Region:Middle East

Author(s):Shubham

Product Code:KRAD6658

Pages:92

Published On:December 2025

By Solution Type:The solution type segmentation includes various software solutions designed to enhance healthcare quality management. The subsegments are Business Intelligence and Data Analytics Solutions, Clinical Risk Management Solutions, Provider Performance Improvement Solutions, Physician Quality Reporting Solutions, Audit and Compliance Management Solutions, Incident and Patient Safety Management Solutions, and Others. Among these, Business Intelligence and Data Analytics Solutions are leading the market due to the increasing need for data-driven decision-making in healthcare facilities.

By End-User:This segmentation focuses on the various end-users of healthcare quality management software, including Public Hospitals (MOH and Government-Owned), Private Hospitals and Health Systems, Specialized and Tertiary Care Centers, Primary Healthcare Centers and Clinics, Long-term Care and Rehabilitation Facilities, and Others. Public Hospitals are the dominant end-user segment, driven by government initiatives to improve healthcare quality and patient outcomes.

The Saudi Arabia Healthcare Quality Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cerner Corporation (Oracle Health), Philips Healthcare (Royal Philips), Siemens Healthineers, GE HealthCare Technologies Inc., IBM Watson Health (Merative), Optum Inc. (UnitedHealth Group), SAP SE (SAP for Healthcare), Infor (Infor Healthcare), Ideagen PLC, Qualityze Inc., MEG (Medical Excellence Group), Effivity Technologies, Intelek Technologies, MorCare, LLC, Karminn Consultancy Network contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia healthcare quality management software market appears promising, driven by ongoing government support and technological advancements. As the healthcare sector continues to digitize, the integration of artificial intelligence and machine learning is expected to enhance software capabilities, improving patient outcomes. Additionally, the growing emphasis on patient-centered care will likely lead to increased demand for innovative solutions that prioritize patient safety and satisfaction, fostering a more efficient healthcare environment.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Business Intelligence and Data Analytics Solutions Clinical Risk Management Solutions Provider Performance Improvement Solutions Physician Quality Reporting Solutions Audit and Compliance Management Solutions Incident and Patient Safety Management Solutions Others |

| By End-User | Public Hospitals (MOH and Government-Owned) Private Hospitals and Health Systems Specialized and Tertiary Care Centers Primary Healthcare Centers and Clinics Long-term Care and Rehabilitation Facilities Others |

| By Deployment Model | On-Premise Cloud-Based Hybrid Others |

| By Functionality | Quality Assurance and Compliance Risk and Incident Management Performance Measurement and Benchmarking Reporting, Dashboards, and Advanced Analytics Patient Safety and Outcome Monitoring Workflow and Document Management Others |

| By Region | Central Region (Including Riyadh) Western Region (Including Makkah & Madinah) Eastern Region Southern Region Northern Region |

| By Customer Size | Large Healthcare Networks and Hospital Groups Mid-sized Hospitals and Clinics Small Clinics and Single-Site Providers Others |

| By Integration Capability | Standalone Quality Management Solutions Integrated with Hospital Information Systems (HIS) Integrated with Electronic Medical Records (EMR/EHR) Integrated with Other Healthcare IT Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Quality Management | 100 | Quality Assurance Managers, IT Directors |

| Private Healthcare Facility Software Adoption | 80 | Healthcare Administrators, Operations Managers |

| Healthcare IT Vendor Insights | 60 | Product Managers, Business Development Executives |

| Patient Management System Users | 75 | Clinical Managers, IT Support Staff |

| Healthcare Analytics Software Implementation | 50 | Data Analysts, Chief Information Officers |

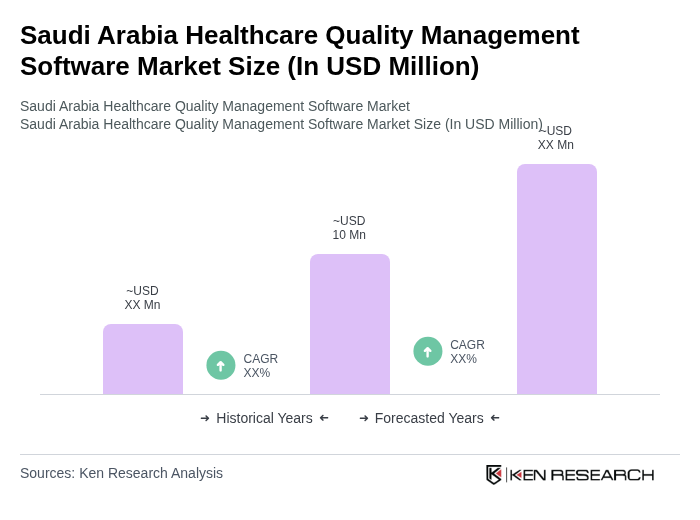

The Saudi Arabia Healthcare Quality Management Software Market is valued at approximately USD 10 million, driven by the demand for improved healthcare services, digital health technologies, and government initiatives focused on enhancing healthcare quality and patient safety.