Saudi Arabia Hair Serum Market Overview

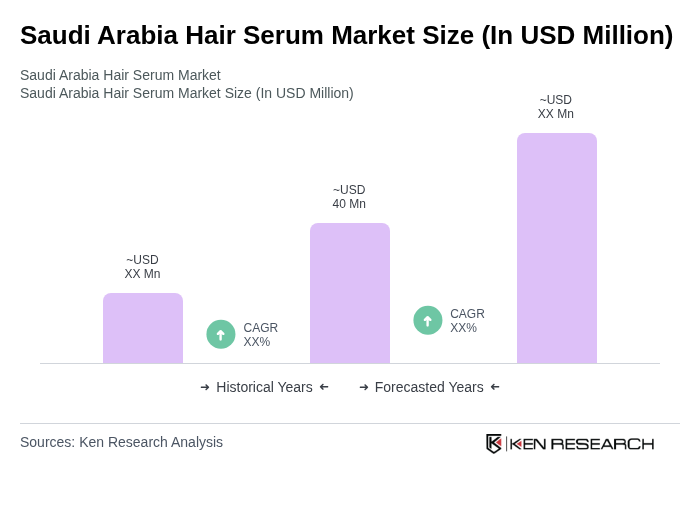

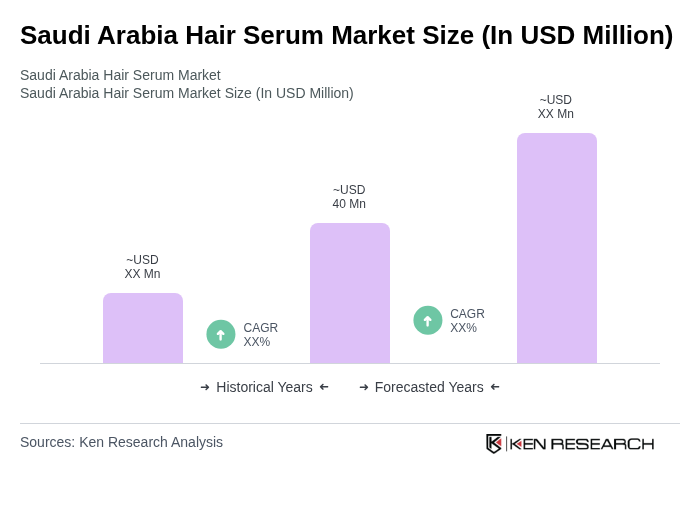

- The Saudi Arabia Hair Serum Market is valued at USD 40 million, based on a five-year historical analysis. This growth is primarily driven by increasing consumer awareness regarding hair care, the rising influence of social media beauty trends, and the growing demand for premium hair care products. The market has seen a significant uptick in the adoption of specialized hair serums that cater to various hair concerns, such as damage repair and frizz control. The demand for products with natural and organic ingredients continues to rise, reflecting a broader shift toward safer, plant-based formulations among Saudi consumers .

- Key cities dominating the market include Riyadh, Jeddah, and Dammam. These urban centers are characterized by a high concentration of beauty salons, retail outlets, and e-commerce platforms, which facilitate easy access to a wide range of hair serum products. The affluent consumer base in these cities is also more inclined to invest in premium hair care solutions, further driving market growth. E-commerce platforms and social media influencers play a significant role in shaping consumer preferences and boosting online sales .

- In 2023, the Saudi Food and Drug Authority (SFDA) implemented the Cosmetics Regulations, 2023, which mandate that all cosmetic products, including hair serums, must undergo comprehensive safety and efficacy testing before market approval. The regulation requires manufacturers and importers to submit product dossiers detailing ingredients, safety assessments, and evidence of efficacy. Only products meeting these standards are authorized for sale, ensuring consumer protection and enhancing trust in the beauty industry .

