Region:Middle East

Author(s):Rebecca

Product Code:KRAD5000

Pages:95

Published On:December 2025

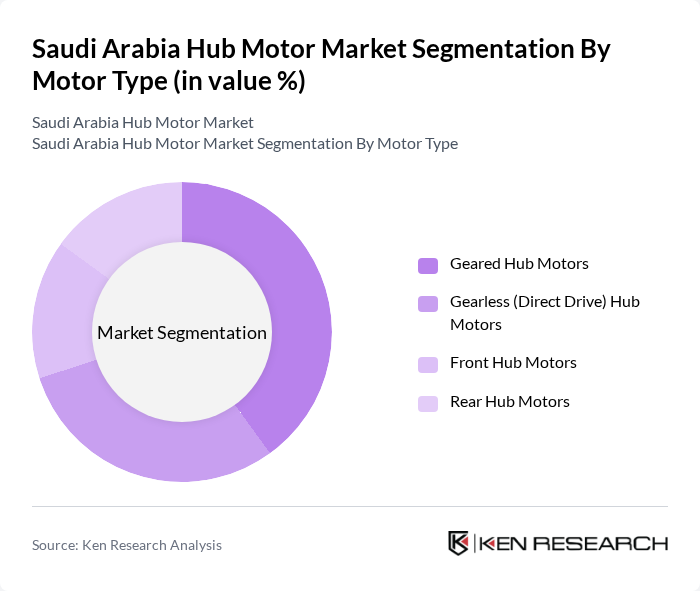

By Motor Type:The market is segmented into various motor types, including Geared Hub Motors, Gearless (Direct Drive) Hub Motors, Front Hub Motors, and Rear Hub Motors. Each type serves different applications and consumer preferences, with geared hub motors being popular for their high torque delivery and efficiency, especially in e-bikes and e-scooters, while gearless (direct drive) motors are favored for their mechanical simplicity, quieter operation, and low maintenance in certain passenger and utility vehicle applications.

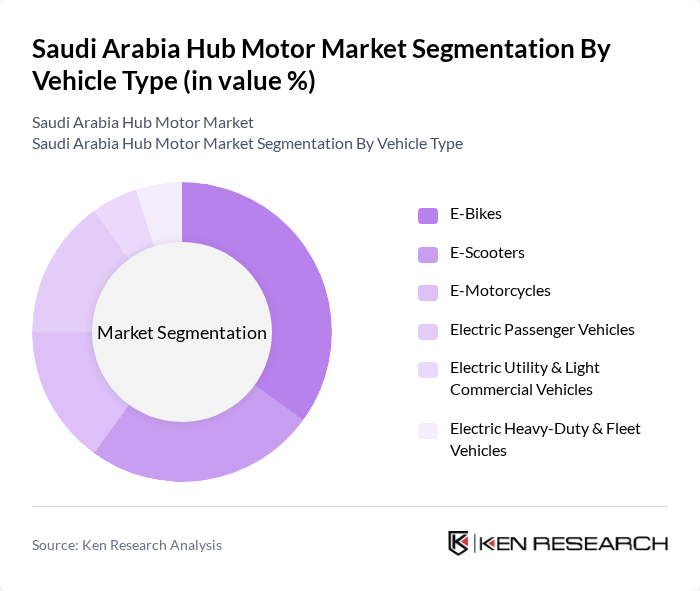

By Vehicle Type:The vehicle type segmentation includes E-Bikes, E-Scooters, E-Motorcycles, Electric Passenger Vehicles, Electric Utility & Light Commercial Vehicles, and Electric Heavy-Duty & Fleet Vehicles. E-Bikes and E-Scooters are leading the market within hub motor applications, in line with global trends where e-bikes account for the largest share of hub motor demand, driven by their popularity in urban commuting, last-mile connectivity, and micro-mobility solutions. Electric passenger vehicles, especially compact city EVs and new domestic brands, are gaining traction as consumer preferences shift towards sustainable transportation and as charging infrastructure and EV incentives expand in Saudi Arabia.

