Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4033

Pages:95

Published On:December 2025

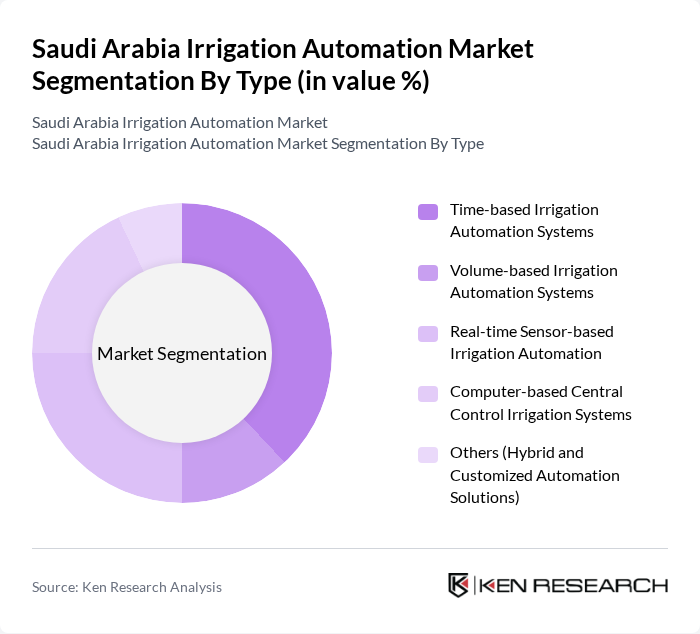

By Type:The market is segmented into various types of irrigation automation systems, including Time-based Irrigation Automation Systems, Volume-based Irrigation Automation Systems, Real-time Sensor-based Irrigation Automation, Computer-based Central Control Irrigation Systems, and Others (Hybrid and Customized Automation Solutions). Among these, Real-time Sensor-based Irrigation Automation is rapidly gaining traction due to its ability to integrate soil-moisture, weather, and crop data to optimize water usage in real time, supporting higher yields and more sustainable practices in arid and water-scarce regions such as Saudi Arabia.

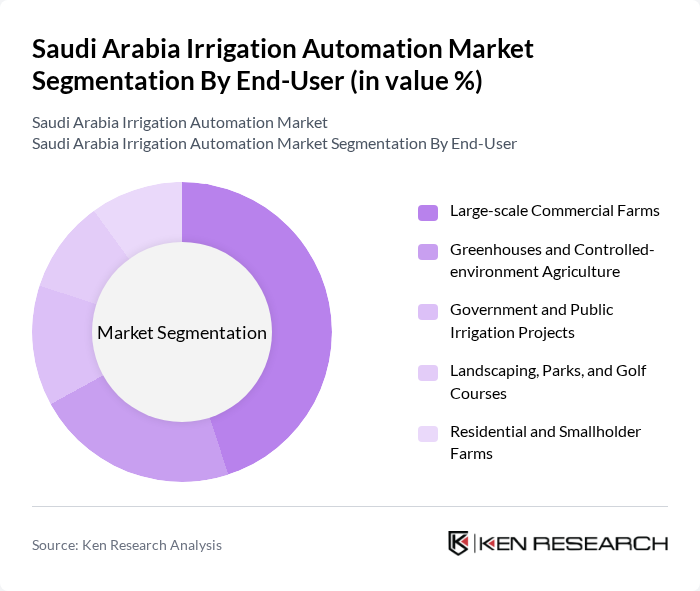

By End-User:The end-user segmentation includes Large-scale Commercial Farms, Greenhouses and Controlled-environment Agriculture, Government and Public Irrigation Projects, Landscaping, Parks, and Golf Courses, and Residential and Smallholder Farms. Large-scale Commercial Farms dominate the market due to their strong investment capacity, access to subsidies for modern irrigation, and clear return-on-investment from adopting automation to reduce water and energy usage, while greenhouse and controlled-environment agriculture is emerging as a particularly fast-growing user group supported by government-backed high?value crop and food security programs.

The Saudi Arabia Irrigation Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Netafim Ltd., Jain Irrigation Systems Ltd., The Toro Company, Rain Bird Corporation, Hunter Industries Inc., Valmont Industries, Inc. (Valley Irrigation), Lindsay Corporation (Zimmatic), Rivulis Irrigation Ltd., Irritec S.p.A., Azud Group, Al Khorayef Group (Alkhorayef Industries – Irrigation Solutions), Saudi Irrigation Organization–affiliated Projects and Integrators, Orbit Irrigation Products, LLC, HydroPoint Data Systems, Inc., Local System Integrators and EPC Firms Specializing in Smart Irrigation contribute to innovation, geographic expansion, and service delivery in this space by supplying drip and sprinkler hardware, smart controllers, sensors, cloud-based management platforms, and turnkey projects tailored to desert and semi-arid farming conditions.

The future of the irrigation automation market in Saudi Arabia appears promising, driven by increasing investments in agricultural technology and a strong governmental push for sustainable practices. In future, the market is expected to witness a surge in the adoption of smart irrigation systems, particularly in arid regions. As farmers become more aware of the benefits of automation, coupled with supportive policies, the market is likely to expand significantly, enhancing water efficiency and agricultural productivity across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Time-based Irrigation Automation Systems Volume-based Irrigation Automation Systems Real-time Sensor-based Irrigation Automation Computer-based Central Control Irrigation Systems Others (Hybrid and Customized Automation Solutions) |

| By End-User | Large-scale Commercial Farms Greenhouses and Controlled-environment Agriculture Government and Public Irrigation Projects Landscaping, Parks, and Golf Courses Residential and Smallholder Farms |

| By Region | Central Region (including Riyadh and Al-Qassim) Western Region (including Makkah, Madinah, and Tabuk) Eastern Region (including Eastern Province and Al-Ahsa) Northern and Southern Regions |

| By Technology | Irrigation Controllers and Automation Panels Soil Moisture, Weather, and Flow Sensors Communication and IoT Connectivity Modules Cloud-based and On-premise Irrigation Management Software Others (Valves, Actuators, and Accessories) |

| By Application | Field Crops Irrigation Orchard, Vineyard, and Perennial Crops Irrigation Greenhouse and High-tech Farming Irrigation Turf, Landscape, and Sports Turf Irrigation Others (Nurseries and Specialty Crops) |

| By Investment Source | Private Farm and Agribusiness Investments Government Programs and Subsidies International Development Agencies and Multilateral Funding Corporate and Institutional Projects |

| By Policy Support | Water Conservation and Efficiency Programs Tax Incentives and Custom Duty Exemptions Research, Pilot Projects, and Demonstration Farms Support Others (Public–Private Partnerships and Concession Models) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Large-scale Agricultural Producers | 90 | Farm Owners, Agricultural Managers |

| Irrigation Technology Suppliers | 60 | Sales Managers, Product Development Engineers |

| Government Agricultural Agencies | 50 | Policy Makers, Water Resource Managers |

| Research Institutions and Universities | 40 | Agricultural Researchers, Professors |

| Consultants in Agricultural Technology | 45 | Industry Analysts, Technology Advisors |

The Saudi Arabia Irrigation Automation Market is valued at approximately USD 270 million, driven by the need for efficient water management in agriculture and government initiatives aimed at enhancing agricultural productivity and sustainability under Vision 2030.