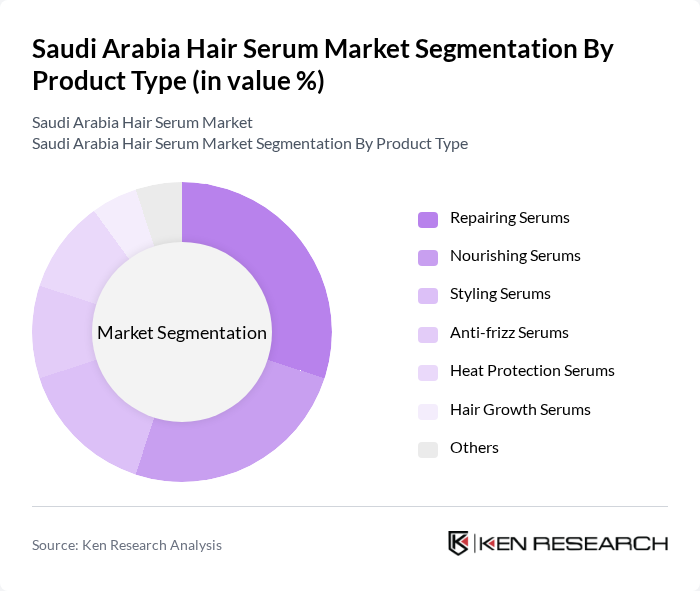

Saudi Arabia Hair Serum Market Segmentation

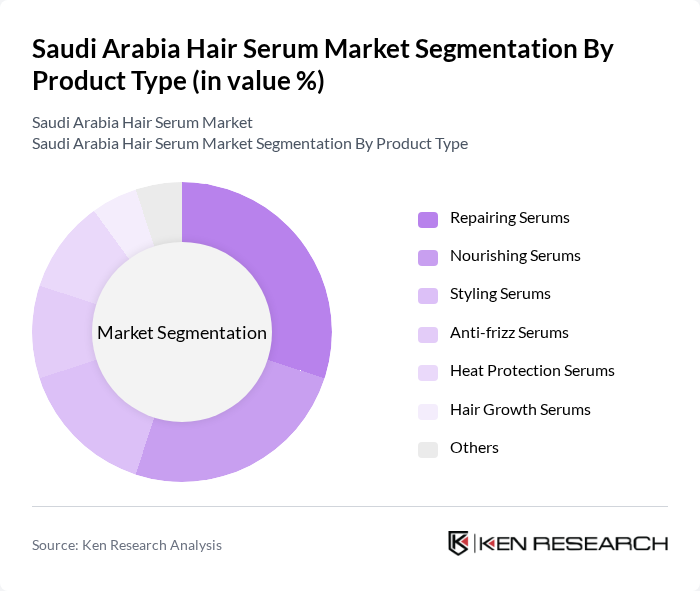

By Product Type:The product type segmentation includes various categories of hair serums that cater to different consumer needs. The subsegments are Nourishing Serums, Repairing Serums, Styling Serums, Anti-frizz Serums, Heat Protection Serums, Hair Growth Serums, and Others. Repairing Serums currently lead the market, reflecting a strong consumer preference for products that address damage and promote hair health. Nourishing Serums remain highly popular due to their ability to provide essential nutrients and moisture, especially among consumers facing dryness and damage. The trend toward natural and organic ingredients continues to bolster the popularity of nourishing and repairing formulations .

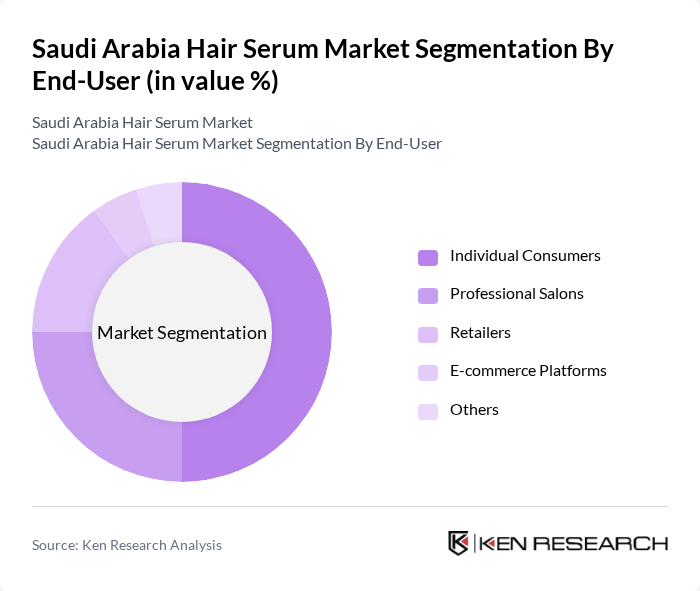

By End-User:The end-user segmentation encompasses Individual Consumers, Professional Salons, Retailers, E-commerce Platforms, and Others. Individual Consumers dominate this segment, driven by the increasing trend of self-care and personal grooming. The rise of social media influencers promoting hair care routines has significantly influenced consumer purchasing behavior, leading to a surge in demand for hair serums among everyday users. Professional Salons also play a crucial role, as they often recommend specific products to clients, further driving sales. E-commerce platforms are gaining market share due to the convenience and variety they offer .

