, and the influence of digital channels. Salons and spas play a significant role as they use professional-grade products and drive consumer adoption of premium and specialized treatments. Retailers and e-commerce platforms are expanding rapidly, reflecting the shift toward online shopping and omnichannel distribution.

The Saudi Arabia Hair Care Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal Middle East, Procter & Gamble (P&G), Unilever, Henkel AG & Co. KGaA, Coty Inc., Shiseido Company, Limited, The Estée Lauder Companies Inc., Amway Corporation, Beiersdorf AG, Revlon, Inc., Avon Products, Inc., Mary Kay Inc., Oriflame Holding AG, Kérastase (L'Oréal Group), TRESemmé (Unilever), Dabur International Ltd., Himalaya Wellness Company, Almarai Company (Herbal Essences distributor), Al-Dawaa Pharmacies (Major Retailer), Nahdi Medical Company (Major Retailer) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia hair care products market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are expected to innovate with eco-friendly formulations and packaging. Additionally, the integration of technology in product development, such as personalized hair care solutions, will likely enhance consumer engagement. The market is poised for growth as companies adapt to these trends and capitalize on emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Shampoos Conditioners Hair Oils & Serums Hair Treatments (e.g., masks, leave-in treatments) Hair Styling Products Hair Colorants Others |

| By End-User | Individual Consumers Salons and Spas Retailers E-commerce Platforms Others |

| By Gender | Male Female Unisex Others |

| By Age Group | Children Teenagers Adults Seniors Others |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Stores Online Retail Pharmacies/Drug Stores Convenience Stores Others |

| By Product Formulation | Natural/Organic Conventional/Synthetic Herbal Others |

| By Packaging Type | Bottles Tubes Jars Sachets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Hair Care Preferences | 120 | Regular Hair Care Users, Beauty Enthusiasts |

| Salon Product Usage | 60 | Salon Owners, Hair Stylists |

| Retail Insights on Hair Care Products | 50 | Retail Managers, Beauty Product Buyers |

| Brand Loyalty and Switching Behavior | 90 | Frequent Hair Care Product Buyers |

| Market Trends and Innovations | 40 | Industry Experts, Product Developers |

The Saudi Arabia Hair Care Products Market is valued at approximately USD 870 million, reflecting a significant growth trend driven by increasing consumer awareness and demand for premium, natural, and halal-certified hair care solutions.