The Saudi Arabia Hub Motor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Robert Bosch GmbH, NTN Corporation, Schaeffler AG, Nidec Corporation, Bafang Electric (Suzhou) Co., Ltd., Golden Motor Technology Co., Ltd., Heinzmann GmbH & Co. KG, Taizhou Quanshun Motor Co., Ltd., Shimano Inc., Mahindra & Mahindra Ltd. (Electric Mobility Division), Hero Electric Vehicles Pvt. Ltd., Zero Motorcycles, Inc., Lucid Group, Inc., Ceer Company, Al-Futtaim Electric Mobility Company contribute to innovation, geographic expansion, and service delivery in this space, leveraging strengths in e-bike systems, electric powertrain components, and localized EV manufacturing and distribution.

The future of the hub motor market in Saudi Arabia appears promising, driven by increasing investments in electric vehicle infrastructure and technological advancements. By future, the government aims to have 5,000 charging stations operational, significantly enhancing accessibility for consumers. Additionally, collaborations between automotive manufacturers and technology firms are expected to foster innovation, leading to more efficient hub motors. This synergy will likely position Saudi Arabia as a leader in sustainable transportation solutions in the Middle East.

| Segment | Sub-Segments |

|---|---|

| By Motor Type | Geared Hub Motors Gearless (Direct Drive) Hub Motors Front Hub Motors Rear Hub Motors |

| By Vehicle Type | E-Bikes E-Scooters E-Motorcycles Electric Passenger Vehicles Electric Utility & Light Commercial Vehicles Electric Heavy-Duty & Fleet Vehicles |

| By Application | Urban Commuting & Micro-Mobility Last-Mile & Delivery Services Tourism, Leisure & Recreational Use Government, Corporate & Campus Fleets |

| By Sales Channel | OEM Aftermarket Online Platforms Specialized EV & Mobility Retailers |

| By Region | Central Region (incl. Riyadh) Western Region (incl. Makkah, Madinah, Jeddah, NEOM corridor) Eastern Region (incl. Dammam, Dhahran, Khobar) Southern & Northern Regions |

| By Power Output | Below 3 kW –5 kW –10 kW Above 10 kW |

| By Price Range (Vehicle/Kit Level) | Entry-Level / Budget Mid-Range Premium & Performance Fleet & Commercial Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Vehicle Manufacturers | 110 | Product Managers, R&D Engineers |

| Hub Motor Suppliers | 90 | Sales Directors, Technical Support Managers |

| Automotive Component Distributors | 70 | Logistics Managers, Procurement Officers |

| Government Regulatory Bodies | 50 | Policy Makers, Industry Analysts |

| Research Institutions | 40 | Academic Researchers, Industry Experts |

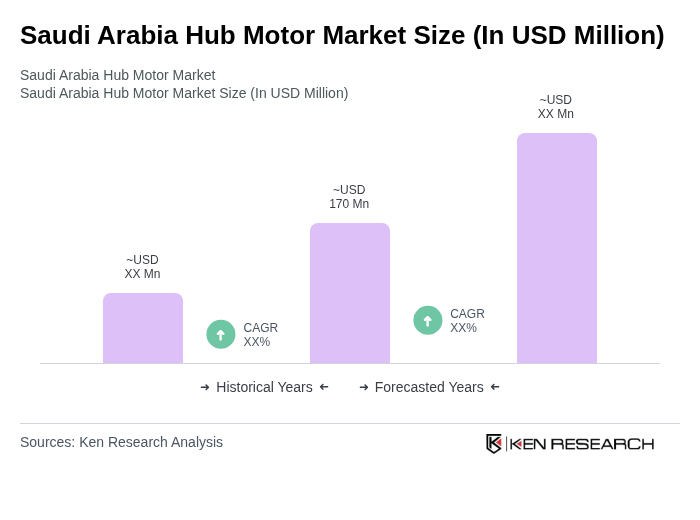

The Saudi Arabia Hub Motor Market is valued at approximately USD 170 million, driven by the increasing adoption of electric vehicles and government initiatives promoting sustainable transportation as part of Saudi Vision 2030.