Saudi Arabia Hair Serum Market Competitive Landscape

The Saudi Arabia Hair Serum Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal Middle East, Procter & Gamble Saudi Arabia, Unilever Arabia, Henkel Arabia, Schwarzkopf Professional, Kerastase, TRESemmé, Garnier, Dove, Pantene, Herbal Essences, OGX, Moroccanoil, SheaMoisture, The Ordinary, Vatika (Dabur International), Himalaya Herbals, Palmer's, BioSilk, Alkhuraiji Cosmetics contribute to innovation, geographic expansion, and service delivery in this space.

Saudi Arabia Hair Serum Market Industry Analysis

Growth Drivers

- Increasing Consumer Awareness about Hair Care:The Saudi Arabian hair care market is witnessing a surge in consumer awareness, with 70% of individuals actively seeking information on hair health. This trend is supported by a 15% increase in online searches for hair care products in future. The rise in educational content from beauty influencers and dermatologists has led to a more informed consumer base, driving demand for specialized hair serums that address specific concerns such as hair loss and damage.

- Rising Demand for Natural and Organic Products:The demand for natural and organic hair serums in Saudi Arabia has increased significantly, with sales reaching approximately SAR 300 million in future. This growth is attributed to a 25% rise in consumer preference for products free from harmful chemicals. The trend aligns with the global shift towards sustainability, as 60% of consumers express a willingness to pay more for eco-friendly products, further propelling the market for organic hair care solutions.

- Growth of E-commerce Platforms for Beauty Products:E-commerce sales of beauty products in Saudi Arabia have surged, with a reported growth of 40% in future, reaching SAR 1.2 billion. This shift is driven by the increasing penetration of internet services, with over 99% of the population online. The convenience of online shopping, coupled with targeted marketing strategies, has made hair serums more accessible, allowing brands to reach a broader audience and cater to diverse consumer needs effectively.

Market Challenges

- High Competition Among Established Brands:The Saudi hair serum market is characterized by intense competition, with over 50 established brands vying for market share. This saturation has led to aggressive pricing strategies, making it challenging for new entrants to gain traction. In future, the top five brands accounted for 60% of the market, creating barriers for innovation and differentiation, which are crucial for capturing consumer interest in a crowded marketplace.

- Price Sensitivity Among Consumers:Price sensitivity remains a significant challenge in the Saudi hair serum market, with 65% of consumers indicating that price is a primary factor in their purchasing decisions. The average price of hair serums has increased by 10% due to rising raw material costs, which has led to a decline in sales volume for premium products. This economic pressure necessitates brands to balance quality and affordability to retain customer loyalty.

Saudi Arabia Hair Serum Market Future Outlook

The future of the Saudi Arabia hair serum market appears promising, driven by evolving consumer preferences and technological advancements. As the market adapts to the growing demand for personalized products, brands are likely to invest in research and development to create innovative solutions. Additionally, the increasing focus on sustainability will push companies to adopt eco-friendly practices, enhancing their brand image and attracting environmentally conscious consumers, ultimately shaping a more dynamic market landscape.

Market Opportunities

- Expansion of Product Lines Targeting Specific Hair Issues:There is a significant opportunity for brands to develop specialized hair serums targeting specific issues such as dandruff, hair thinning, and scalp health. With 40% of consumers reporting hair-related concerns, tailored products can capture a larger market share and foster brand loyalty among consumers seeking effective solutions.

- Collaborations with Salons and Beauty Professionals:Partnering with salons and beauty professionals presents a lucrative opportunity for hair serum brands. Collaborations can enhance product visibility and credibility, as 55% of consumers trust recommendations from beauty experts. Such partnerships can lead to increased sales and brand recognition, particularly in urban areas where salon culture is prevalent.