Region:Middle East

Author(s):Geetanshi

Product Code:KRAD6035

Pages:91

Published On:December 2025

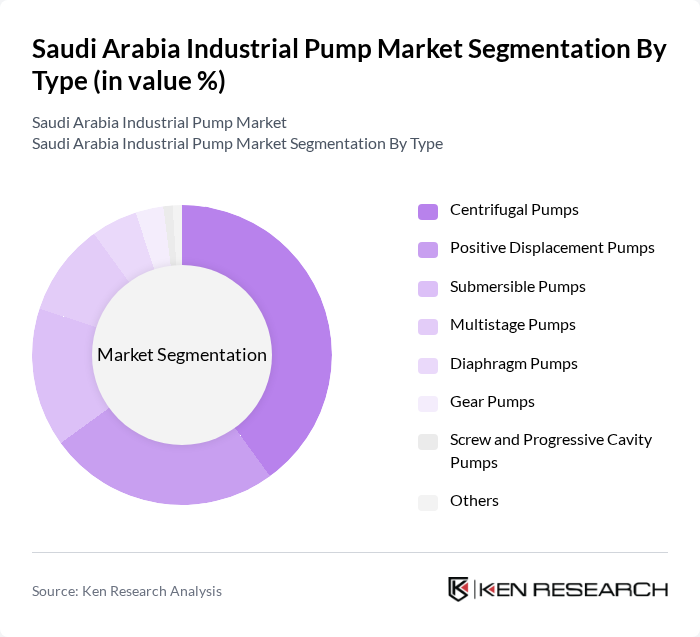

By Type:The market is segmented into various types of pumps, including centrifugal pumps, positive displacement pumps, submersible pumps, multistage pumps, diaphragm pumps, gear pumps, screw and progressive cavity pumps, and others. This structure is aligned with leading industry studies that classify the Saudi Arabia industrial pumps market primarily into centrifugal and positive displacement technologies. Among these, centrifugal pumps are the most widely used, accounting for the largest revenue share in the Saudi industrial pumps market, driven by their efficiency, relatively simple design, and versatility in handling water, chemicals, hydrocarbons, and other fluids in oil and gas, water and wastewater, and power generation applications.

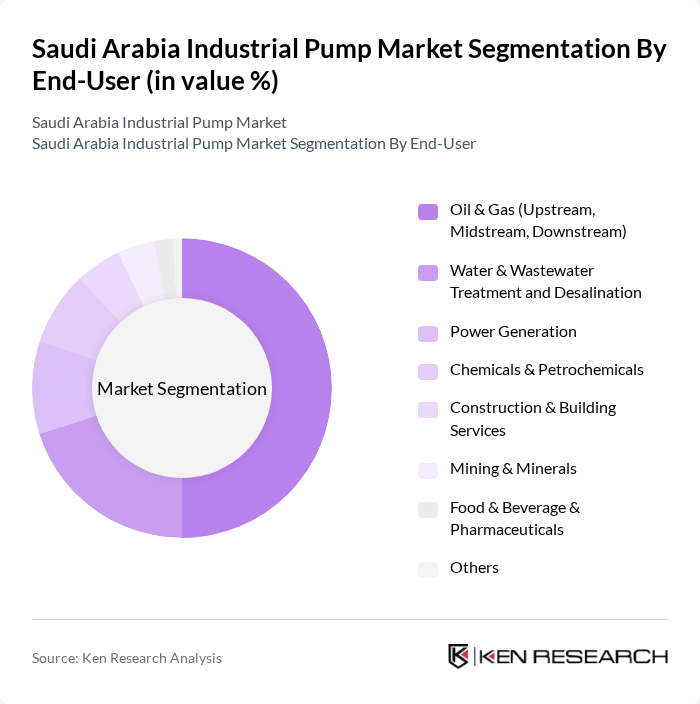

By End-User:The industrial pump market is further segmented by end-user industries, including oil and gas (upstream, midstream, downstream), water and wastewater treatment and desalination, power generation, chemicals and petrochemicals, construction and building services, mining and minerals, food and beverage and pharmaceuticals, and others. This segmentation reflects the major demand centers highlighted in recent market analyses, where oil and gas, followed by water and wastewater and power, are the principal users of industrial pumps in the country. The oil and gas sector is the leading end-user, supported by Saudi Arabia’s position as one of the world’s largest crude producers and refiners, ongoing investments in upstream capacity, gas processing, and downstream petrochemical complexes, as well as pipeline and export infrastructure, all of which rely heavily on robust pumping systems.

The Saudi Arabia Industrial Pump Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grundfos, KSB SE & Co. KGaA (KSB Saudi Arabia), Flowserve Corporation, Sulzer Ltd., Xylem Inc., Ebara Corporation, Wilo SE, ITT Inc., Weir Group PLC, Kirloskar Brothers Limited, SPX FLOW, Inc., Saudi Pump Factory Company, Riyadh Pump Factory, Omega Engineering Saudi Arabia, National Oilwell Varco (NOV) – Process & Production Pumps contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia industrial pump market appears promising, driven by technological advancements and a focus on sustainability. The integration of smart technologies and IoT in pump systems is expected to enhance operational efficiency and reduce maintenance costs. Additionally, the government's commitment to renewable energy projects will likely create new opportunities for innovative pump solutions, aligning with global trends towards energy efficiency and environmental sustainability in industrial applications.

| Segment | Sub-Segments |

|---|---|

| By Type | Centrifugal Pumps Positive Displacement Pumps Submersible Pumps Multistage Pumps Diaphragm Pumps Gear Pumps Screw and Progressive Cavity Pumps Others |

| By End-User | Oil & Gas (Upstream, Midstream, Downstream) Water & Wastewater Treatment and Desalination Power Generation Chemicals & Petrochemicals Construction & Building Services Mining & Minerals Food & Beverage & Pharmaceuticals Others |

| By Application | Water & Wastewater Handling Process Pumping Crude Oil & Refined Products Transfer Chemical Dosing & Injection Firefighting & Utility Services Cooling & Boiler Feed Others |

| By Material | Stainless Steel Cast Iron Carbon Steel & Alloy Steel Non-metallic (Thermoplastics, Composites) Special Alloys (Duplex, Super Duplex, Bronze) Others |

| By Drive Type | Electric Motor Driven Diesel Engine Driven Hydraulic Driven Pneumatic Driven Solar and Other Energy-Efficient Drives |

| By Distribution Channel | Direct Sales (OEMs & EPCs) Authorized Distributors & System Integrators Industrial Traders and Dealers Online/ E-Procurement Platforms Others |

| By Region | Northern and Central Region Eastern Region Western Region Southern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector | 100 | Procurement Managers, Operations Directors |

| Water Treatment Facilities | 80 | Plant Managers, Environmental Engineers |

| Construction Industry | 70 | Project Managers, Site Engineers |

| Manufacturing Sector | 90 | Production Supervisors, Maintenance Managers |

| Agricultural Irrigation Systems | 60 | Agronomists, Farm Equipment Managers |

The Saudi Arabia Industrial Pump Market is valued at approximately USD 880 million, reflecting a robust growth trajectory driven by demand in sectors such as oil and gas, water treatment, and construction, supported by government initiatives under Vision 2030.