Region:Middle East

Author(s):Rebecca

Product Code:KRAC3307

Pages:97

Published On:October 2025

By Type:The immersive entertainment market in Saudi Arabia is segmented into various types, including Virtual Reality Experiences, Augmented Reality Applications, Mixed Reality Installations, Immersive Theaters, Escape Rooms, Interactive Exhibitions, Immersive Theme Parks & Attractions, eSports Arenas & Gaming Zones, and Others. Among these, Virtual Reality Experiences and Immersive Theme Parks & Attractions are particularly popular, driven by consumer demand for engaging and interactive entertainment options. The rapid expansion of VR arcades and the introduction of large-scale immersive attractions in giga-projects have further accelerated the adoption of these segments .

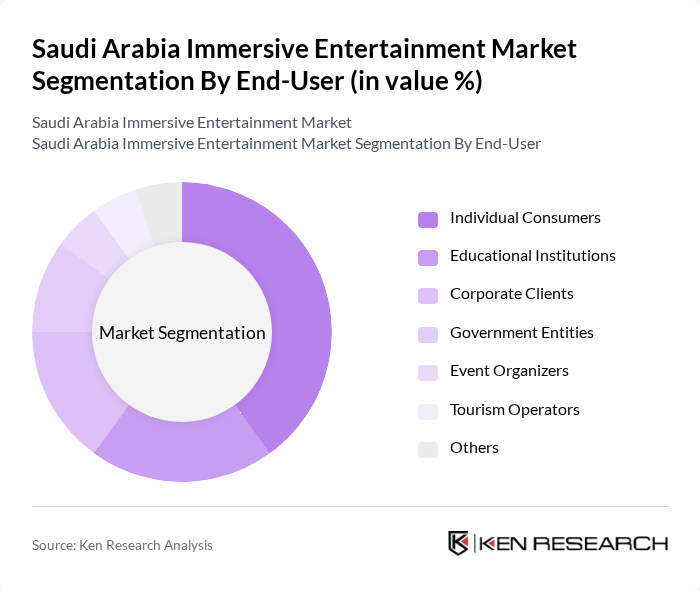

By End-User:The end-user segmentation of the immersive entertainment market includes Individual Consumers, Educational Institutions, Corporate Clients, Government Entities, Event Organizers, Tourism Operators, and Others. Individual Consumers and Educational Institutions are the leading segments, as they seek innovative ways to engage audiences and enhance learning experiences through immersive technologies. The education sector, in particular, is leveraging VR and AR for interactive learning, while tourism operators are integrating immersive experiences to attract visitors .

The Saudi Arabia Immersive Entertainment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Entertainment Ventures (SEVEN), Qiddiya Investment Company, Abdul Mohsen Al Hokair Group, Al Othaim Leisure & Tourism, Sela, IMAX Corporation, Dreamscape Immersive, Hologate, Zero Latency, Sandbox VR, Barco NV, Samsung Electronics Co Ltd, Sony Interactive Entertainment, Meta Platforms, Inc. (Oculus), and Magic Leap contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia immersive entertainment market appears promising, driven by technological advancements and a growing appetite for unique experiences. As the government continues to invest in infrastructure and regulatory frameworks evolve, opportunities for innovation will expand. The integration of AI and VR technologies is expected to enhance user engagement, while the rise of mobile applications will cater to the increasing demand for on-the-go entertainment. This dynamic environment will likely attract both local and international players, fostering a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Virtual Reality Experiences Augmented Reality Applications Mixed Reality Installations Immersive Theaters Escape Rooms Interactive Exhibitions Immersive Theme Parks & Attractions eSports Arenas & Gaming Zones Others |

| By End-User | Individual Consumers Educational Institutions Corporate Clients Government Entities Event Organizers Tourism Operators Others |

| By Application | Entertainment Venues Educational Programs Marketing Campaigns Training Simulations Health and Therapy Retail & Shopping Experiences Others |

| By Distribution Channel | Direct Sales Online Platforms Retail Outlets Event Partnerships Others |

| By Pricing Model | Subscription-Based Pay-Per-Experience Freemium Models Bundled Packages Others |

| By Content Type | Gaming Content Educational Content Corporate Training Content Entertainment Content Live Event Content Others |

| By User Demographics | Age Groups Gender Income Levels Geographic Distribution Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Virtual Reality Experiences | 100 | VR Developers, Entertainment Venue Managers |

| Augmented Reality Applications | 80 | AR Content Creators, Marketing Executives |

| Location-Based Entertainment | 90 | Theme Park Operators, Event Coordinators |

| Consumer Insights on Immersive Experiences | 120 | General Public, Frequent Visitors to Entertainment Venues |

| Industry Expert Opinions | 40 | Market Analysts, Academic Researchers |

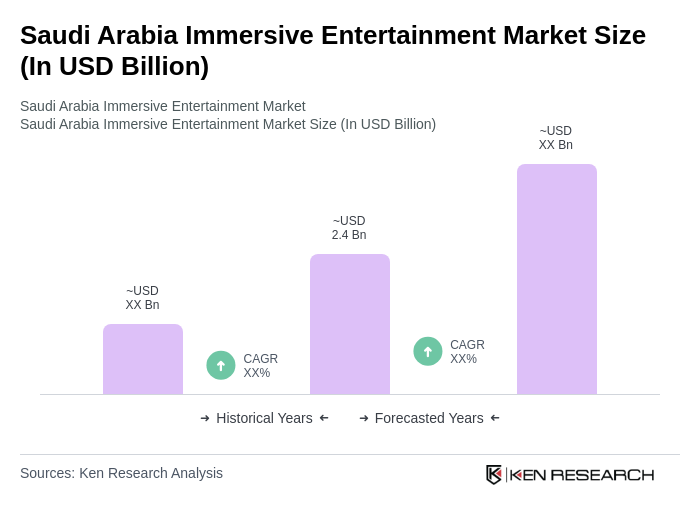

The Saudi Arabia Immersive Entertainment Market is valued at approximately USD 2.4 billion, reflecting significant growth driven by consumer demand for innovative entertainment experiences and substantial investments in the sector from both public and private entities.