Region:Middle East

Author(s):Rebecca

Product Code:KRAB7361

Pages:87

Published On:October 2025

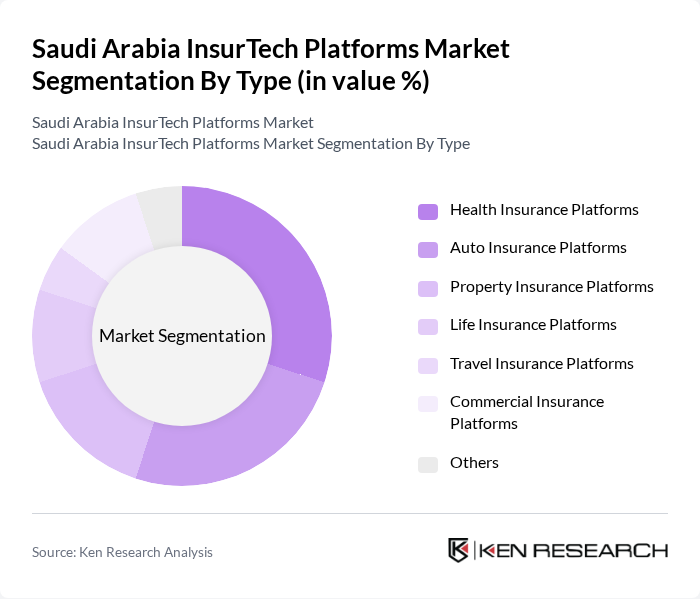

By Type:The InsurTech market can be segmented into various types, including Health Insurance Platforms, Auto Insurance Platforms, Property Insurance Platforms, Life Insurance Platforms, Travel Insurance Platforms, Commercial Insurance Platforms, and Others. Among these, Health Insurance Platforms are gaining traction due to the increasing healthcare costs and the demand for comprehensive health coverage. Auto Insurance Platforms are also significant, driven by the growing vehicle ownership and regulatory requirements for insurance.

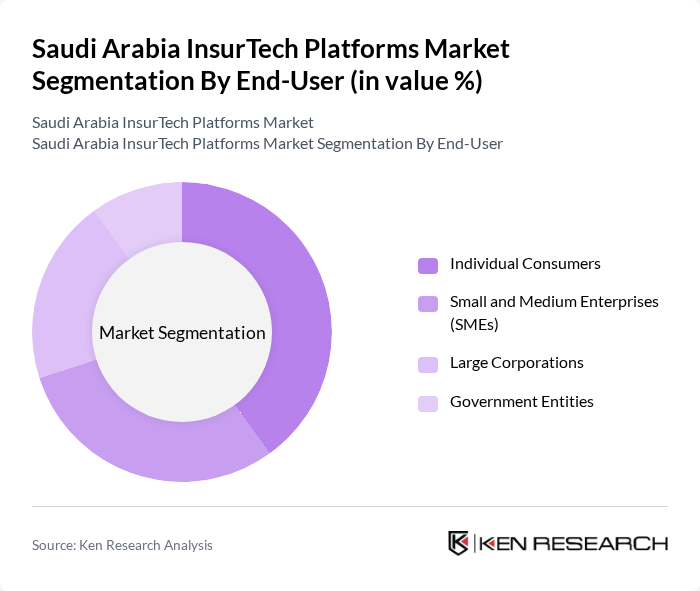

By End-User:The InsurTech market is segmented by end-users, including Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Consumers are the largest segment, driven by the increasing awareness of personal insurance needs and the convenience of digital platforms. SMEs are also significant, as they seek affordable and flexible insurance solutions to protect their businesses.

The Saudi Arabia InsurTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tawuniya, Bupa Arabia, Al Rajhi Takaful, Gulf Insurance Group, AXA Cooperative Insurance, MetLife AIG ANB, Alinma Tokio Marine, Saudi Re, Al Ahli Takaful, Walaa Cooperative Insurance, Aljazira Takaful, United Cooperative Assurance, Al Sagr Cooperative Insurance, Al-Etihad Cooperative Insurance, Al-Masane Al-Khobari Holding Co. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the InsurTech market in Saudi Arabia appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance risk assessment and underwriting processes, leading to more efficient operations. Additionally, as consumer awareness of InsurTech solutions grows, companies that prioritize customer experience and innovative product offerings will likely capture significant market share, positioning themselves for long-term success in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Health Insurance Platforms Auto Insurance Platforms Property Insurance Platforms Life Insurance Platforms Travel Insurance Platforms Commercial Insurance Platforms Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Distribution Channel | Direct Sales Online Platforms Insurance Brokers Agents |

| By Customer Segment | Retail Customers Corporate Clients Institutional Clients |

| By Service Model | B2C (Business to Consumer) B2B (Business to Business) B2B2C (Business to Business to Consumer) |

| By Technology Used | Mobile Applications Web Platforms API Integrations |

| By Policy Type | Comprehensive Policies Basic Policies Customizable Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| InsurTech Platform Users | 150 | Individual Policyholders, Small Business Owners |

| Insurance Brokers and Agents | 100 | Insurance Brokers, Independent Agents |

| InsurTech Startups | 80 | Founders, Product Managers |

| Regulatory Bodies | 50 | Policy Makers, Regulatory Analysts |

| Traditional Insurers Adopting Technology | 70 | Chief Technology Officers, Digital Transformation Leads |

The Saudi Arabia InsurTech Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by digital technology adoption, personalized insurance demand, and increased consumer awareness regarding insurance products.