Region:Middle East

Author(s):Shubham

Product Code:KRAD4725

Pages:88

Published On:December 2025

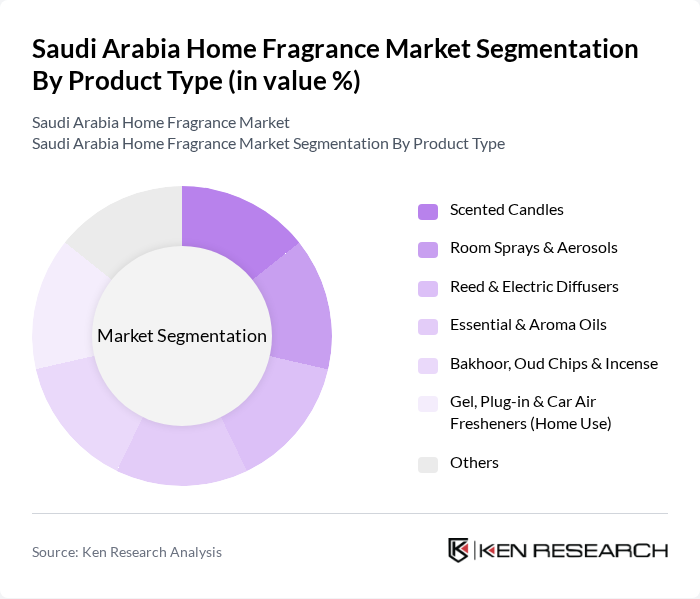

By Product Type:The product type segmentation includes various categories such as scented candles, room sprays & aerosols, reed & electric diffusers, essential & aroma oils, bakhoor, oud chips & incense, gel, plug-in & car air fresheners (home use), and others. Among these, scented candles and bakhoor are particularly popular due to their cultural significance and aesthetic appeal. The demand for room sprays and diffusers has also increased as consumers look for convenient and effective ways to enhance their home environments.

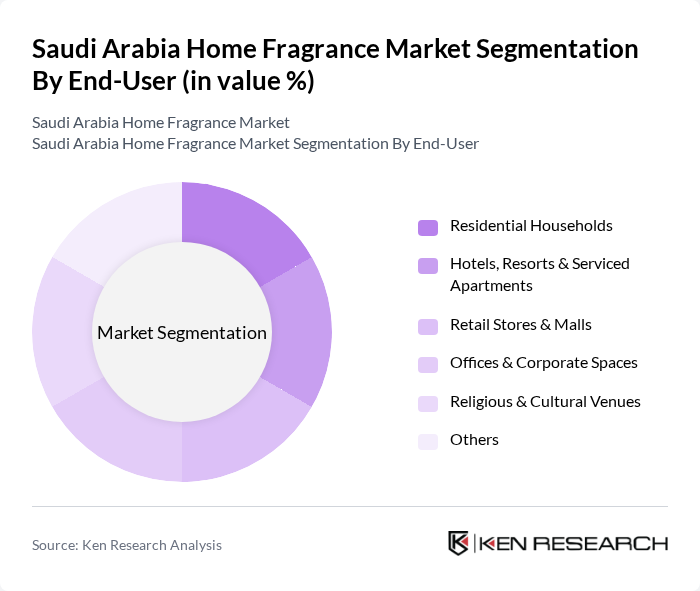

By End-User:The end-user segmentation encompasses residential households, hotels, resorts & serviced apartments, retail stores & malls, offices & corporate spaces, religious & cultural venues, and others. Residential households represent the largest segment, driven by the growing trend of home decoration and personal wellness. Hotels and resorts also contribute significantly, as they seek to create inviting atmospheres for guests through the use of premium fragrances.

The Saudi Arabia Home Fragrance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Arabian Oud, Abdul Samad Al Qurashi, Al Haramain Perfumes, Ajmal Perfumes, Swiss Arabian Perfumes, Nabeel Perfumes, Rasasi Perfumes, Al Rehab Perfumes, Afnan Perfumes, Anfasic Dokhoon, Oudh Al Anfar, The Fragrance Kitchen, Lootah Perfumes, Bath & Body Works, and Yankee Candle contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia home fragrance market appears promising, driven by evolving consumer preferences and technological advancements. As the market adapts to the increasing demand for eco-friendly products, brands are likely to innovate in sustainable packaging and natural ingredients. Additionally, the integration of smart technology in fragrance delivery systems is expected to enhance user experience, making home fragrances more accessible and personalized. These trends will likely shape the market landscape, fostering growth and diversification in product offerings.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Scented Candles Room Sprays & Aerosols Reed & Electric Diffusers Essential & Aroma Oils Bakhoor, Oud Chips & Incense Gel, Plug?in & Car Air Fresheners (Home Use) Others |

| By End-User | Residential Households Hotels, Resorts & Serviced Apartments Retail Stores & Malls Offices & Corporate Spaces Religious & Cultural Venues Others |

| By Distribution Channel | Supermarkets & Hypermarkets Specialty Fragrance & Home Décor Stores Branded Boutiques & Kiosks Online Retail & Marketplaces Pharmacies & Convenience Stores Others |

| By Fragrance Family | Oriental & Oud-based Floral Woody & Amber Citrus & Fresh Gourmet & Spicy Others |

| By Packaging Format | Glass Jars & Bottles Metal Tins & Cans Plastic Containers & Refills Ceramic & Decorative Packaging Others |

| By Price Tier | Luxury & Niche Premium Mass & Value Private Label & Economy |

| By Brand Origin | Saudi & GCC Heritage Brands Global Multinational Brands Indie & Boutique Brands Private Labels & Retailer Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Outlets for Home Fragrances | 120 | Store Managers, Sales Associates |

| Manufacturers of Home Fragrance Products | 90 | Product Development Managers, Marketing Directors |

| Distributors and Wholesalers | 80 | Supply Chain Managers, Sales Directors |

| Consumers of Home Fragrance Products | 150 | General Consumers, Brand Loyalists |

| Online Retailers of Home Fragrance | 70 | E-commerce Managers, Digital Marketing Specialists |

The Saudi Arabia home fragrance market is valued at approximately USD 135 million, driven by consumer interest in home aesthetics, cultural significance of fragrances, and a growing trend towards wellness and relaxation products.