Region:Middle East

Author(s):Shubham

Product Code:KRAD0693

Pages:81

Published On:August 2025

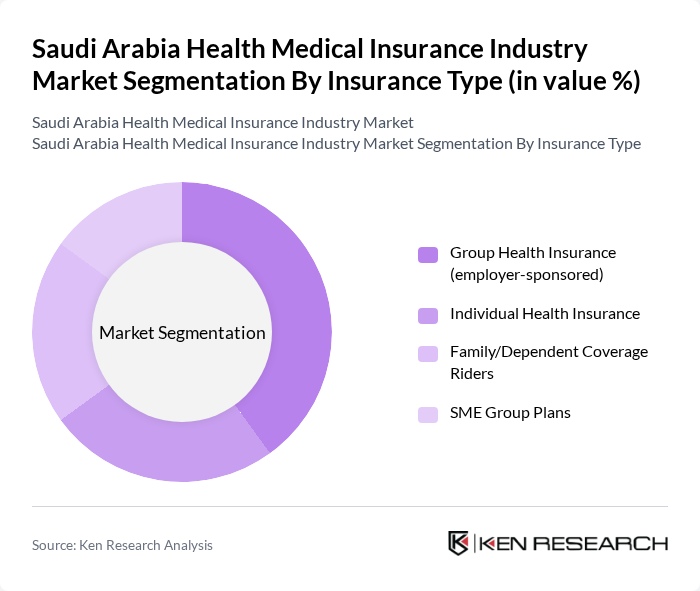

By Insurance Type:The insurance type segmentation includes various subsegments such as Group Health Insurance (employer-sponsored), Individual Health Insurance, Family/Dependent Coverage Riders, and SME Group Plans. Group Health Insurance is particularly popular among large corporations, while Individual Health Insurance caters to self-employed individuals and families. Family/Dependent Coverage Riders are gaining traction as families seek comprehensive coverage, and SME Group Plans are tailored for small and medium enterprises looking to provide health benefits to their employees.

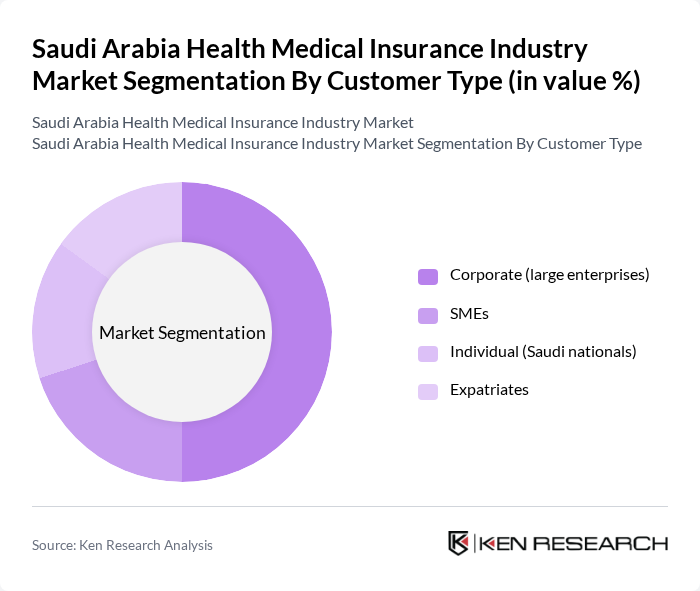

By Customer Type:The customer type segmentation encompasses Corporate (large enterprises), SMEs, Individual (Saudi nationals), and Expatriates. Corporate customers dominate the market due to their ability to provide comprehensive health insurance plans for employees. SMEs are increasingly recognizing the importance of health insurance for employee retention. Individual policies cater to Saudi nationals and expatriates, with the latter group growing due to the influx of foreign workers in the country. Private health insurance coverage among residents has expanded, supporting growth across corporate, SME, and individual segments.

The Saudi Arabia Health Medical Insurance Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Company for Cooperative Insurance (Tawuniya), Bupa Arabia for Cooperative Insurance, MEDGULF (The Mediterranean and Gulf Cooperative Insurance and Reinsurance Company), Al Rajhi Company for Cooperative Insurance (Al Rajhi Takaful), Gulf Insurance Group – Saudi (GIG Saudi), Allianz Saudi Fransi Cooperative Insurance, United Cooperative Assurance (UCA), Alinma Tokio Marine Company, Saudi Arabian Cooperative Insurance Company (SAICO), Al-Etihad Cooperative Insurance Company, Aljazira Takaful Taawuni Company, Al Sagr Cooperative Insurance Company, Walaa Cooperative Insurance Company, Malath Cooperative Insurance Company, AXA Cooperative Insurance Company (now GIG – Gulf Insurance Group) contribute to innovation, geographic expansion, and service delivery in this space. Market concentration is high, with the two largest insurers generating over half of sector insurance revenue and the top five nearing three-quarters in recent periods.

The future of the Saudi health medical insurance industry appears promising, driven by ongoing government reforms and increasing healthcare demands. As the population ages and chronic diseases become more prevalent, insurers are likely to innovate their product offerings. Additionally, the integration of technology in healthcare services, such as telemedicine and AI, will enhance operational efficiency and customer experience, positioning the industry for sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Insurance Type | Group Health Insurance (employer-sponsored) Individual Health Insurance Family/Dependent Coverage Riders SME Group Plans |

| By Customer Type | Corporate (large enterprises) SMEs Individual (Saudi nationals) Expatriates |

| By Distribution Channel | Direct (insurer branches/tele-sales) Brokers Bancassurance/Corporate Tie-ups Online Platforms and Insurer Apps |

| By Coverage Components | Inpatient (hospitalization) Outpatient (consultations, diagnostics) Maternity and Neonatal Emergency and Ambulance Pharmacy/Prescription Drugs Dental and Optical |

| By Provider Type | Private Insurers Public/Programs (government-linked) |

| By Policy Compliance Tier (CCHI) | Basic (CCHI-compliant minimum benefits) Enhanced/Comprehensive Sharia-compliant Takaful Plans |

| By Demographics | Minors Adults Seniors |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Health Insurance Policies | 140 | Policyholders, Insurance Agents |

| Group Health Insurance Plans | 100 | HR Managers, Business Owners |

| Government Health Insurance Programs | 80 | Government Officials, Policy Analysts |

| Healthcare Provider Partnerships | 70 | Hospital Administrators, Clinic Managers |

| Consumer Awareness and Satisfaction | 120 | General Public, Healthcare Consumers |

The Saudi Arabia Health Medical Insurance Industry Market is valued at approximately USD 8.1 billion, reflecting significant growth driven by increased private insurance coverage and rising healthcare awareness among residents.