Region:Middle East

Author(s):Dev

Product Code:KRAD6423

Pages:100

Published On:December 2025

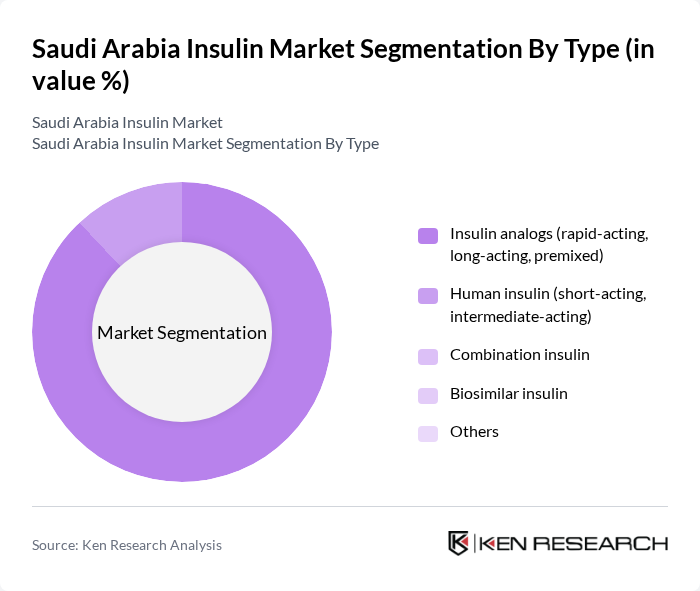

By Type:The insulin market can be segmented into various types, including insulin analogs, human insulin, combination insulin, biosimilar insulin, and others. Insulin analogs, which include rapid-acting, long-acting, and premixed formulations, are gaining popularity due to their improved pharmacokinetic profiles and patient convenience and dominate the market revenue. Human insulin remains a staple due to its affordability and long-standing use. Combination insulin products are also emerging as effective solutions for managing diabetes, while biosimilar insulin is gaining traction as a cost-effective alternative.

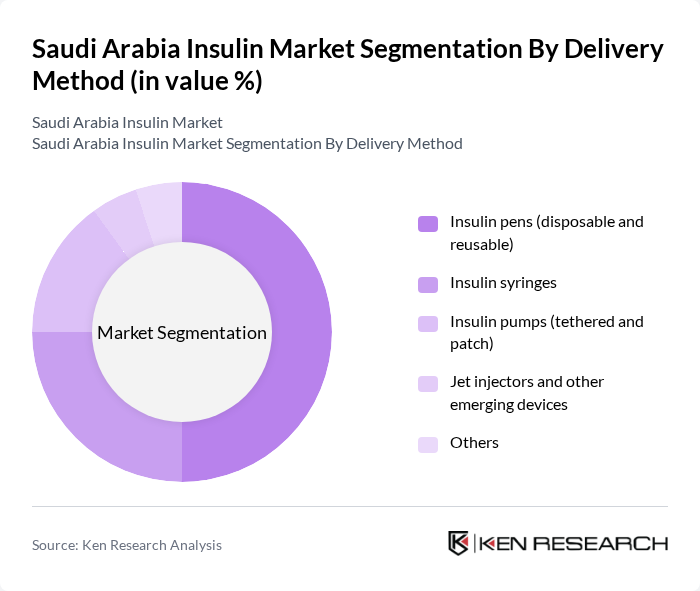

By Delivery Method:The delivery methods for insulin include insulin pens (both disposable and reusable), insulin syringes, insulin pumps (tethered and patch), jet injectors, and other emerging devices. Insulin pens are the most popular delivery method due to their ease of use and convenience, particularly among patients who require multiple daily injections. Insulin syringes remain widely used, especially among older patients. Insulin pumps are gaining traction for their ability to provide continuous insulin delivery, while jet injectors and other devices are emerging as innovative alternatives.

The Saudi Arabia Insulin Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novo Nordisk A/S, Sanofi S.A., Eli Lilly and Company, Biocon Limited, Julphar – Gulf Pharmaceutical Industries P.S.C., Wockhardt Limited, Bayer AG, Boehringer Ingelheim International GmbH, Merck KGaA (including Merck Serono Saudi Arabia), AstraZeneca PLC, Pfizer Inc., GlaxoSmithKline plc (GSK), Medtronic plc, Insulet Corporation, Nupco (National Unified Procurement Company for Medical Supplies) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia insulin market is poised for significant transformation, driven by increasing awareness of diabetes management and technological innovations. The integration of digital health solutions, such as telemedicine, is expected to enhance patient engagement and access to care. Furthermore, the development of biosimilar insulin products will likely increase competition and reduce costs, making treatment more accessible. As the government continues to prioritize healthcare spending, the market is set to evolve, addressing the growing diabetes epidemic effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Insulin analogs (rapid-acting, long-acting, premixed) Human insulin (short-acting, intermediate-acting) Combination insulin Biosimilar insulin Others |

| By Delivery Method | Insulin pens (disposable and reusable) Insulin syringes Insulin pumps (tethered and patch) Jet injectors and other emerging devices Others |

| By Distribution Channel | Hospital pharmacies Retail/community pharmacies Online pharmacies & e-commerce platforms Government tenders & institutional procurement Others |

| By Patient Demographics | Type 1 diabetes patients Type 2 diabetes patients Gestational diabetes patients Pediatric and adolescent patients Others |

| By Region | Central Region (including Riyadh) Eastern Region Western Region (including Makkah & Madinah) Southern Region Northern & other regions |

| By Age Group | Children (0–14 years) Adults (15–64 years) Elderly (65+ years) Others |

| By Insurance Coverage | Public insurance (government schemes & GOSI) Private insurance Out-of-pocket payments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Endocrinologists and Diabetes Specialists | 60 | Healthcare Providers, Clinical Researchers |

| Pharmacists in Urban Areas | 50 | Community Pharmacists, Pharmacy Managers |

| Diabetes Patients on Insulin Therapy | 120 | Type 1 and Type 2 Diabetes Patients |

| Healthcare Policy Makers | 40 | Government Officials, Health Administrators |

| Diabetes Educators and Counselors | 50 | Certified Diabetes Educators, Nutritionists |

The Saudi Arabia Insulin Market is valued at approximately USD 190 million, driven by the rising prevalence of diabetes, increased healthcare expenditure, and advancements in insulin delivery technologies.